Outstanding Financial Statements Prepared On A Non Going Concern Basis

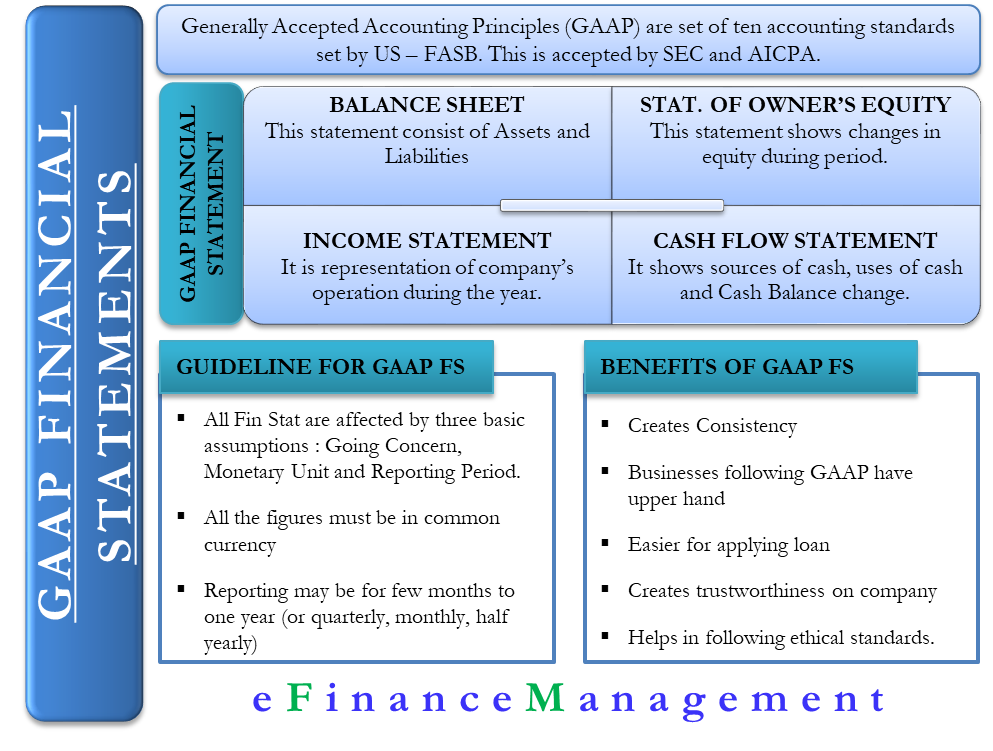

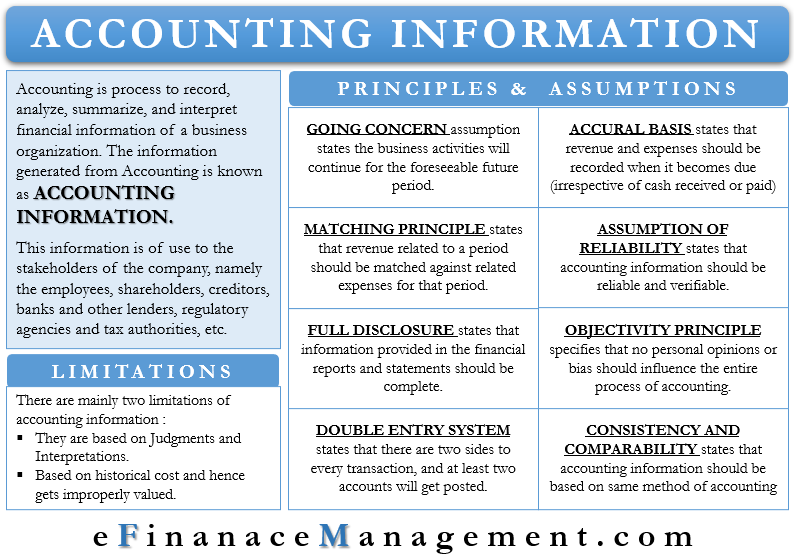

When an entity does not prepare financial statements on a going concern basis it shall disclose that fact together with the basis on which it prepared the financial statements and the reason why the entity.

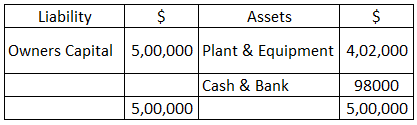

Financial statements prepared on a non going concern basis. The Companys financial statements have been prepared using the going concern basis of accounting. Its 2018 financial statements on a going concern basis. Financial statements might be prepared on a liquidation or break-up basis but sometimes this will be inappropriate.

