Fantastic Ratio Analysis Involves Analyzing Financial Statements

Wall Street investment firms bank loan officers and knowledgeable business owners all use financial ratio analysis to learn more about a companys current financial health as well as its potential.

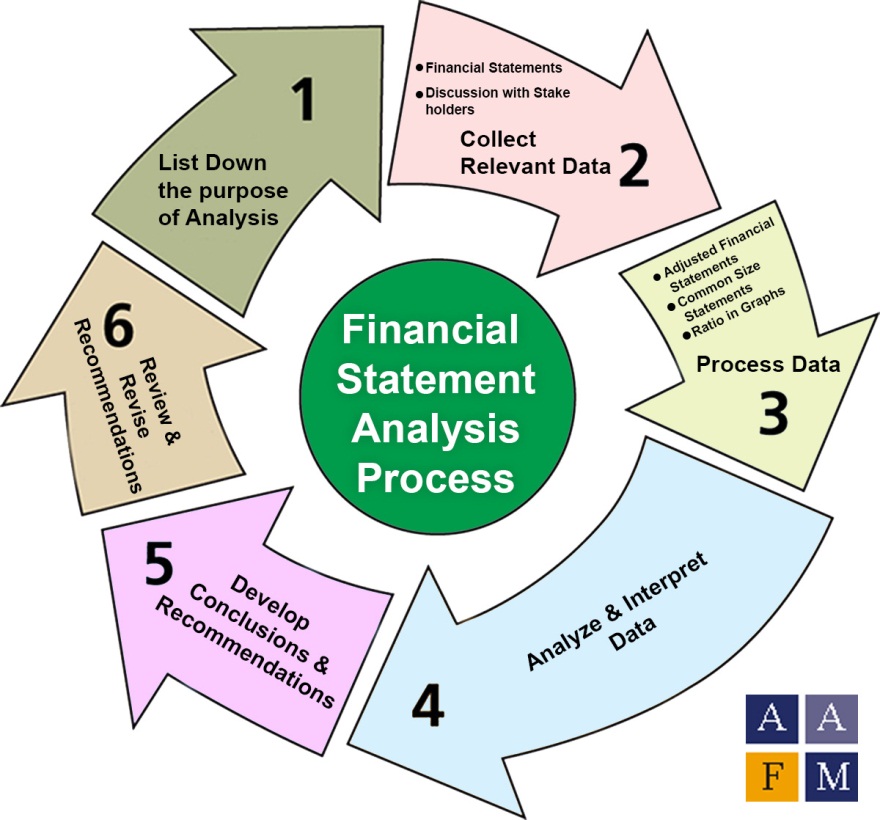

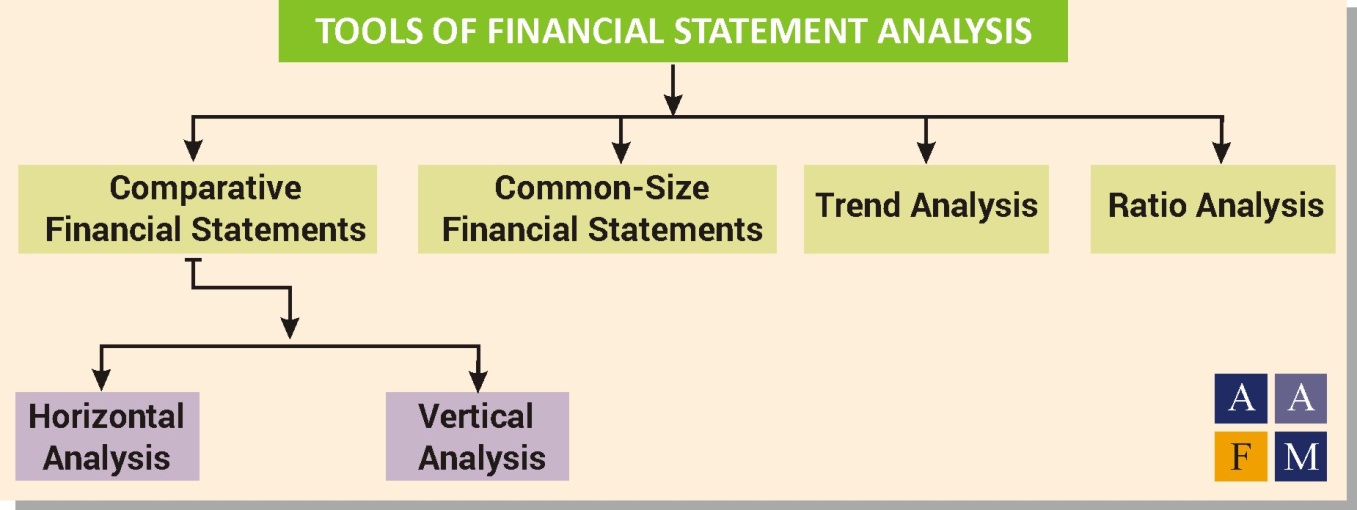

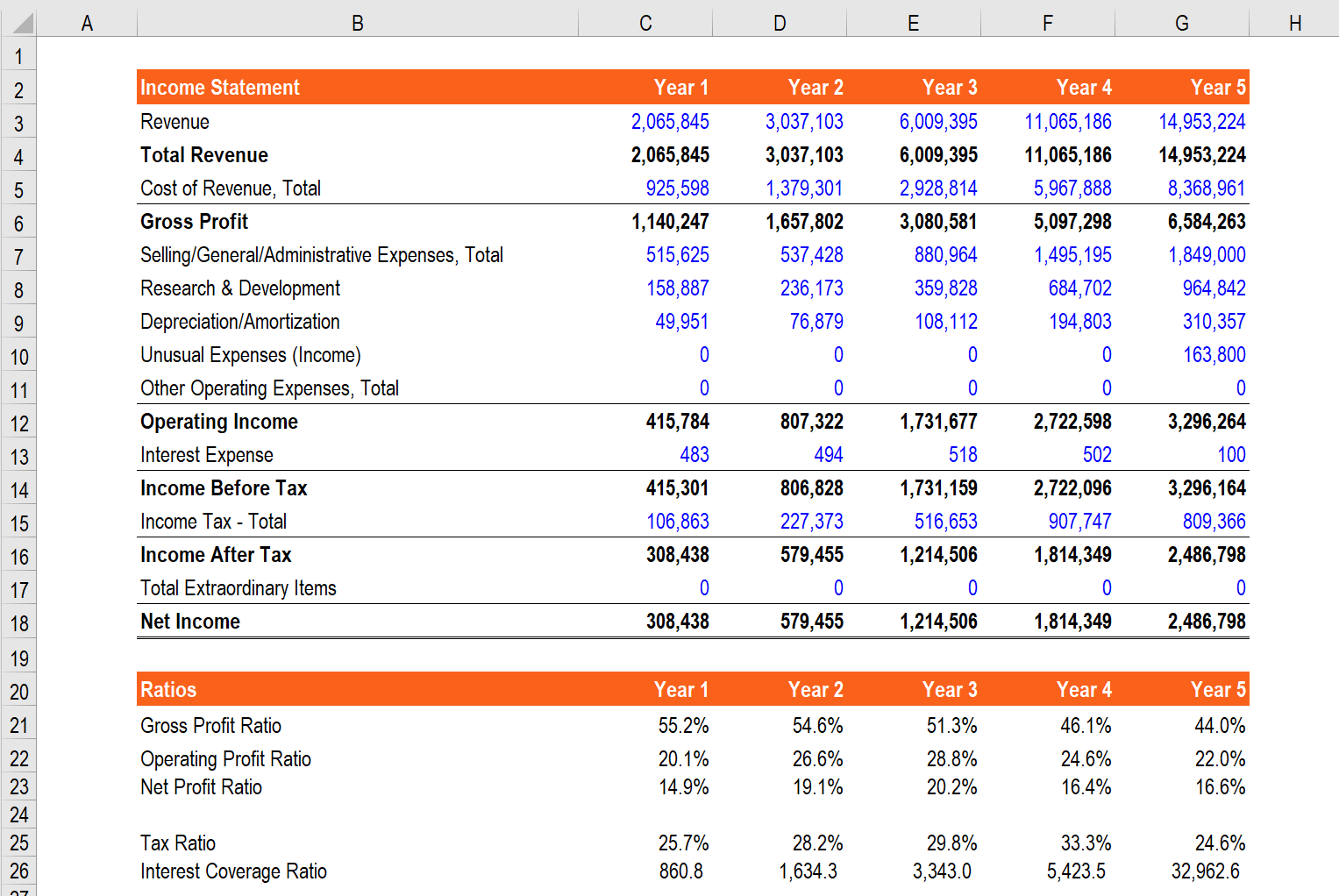

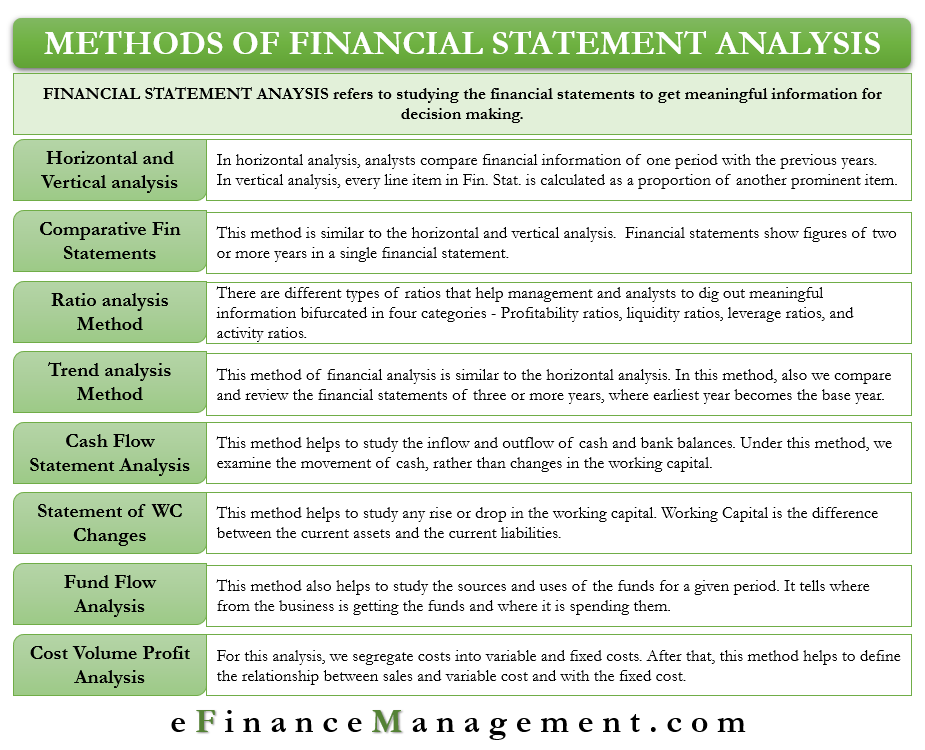

Ratio analysis involves analyzing financial statements. Ratio analysis is an effective tool to assist the analyst in answering some basic questions such as. Ratio analysis involves analyzing financial statements to help appraise a firms financial position and strength. Please note that although an analysis of financial ratios will help identify a companys strengths.

In-Depth Analysis from In-Country Experts Practice Tools Global News. Ratio analysis involves calculating and interpreting financial ratios using data taken from the firms financial statements in order to assess its condition and performance. In-Depth Analysis from In-Country Experts Practice Tools Global News.

These limits leave analysts with remaining questions about the company. Profitability activity liquidity and leverage ratios. Ad Best-in-Class Data Marketplace Connected Symbology for Financial Professionals.

The ratios used are. Uses and Users of Financial Ratio Analysis. Make Better Decisions Through A Trusted Authoritative Provider - Learn More With Us Now.

What are its strengths and weaknesses. It also shows the state of the company compared to prior years. Determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company.

Ad Primary Capital Markets Analysis Intelligence Covering The Worlds Fixed Income Market. Ad Primary Capital Markets Analysis Intelligence Covering The Worlds Fixed Income Market. Request A Demo And Speak To A FactSet Specialist About Our Flexible Data Solutions.