Best Goodwill Impairment Balance Sheet

An impairment loss makes it into the total operating expenses section of an income statement and thus decreases corporate net income.

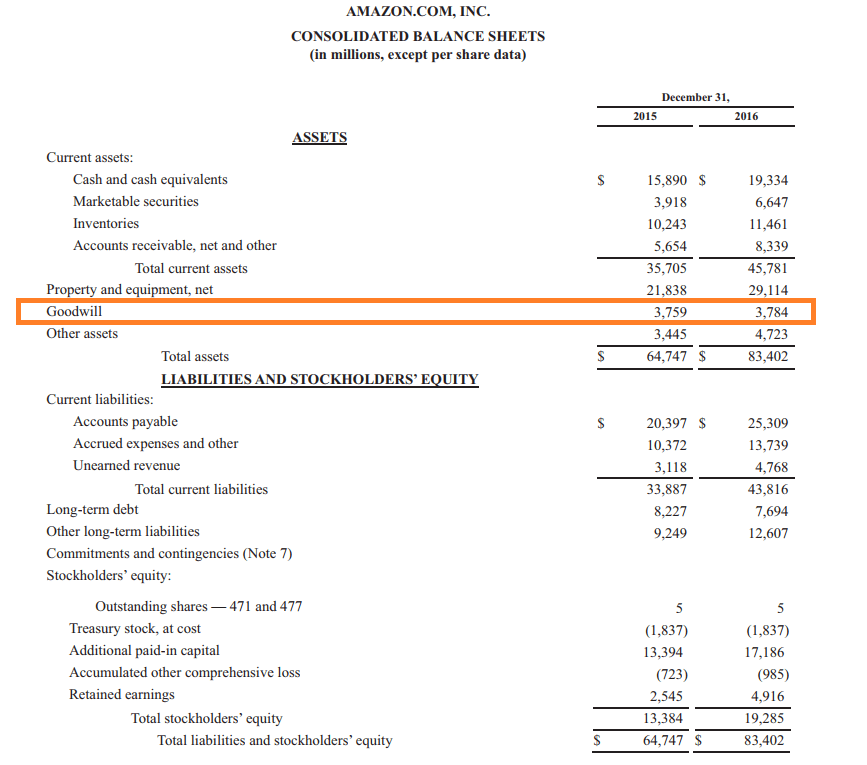

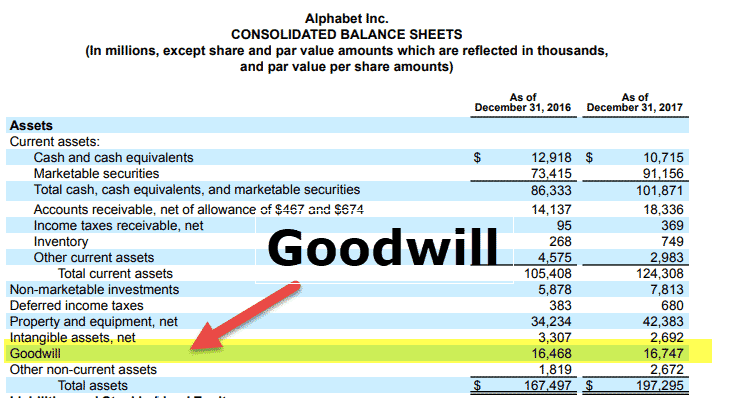

Goodwill impairment balance sheet. By debiting Loss on Goodwill Impairment you are recording the fact that a loss of 100000 has occurred which will appear on the income statement as an expense. You can find goodwill on a balance sheet but it is a separate line item under intangible assets. This is known as impairment.

