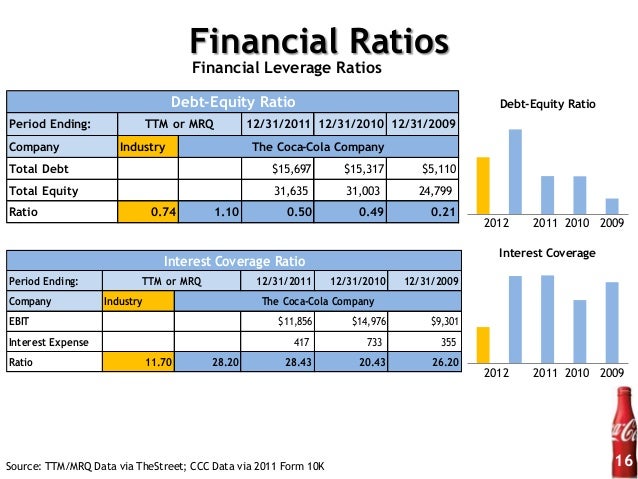

Outstanding Coca Cola Financial Ratios

1 between the second and the third quartile.

Coca cola financial ratios. 2 above the third quartile. -1 between the first and the second quartile. Ad Find Coca Cola Coca Cola.

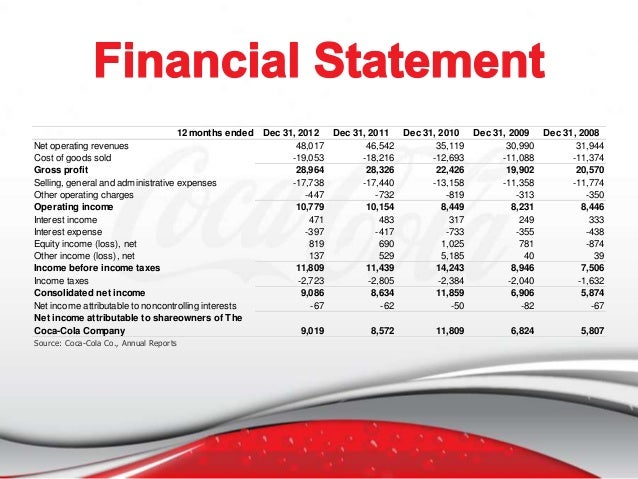

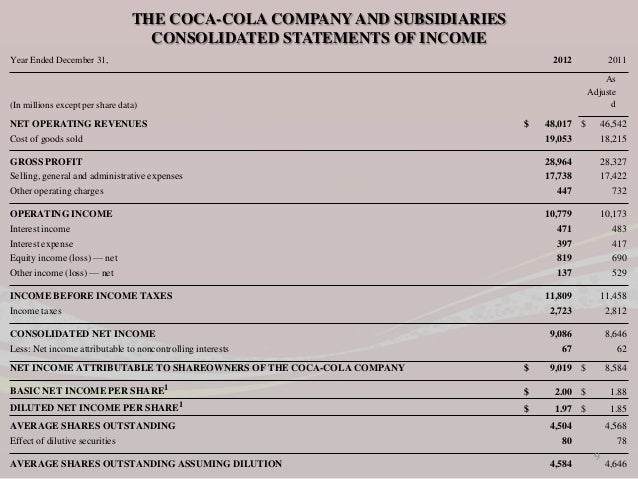

EPS Declined 19 to 052. Financial ratio Description The company. Our long-term targets consist of solid revenue growth of 4 to 6 strong operating leverage driving 6 to 8 operating income growth delivering meaningful EPS growth and improving on our free cash flow conversion.

In the next year the organizations current ratio would slightly increase to 134. -0275 -049 DATA AS OF Jul 15 2021 1100 AM ET. 67 rows CocaCola current ratio for the three months ending June 30 2021 was 147.

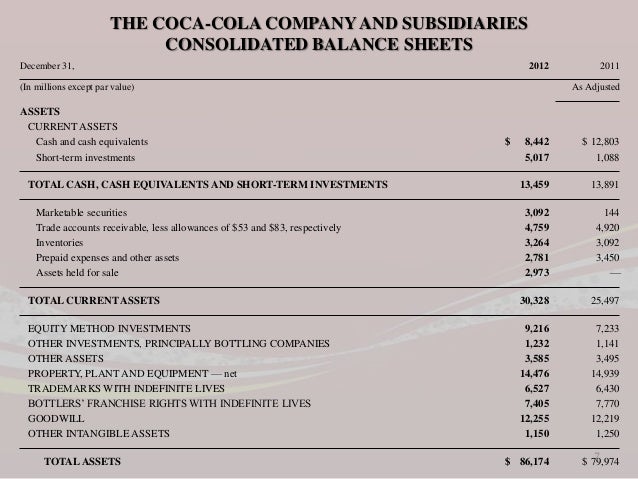

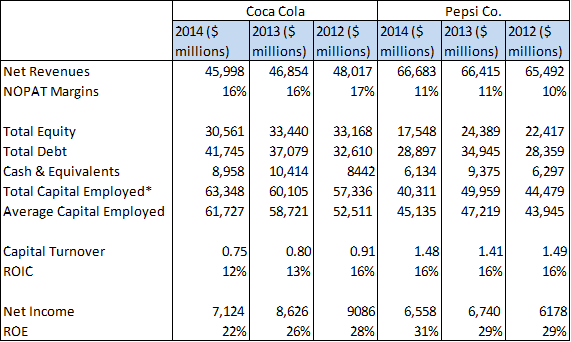

Coca-Cola Company The key financial stats and ratios. Ten years of annual and quarterly financial ratios and margins for analysis of CocaCola KO. An activity ratio calculated as total revenue divided by adjusted total assets.

However the firm would. Ad Find Coca Cola Coca Cola. Coca-Colas operated at median current ratio of 13x from fiscal years ending December 2016 to 2020.

The financial condition of Coca-Cola Company The in 2020 is worse than the financial condition of half of all companies engaged in the activity Beverages Due to the fact that the average industry ratios are much better than those for all industries there is. Coca-Cola Cos adjusted total asset turnover ratio improved from 2018 to 2019 but then deteriorated significantly from 2019 to 2020. 21 rows PB Ratio.