Divine Cra T776 Rental Form

I learned that I couldnt expense my home office without prorating hours Erik great question.

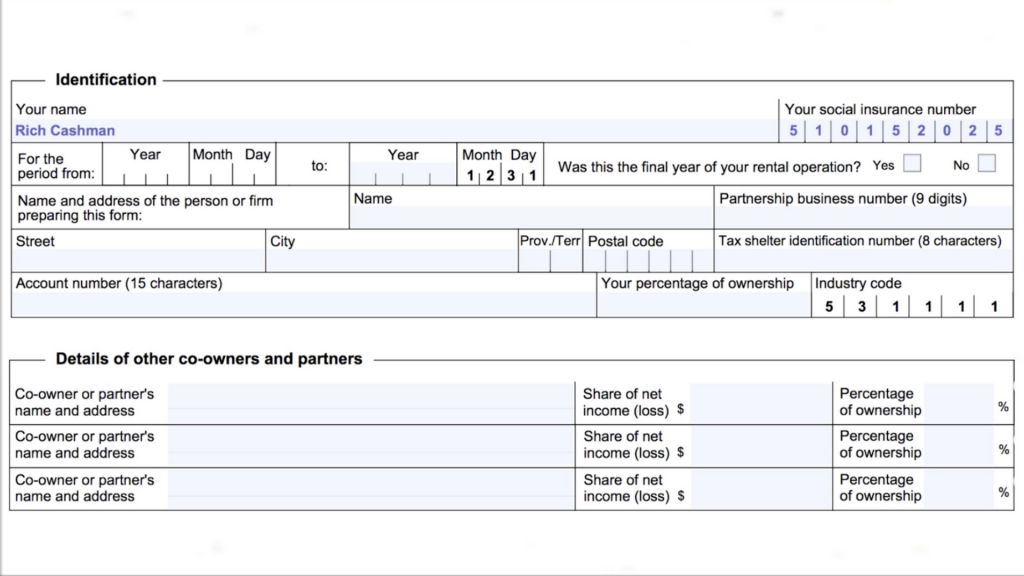

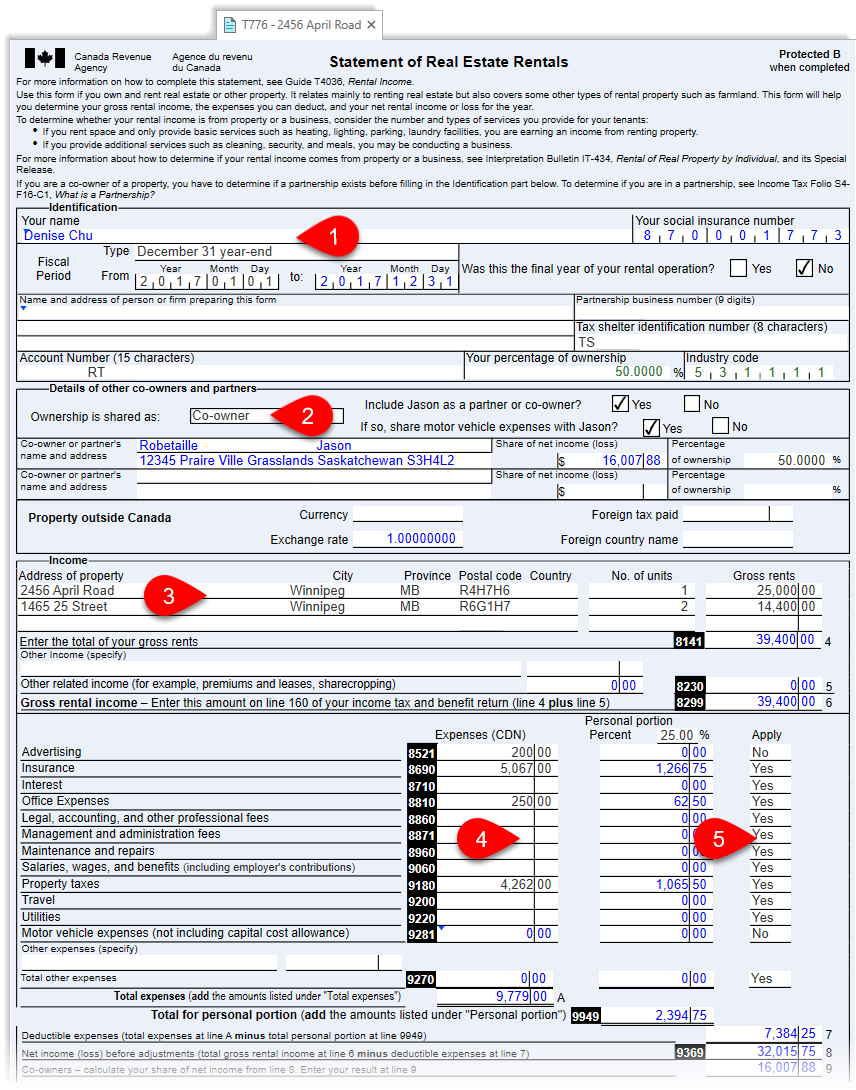

