Simple Investment In Subsidiary In Balance Sheet

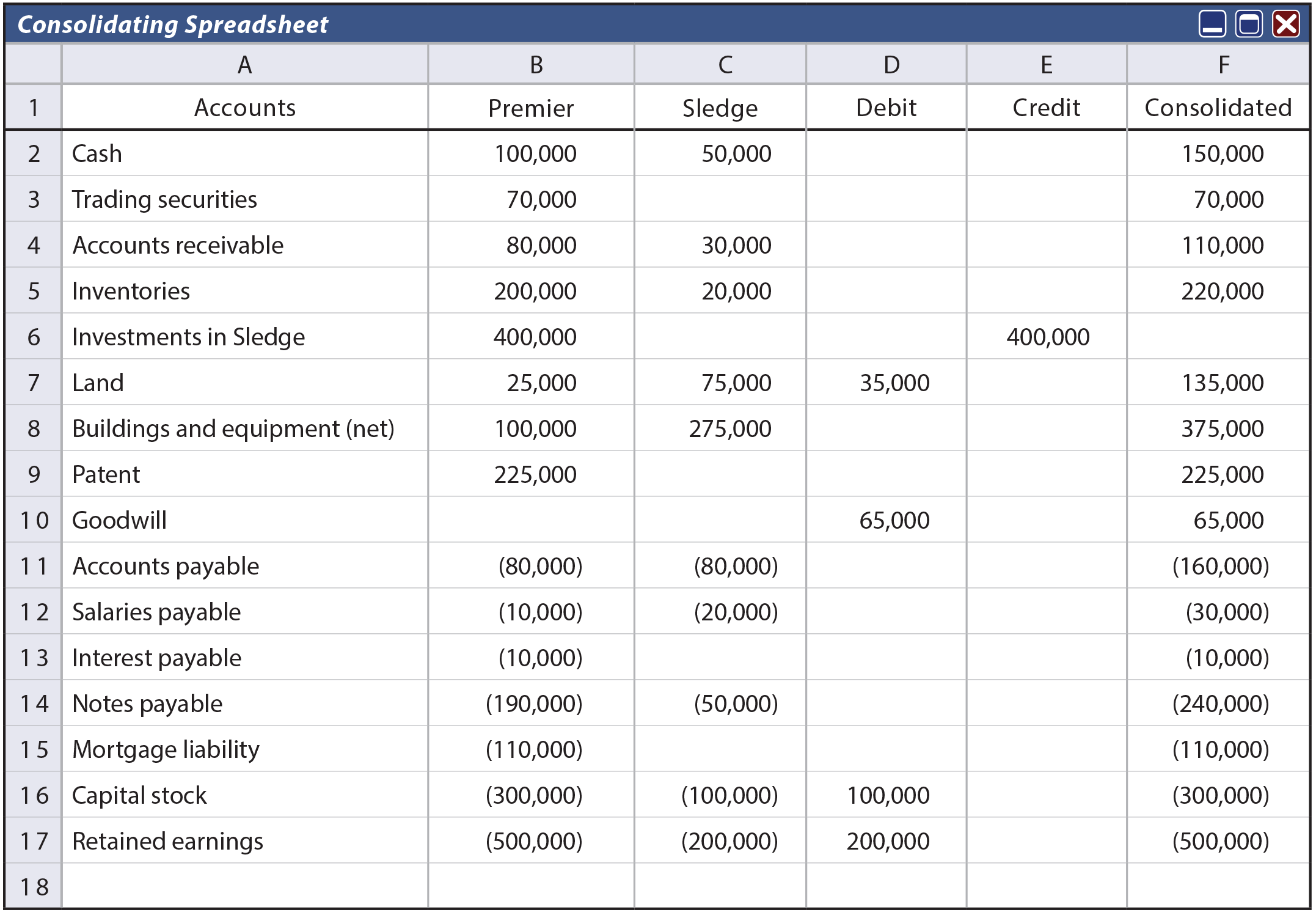

The consideration was 400000.

