Beautiful Gaap Accounting For Pass Through Expenses

Pass through costs conceptually are those which are incurred by an enterprise incidental to the business activity and in respect of which the enterprise does not perform any significant function or.

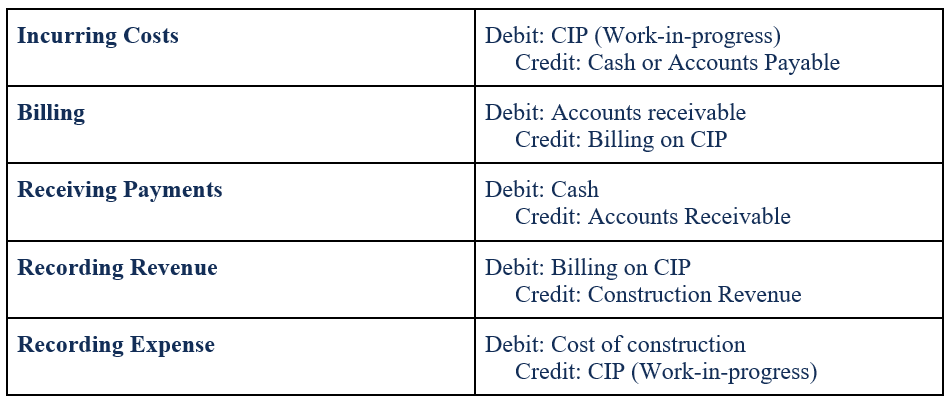

Gaap accounting for pass through expenses. If a customer agrees to reimburse you for these expenses then you can record the reimbursed expenses as revenue. A second level of income taxes are incurred at the C corporation owner level when after-tax net income is distributed in the form of dividends. We never net billings against expenses and show as a net zero expense in GA expense.

Current GAAP includes explicit presentation guidance on the accounting for reimbursements of out of pocket expenses. 2 - Pays expenses to the supplier on behalf of the client. With Odoo Expenses youll always have a clear overview of your teams expenses.

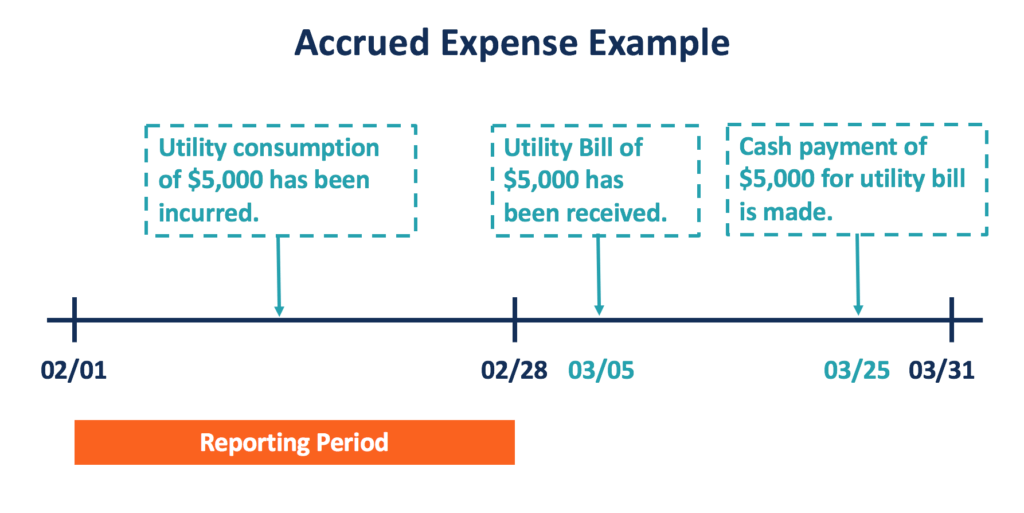

Such funding may be classified as dividends compensation andor loans. This is a straight in and out pass through however there are months of time lag between the two. With Odoo Expenses youll always have a clear overview of your teams expenses.

You are jumbling things up a lot unnecessarily especially if you are just going to net things at the end anyway. When AR is paid. As a general rule recipient governments should recognize all cash pass-through grants as revenue and expenditures or expenses in a governmental proprietary or trust fund.

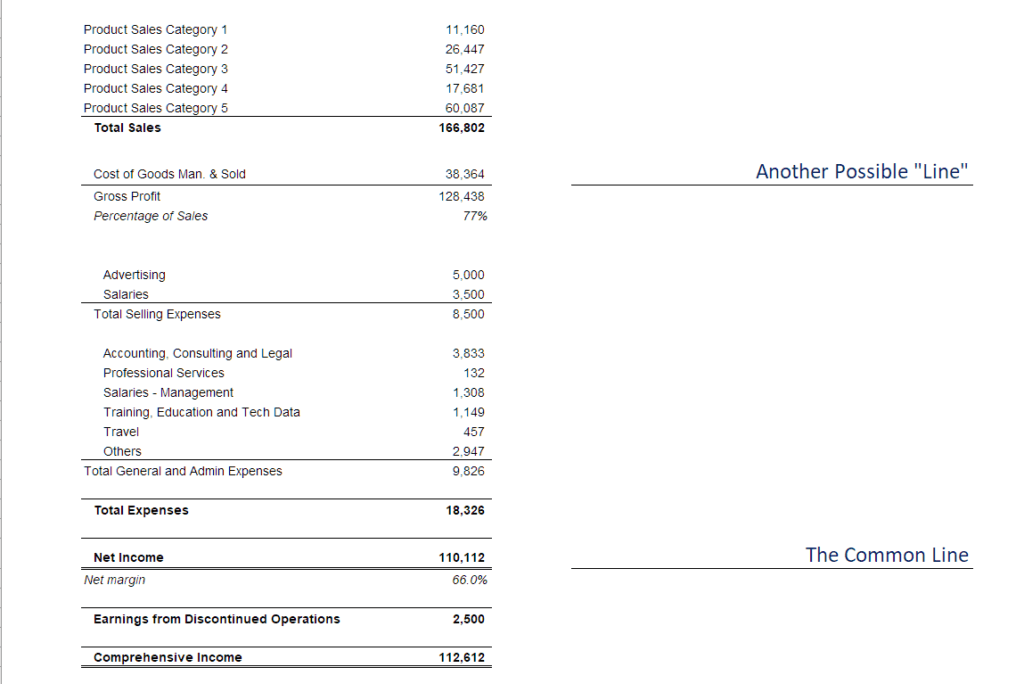

Just code the reimbursement against the expense. Accordingly C corporation financial statements may contain current and deferred income tax expenses and assets and liabilities not found on PTE financial statements. For example a business with 1000 in service sales 100 in billable Meal expenses and 100 in other non-billable expenses bills its client for 1100.

Income passed-through to them from the business. In those infrequent cases in which a recipient government serves only as a cash conduit-that is it has no administrative or direct financial involvement in the program-the grant should be reported in an agency fund. 01-14 Income Statement Characterization of.

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)