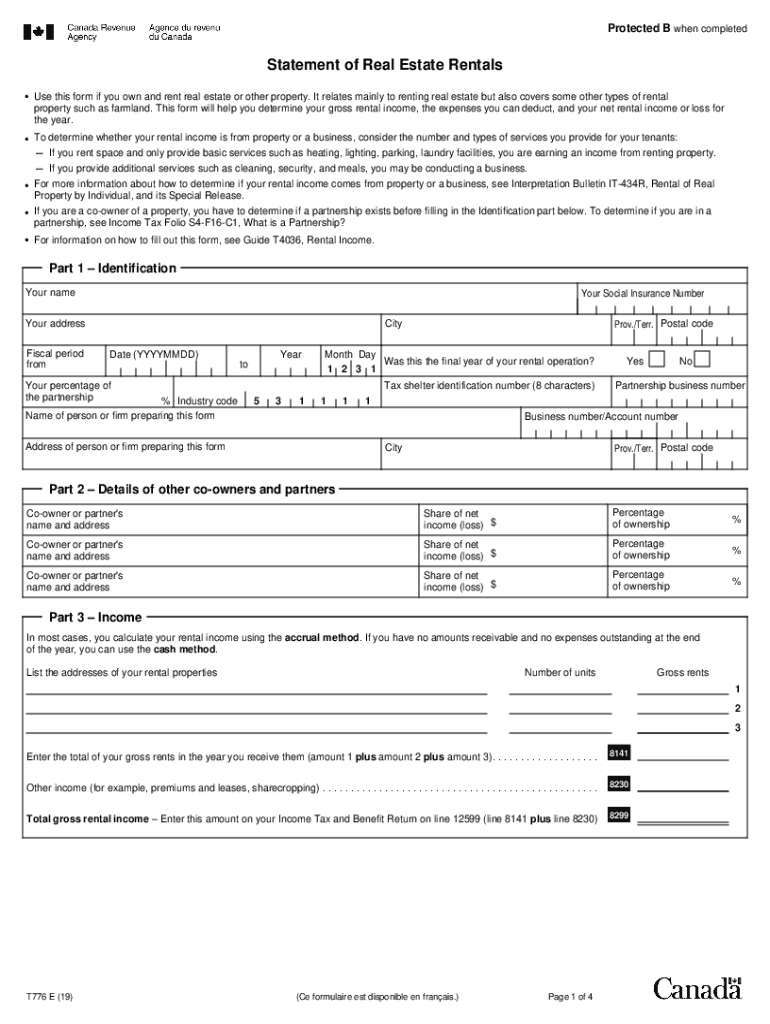

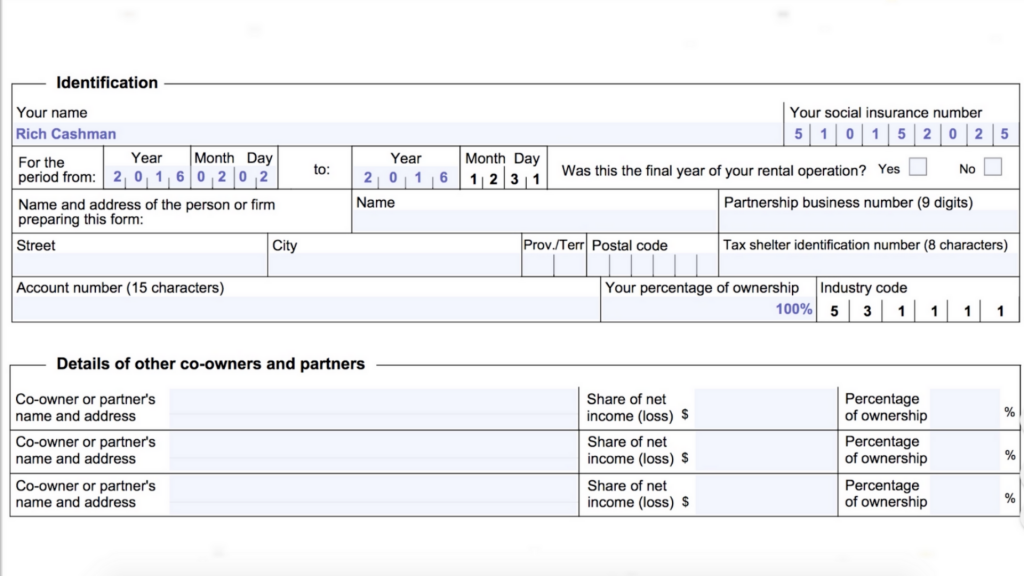

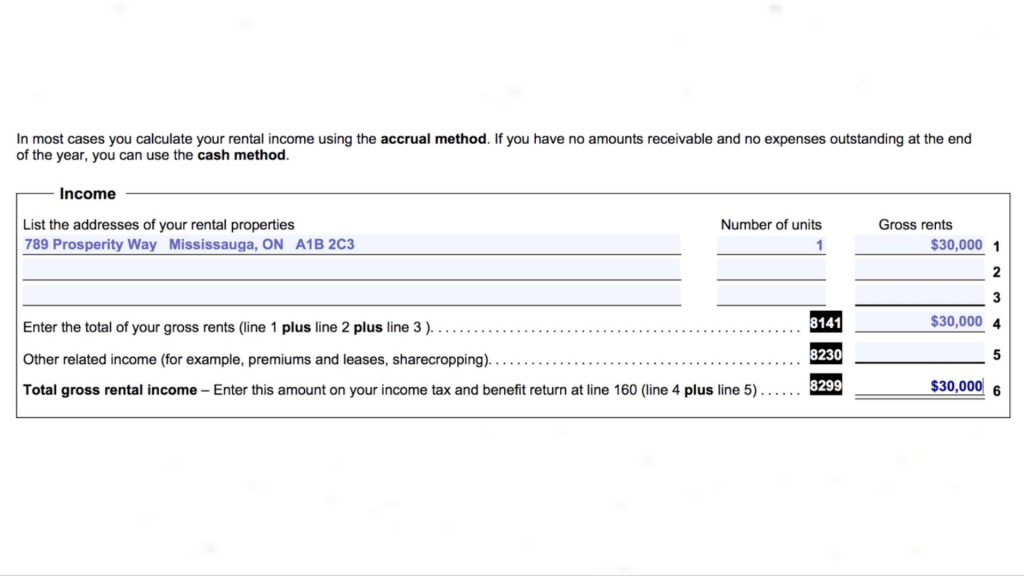

Cra t776 rental form. T4036 Rental Income - Includes Form T776 You can view this publication in. Presumably you have filled out the T776 for Real Estate Rentals. This form will help you determine your gross rental income the expenses you can deduct and your net rental income.

