Heartwarming Common Size Financials

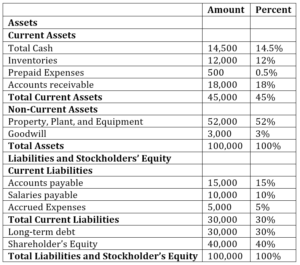

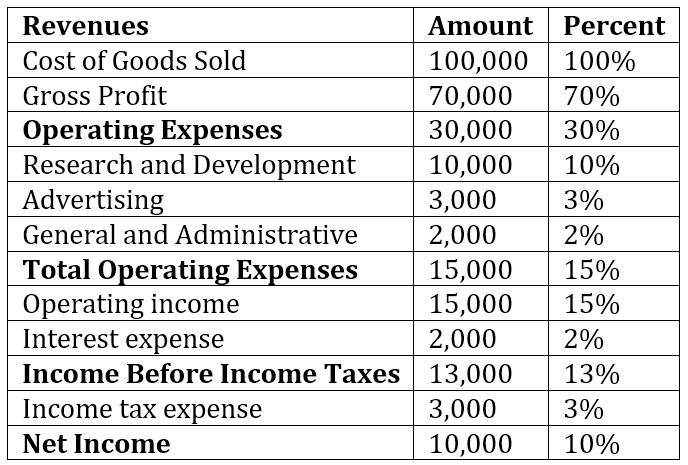

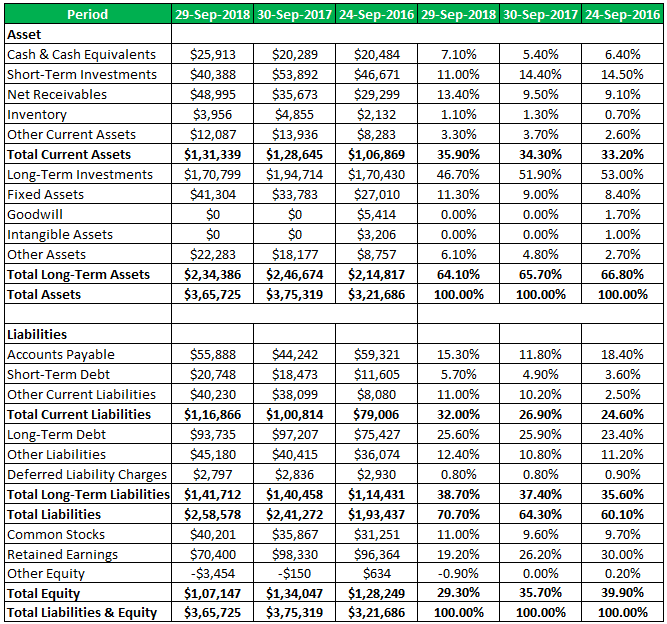

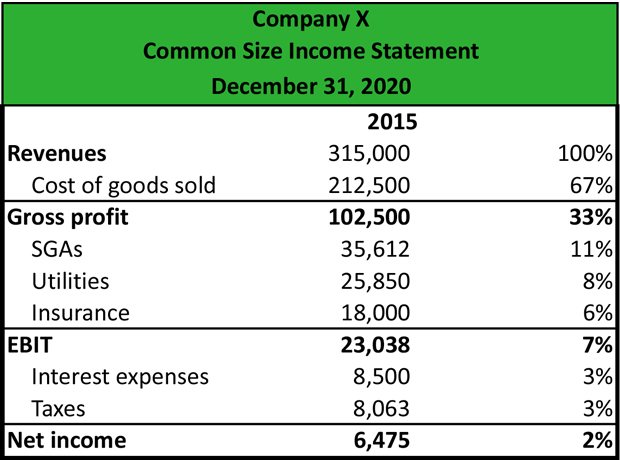

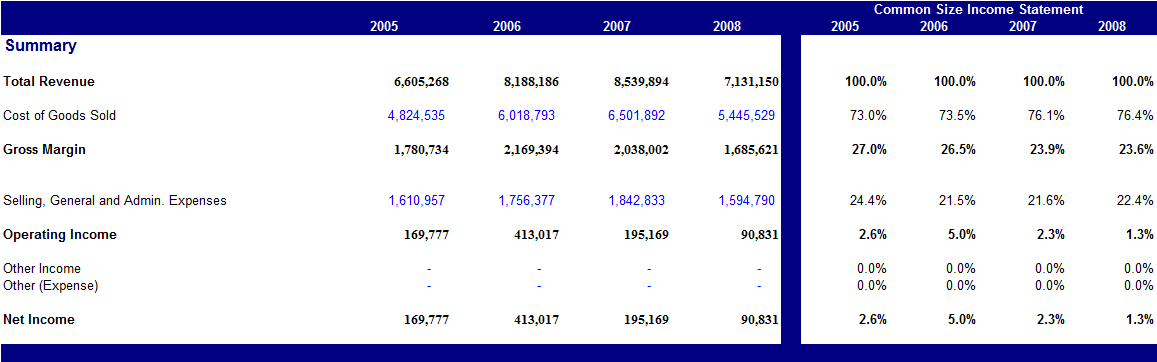

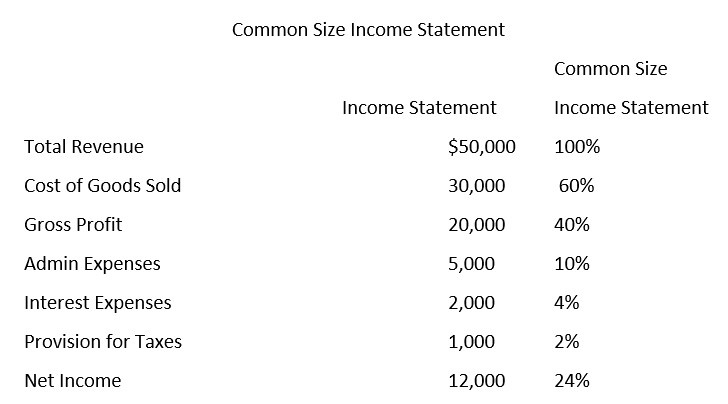

Vertical analysis refers to the analysis of specific line items in relation to a base item within the same financial period.

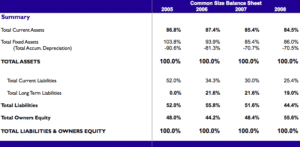

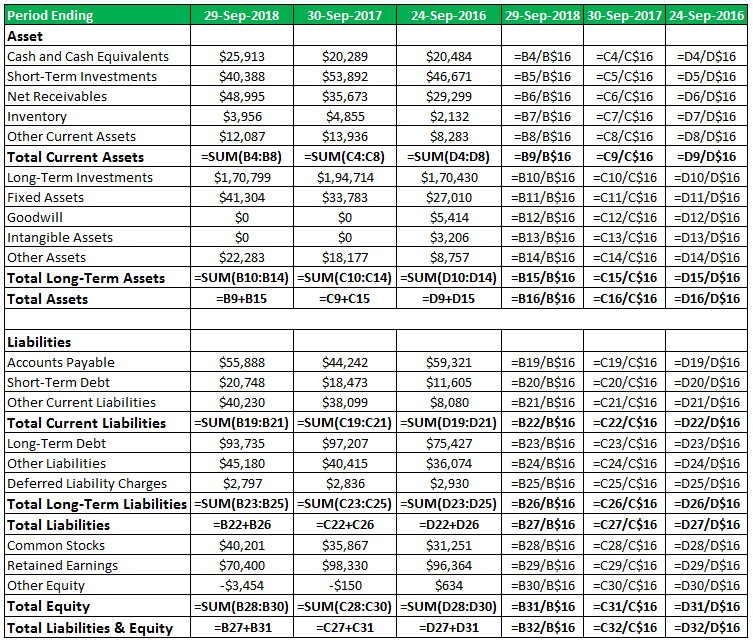

Common size financials. Common Size Financial Statements Common size ratios are used to compare financial statements of different-size companies or of the same company over different periods. Analysis of Financial Ratios. This is called common-sized financial statement.

Prices of access to the entire website 3 months. Discounted Cash Flow DCF Valuation. For example if total sales revenue is used as the common base figure then other.

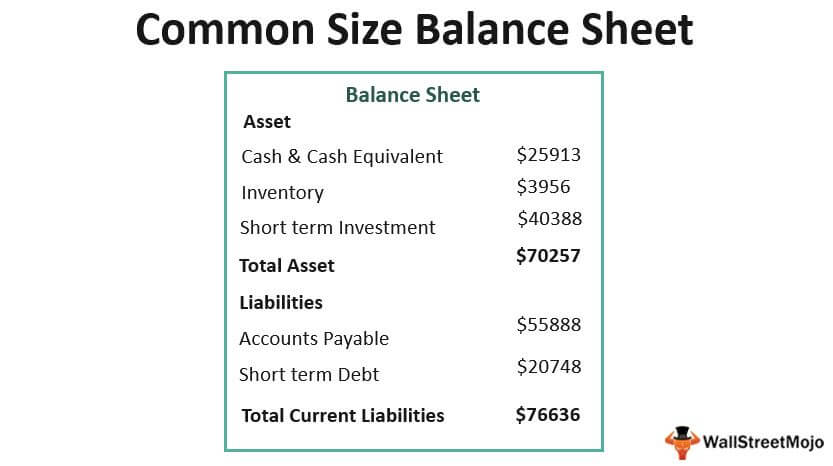

Explanation of Common Size Financial Statement. Common size financial statements reduce all figures to a comparable figure such as a. Analysis of Components of Financial Statements.

Prices of access to the entire website 3 months. Types of Common Size Analysis Common size analysis can be conducted in two ways ie vertical analysis and horizontal analysis. What is a Common-Size Financial Statement.

Common size financial statement is a method to represent financial data in a percentage format. Describe common-size financial statements and explain why they are used. One tool of financial analysis is common-size financial statements.

Common-Size Financial Statements Analysts also use vertical analysis of a single financial statement such as an income statement. The common size financial statements definition is a form of financial statement analysis that shows the actual dollar amounts for a balance sheet or income statement as well as the relative percentages for each one of the dollar amount items. The financial statement reports owner equity assets.