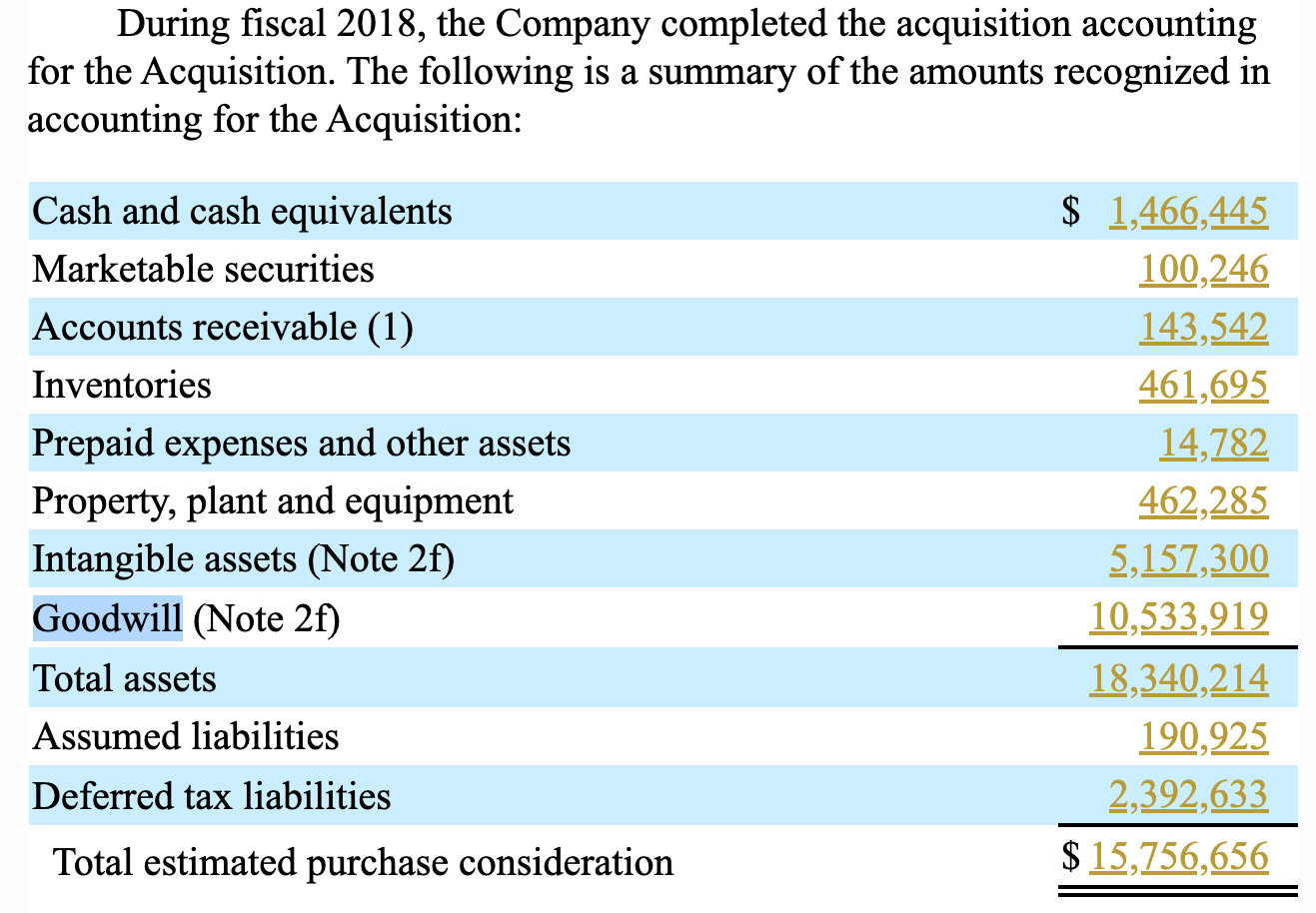

In accounting goodwill is recorded after a company. But at the same time we do not get the same sense of the importance of goodwill impairment testing from analysts and other market commentators or even from preparers themselves. FASB requires private companies.

This is then continually passed on into the next quarter. If goodwill is appreciated it is placed on the balance sheet in the existing system. Goodwill impairment and what has changed In situations where economic downturn or other conditions have resulted in a business being worth less than it previously was any goodwill on the balance sheet needs to be adjusted.

It should be written off as impairment charges in the Income Statement. Take a look at a balance sheet example from Microsoft Corp. Underlying goodwill on the balance sheet impairment testing is increasingly becoming a focus for regulators.

Then is impairment an operating expense. Then its continuously carried over into the next period. Once the reporting units of the carve-out business and the amount of goodwill attributable to each have been determined management should assess goodwill for impairment as of the first day of the initial year presented in the carve-out financial statements ie the opening balance sheet date and at least annually thereafter based on the reporting units of the carve-out business.

It has unlimited useful life which means it is not depreciated however it must be tested at least annually for impairment at the same time each year. If the fair value is lower than the carrying amount on the balance sheet date the emission rights are impaired. Goodwill Impairment Test.

:max_bytes(150000):strip_icc()/accountingcalculating-5bfc31ea46e0fb00265d18b4.jpg)