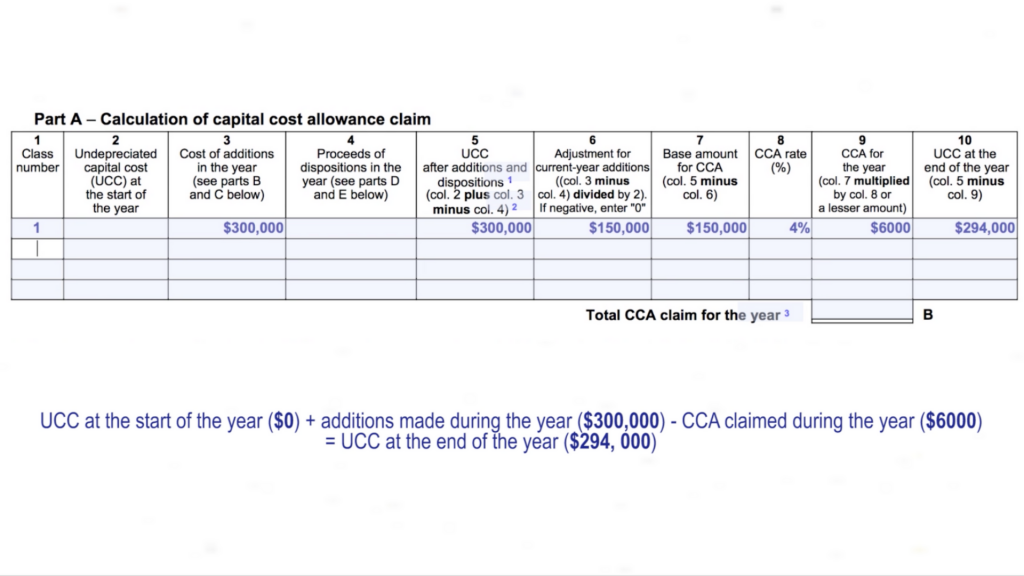

Click on the little green box to find the T776. In the Income section complete one line for each property entering the address and the income. The capital cost of your rental property is recorded in your personal tax return on form T776 Statement of Real Estate Rentals.

Use a separate form for each property if you have multiple rental properties. Or loss for the year. It is an integral part of the tax return.

Rental Statement for T1 in Pro Tax. Fill out securely sign print or email your form t776 2013-2020 instantly with SignNow. It usually represents income from property where you rent space and provide basic services only heat light parking and laundry facilities.

2012-01-09 Available in print. For people with visual impairments the following alternate formats are also available. Use this form to enter rental income and expenses.

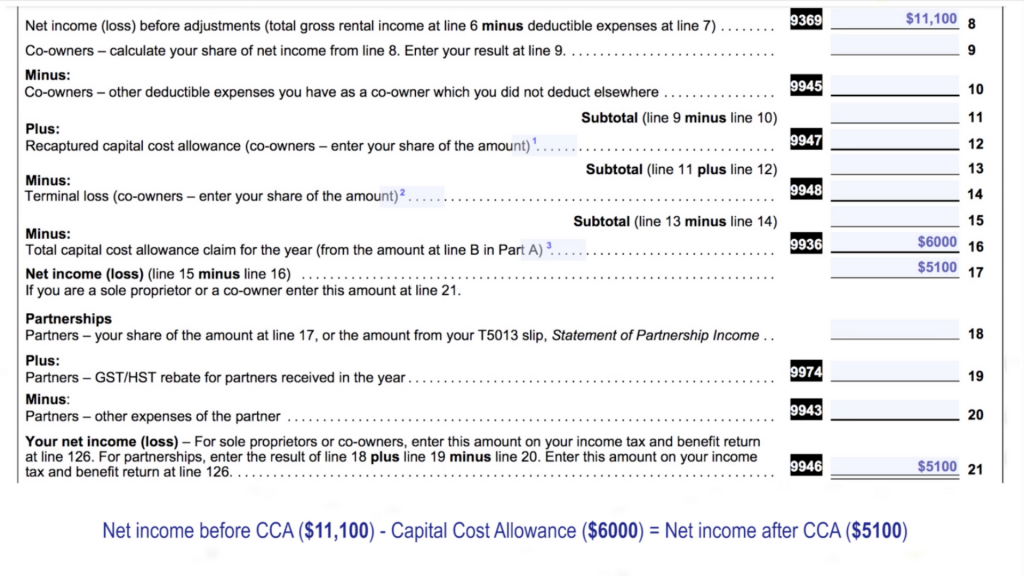

Form T776 will help you calculate your rental income and expenses for income tax purposes. If you had rental income in 2018 from renting out a property that you own or co-own a house an apartment rooms space in an office building or other property youll need to use the T776 form to report your gross rental income expenses and any capital cost allowance for the year. Could rental income be considered business income.