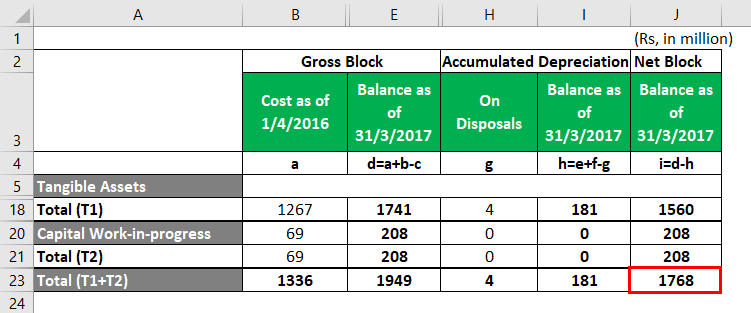

Peerless Accumulated Depreciation Amounts Are Shown As Deductions From The

Salaries that have been paid.

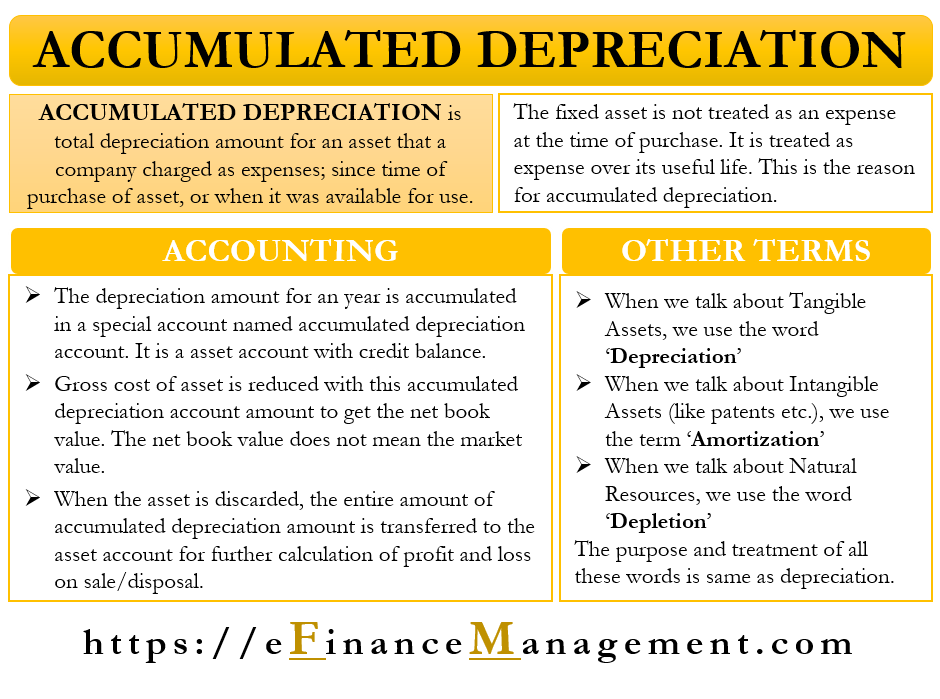

Accumulated depreciation amounts are shown as deductions from the. A contra account on the balance sheet. Sometimes accumulated depreciation is referred to as a negative asset. Depreciation taken throughout the useful life of an asset.

A liability on the balance sheet. An expense on the income statement. Accumulated depreciation amounts are shown as deductions from the cost of building and equipment accounts accounts receivable account.

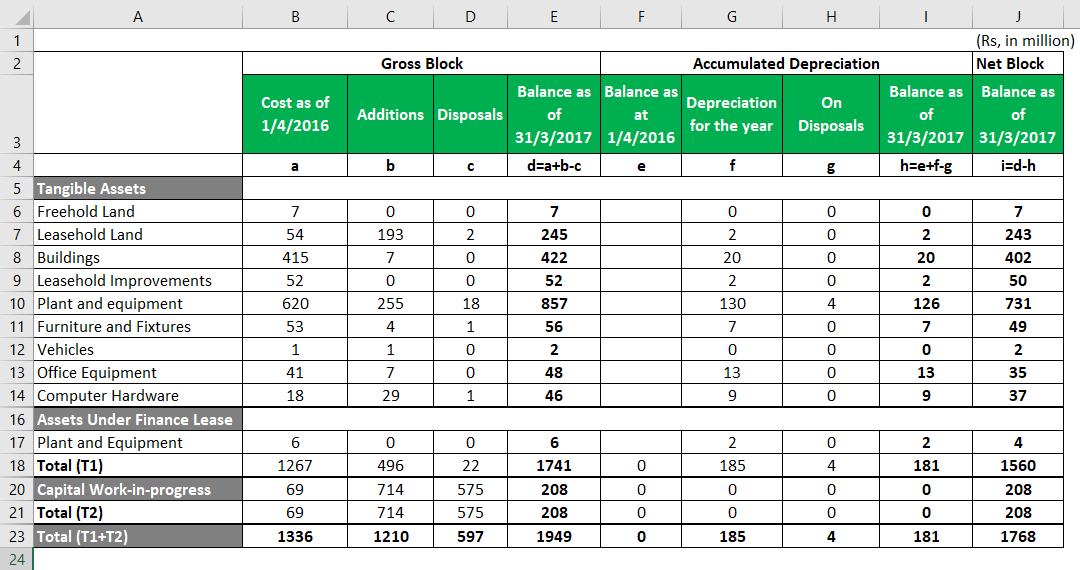

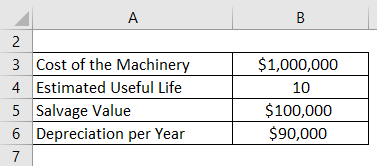

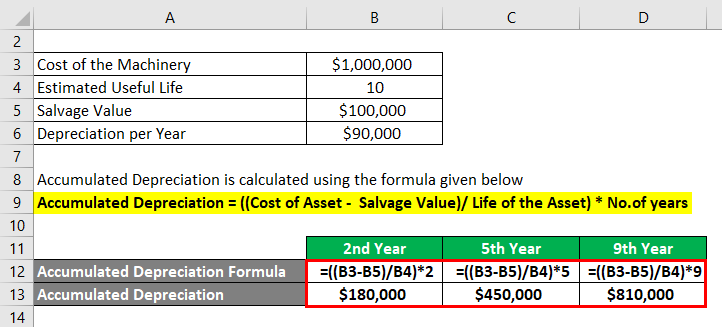

Accumulated depreciation is an accounting term. An assets original value is adjusted during each. The book value of an asset is calculated by deducting the accumulated depreciation from the original purchase price.

Accrued salaries are a. An expense on the income statement. A deduction from profit on the st atement of owners equity.

Accumulated Depreciation- Equipment is shown as a. This method includes an accelerator so the asset depreciates more at the beginning of its useful life used with cars for example as a new car depreciates faster than an older one. Is used to show the amount of cost expiration of intangibles.

Many businesses dont even bother to show you the accumulated depreciation account at all. Question 2 At 30 June 2019 the financial statements of McMaster Ltd showed a building with a cost net of GST of 240000 and accumulated depreciation of 122000. Accumulated Depreciation Equipment is shown as a.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)