Beautiful Work Direct Indirect Cash Flow

Loss on sale of long-t erm assets xxx.

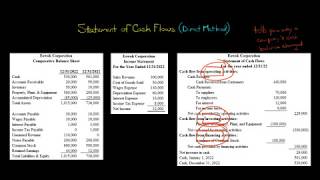

Direct indirect cash flow. Direct cash forecasting sometimes called the receipts and disbursements method of forecasting aims to show cash movements and positions at specific future points in time. Example of the Statement of Cash Flows Indirect Method. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments.

Using your income statement you start with your companys net income as a base. For example Lowry Locomotion constructs the following statement of cash flows using the. Unlike the direct approach the net profit or loss from the Income Statement is adjusted for the effect of non-cash transactions.

The direct method only takes the cash transactions into account and produces the cash flow from operations. The indirect method is less favored by the standard-setting bodies since it does not give a clear view of how cash flows through a business. Direct atau Indirect.

Adjustmen ts to re concile net inc ome to net c ash pr ovided by ope ra ting activities. Direct cash forecasting is a method of forecasting cash flows and balances used for short term liquidity management purposes. The Direct method discloses major classes of gross cash receipts and cash payments while the Indirect method focuses on net income and non-cash transactions.

The direct method is perhaps the simplest to understand though it is often more complex to calculate in practice. You may also see the indirect cash flow method referred to as the reconciliation method. Then you indicate the changes in current liabilities current assets and other sourceseg non-operating lossesgains from non-current assets on the balance sheet.

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. There are no differences in the cash flows from investing activities andor the cash flows from financing activities. If you are a QuickBooks user QuickBooks.