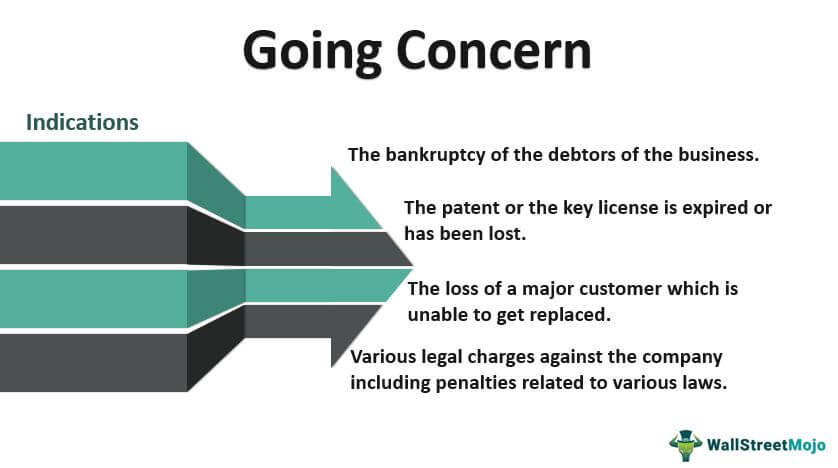

4 IFRS Viewpoint 7. If management has significant concerns about the entitys ability to continue as a going concern the uncertainties must be disclosed. Management intends to liquidate the entity cease trading or has no realistic alternative but to do so.

Neither Standard however provides any details of an alternative basis of preparation and how it may differ from the going concern basis. Both IAS 1 Presentation of Financial Statements and IAS 10 Events after the Reporting Period suggest that a departure from the going concern basis is required when specified circumstances exist. IFRS does not prescribe the basis of accounting for an entity that is not a going concern.

For instance when financial statements are prepared on a going concern basis a non-financial asset may be stated at an amount which is greater than its net realisable value provided that it is no greater than its recoverable amount. Entities should therefore consider. For example an entity might be placed in administration with liquidation or break-up being only one of the possible outcomes.

The example wording in this Guide has been adapted from the company examples in the FRCs. This guidance applies even if those events would otherwise be non-adjusting. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so.

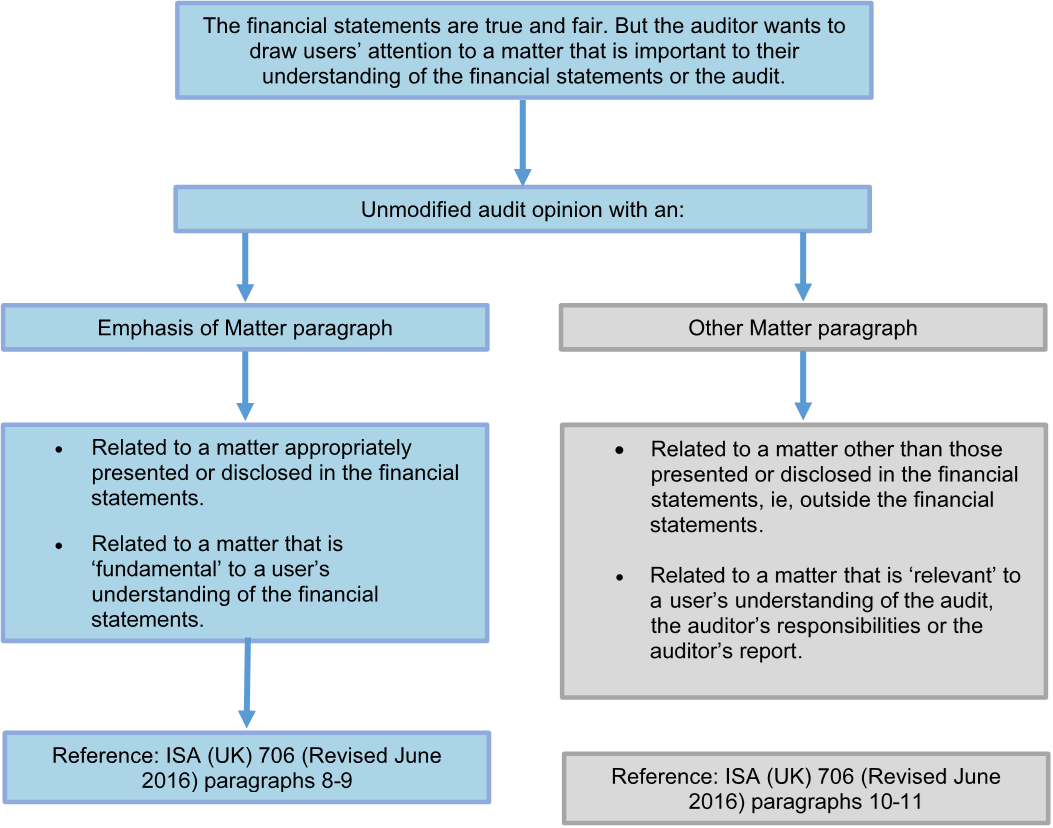

For instance when financial statements are prepared on a going concern basis a non-financial asset may be stated at an amount which is greater than its net realisable value provided that it is no greater than its recoverable amount. This guide is designed to explain the main changes that are needed to the audit report of a company where the financial statements are prepared on a basis other than going concern. An entity shall not prepare its financial statements on a going concern basis if management determines after the balance sheet date that it either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so.