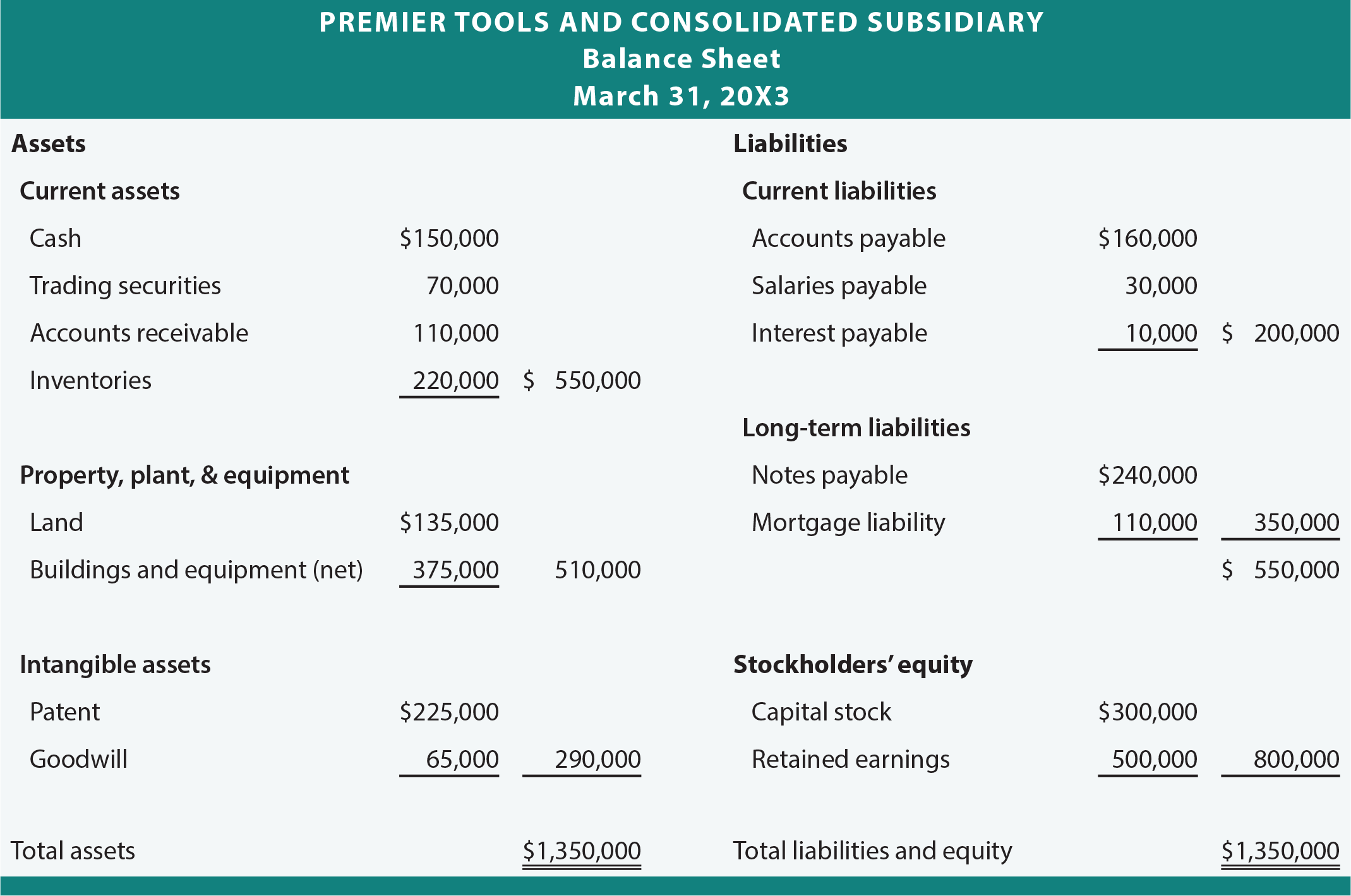

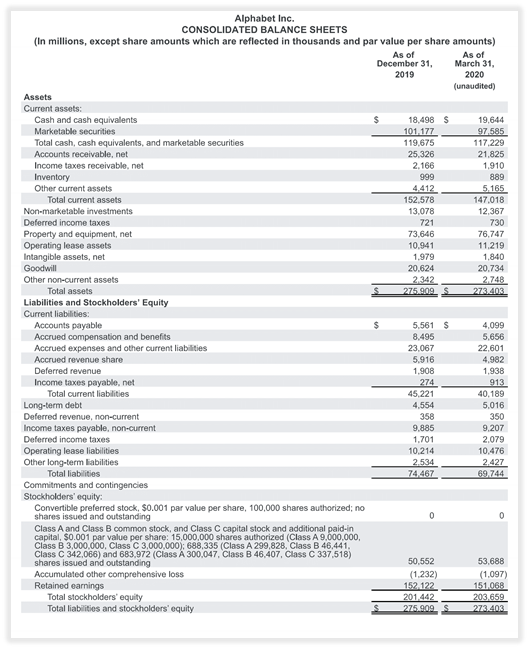

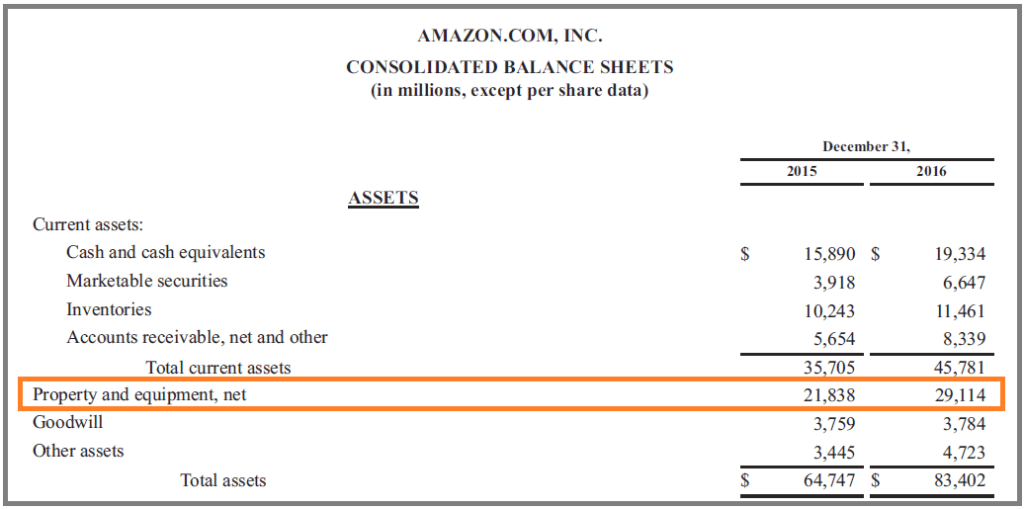

Investment in subsidiary in balance sheet. Real-world examples of Holding Subsidiary Company. There are several approaches to. The consolidated balance sheet also includes foreign subsidiaries.

You divide investments on a balance sheet into long-term and short-term investments. Illustration 1 The Balance Sheet of the H Ltd. This has been treated as an investment in a subsidiary in the draft accounts at cost.

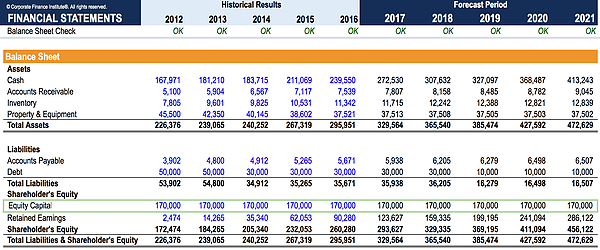

Whereas the subsidiary company will report the same transaction as equity in its balance sheet. The consolidation method records investment in subsidiary as an asset on the parent companys balances while recording an equal transaction in the equity side of the subsidiarys balance sheet. As on 31st March 2014 are given below.

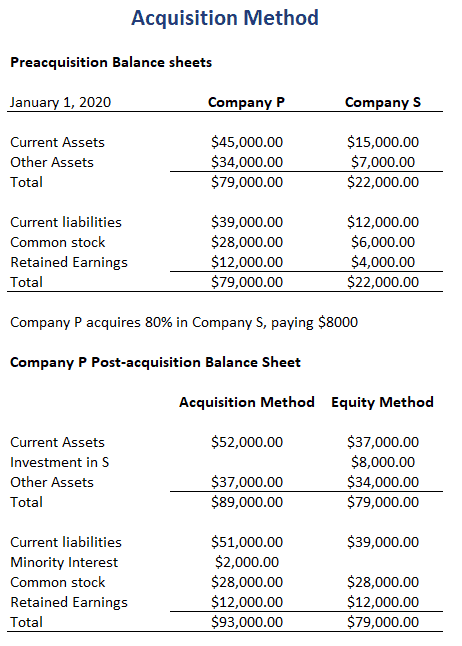

However it is sometimes difficult to convert the. While preparing the Consolidated Balance Sheet investments of the holding company in shares of subsidiary company have simply to be replaced by the net assets ie total assets and liabilities of subsidiary company. On acquisition the balance sheet of the parent will show the investment in subsidiary as 1000 for the purchase of shares from Mr X.

To do this debit Intercorporate Investment and credit Cash. Subsequent to this the subsidiary company prepared accounts to 30 April 2016 which showed all assetsliabilities had been stripped out. For example if the parent bought 50000 worth of a subsidiarys stock it would debit Intercorporate Investment for 50000 to reflect the new asset and credit cash for 50000 to reflect the cash outflow.

The subsidiarys retained earnings are allocated proportionally to controlling and non-controlling interests. Parent investment in a subsidiary previously accounted for as an asset in the parents balance sheet and as equity in the subsidiaries balance sheet is eliminated. Simply so where does investment in subsidiary go on the balance sheet.