Fun Security Deposit In Cash Flow Statement

Presentation of a Statement of Cash Flows 10 12.

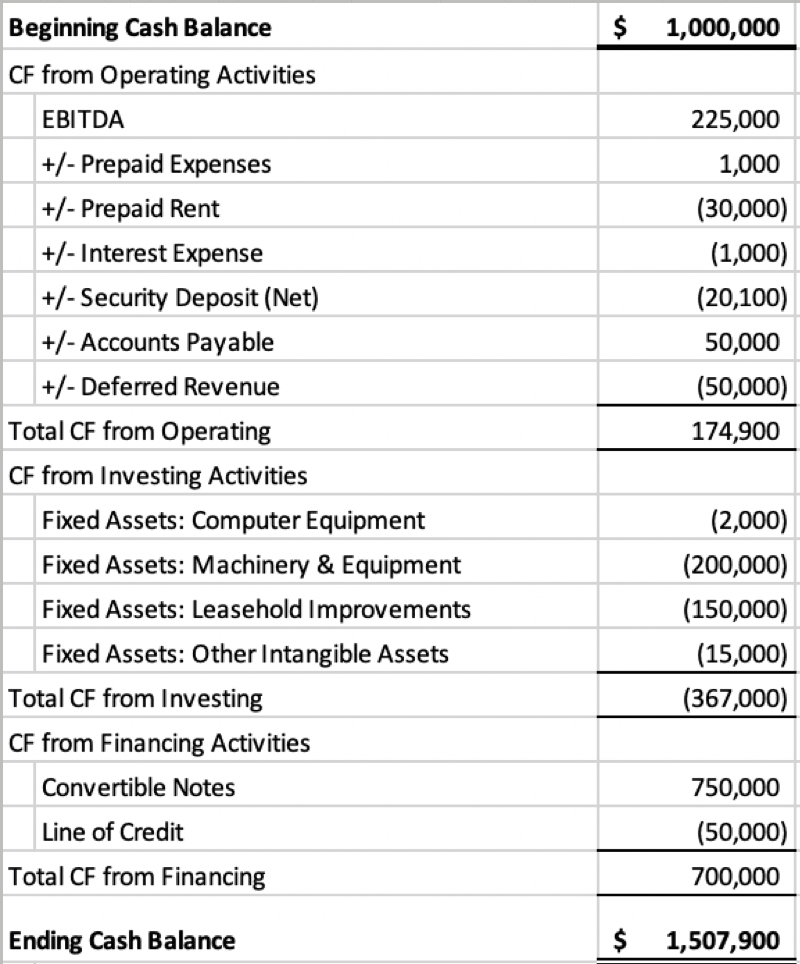

Security deposit in cash flow statement. Is it used in determining cash flow statement and how. Two exceptions to the gross reporting are. Thats 42500 we can spend right now if need be.

When a business places a security deposit that is it gives someone else money to hold against possible future charges the deposit is listed as an asset on its balance sheet. Even though our net income listed at the top of the cash flow statement and taken from our income statement was 60000 we only received 42500. Reporting Cash Flows from Investing and Financing.

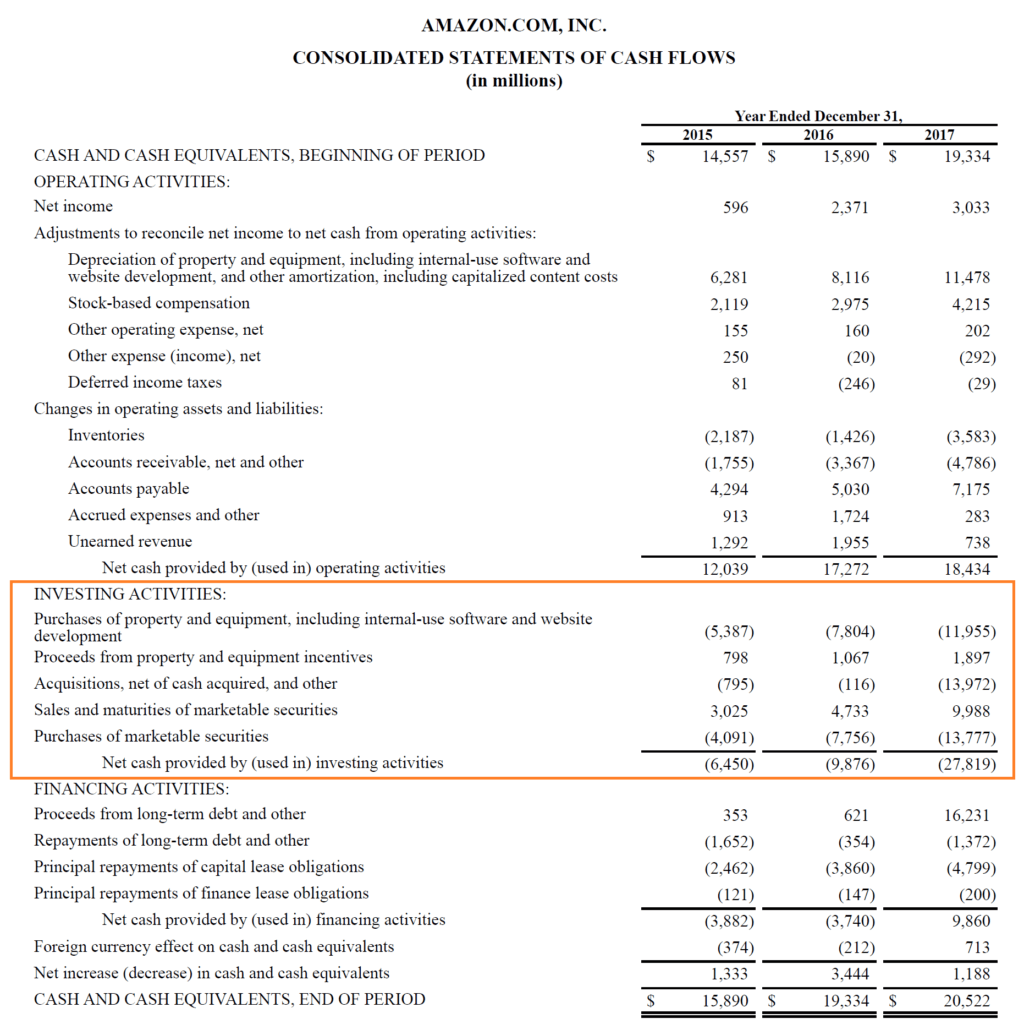

Generally cash receipts and cash payments are reported as gross rather than net. Capital and related financing. Statement of Cash Flows Categories for Classifying Cash Transactions.

The statement of cash flows primarily that in ASC 2301 The accounting principles related to the statement of cash flows have been in place for many years. As far as concern a short term deposit the amounts deposited may be the fair value since the effect of discounting may be immaterial. Reduces profit but does not impact cash flow it is a non-cash expense.

Investing activities the purchase and sale of long-term investments property plant and equipment as well as security deposits. This is where the cash flow statement comes in showing you that you do not yet have access to that 50000. The person receiving the security deposit would debit the asset account Cash and would credit the liability account Security Deposits Returnable.

It might be entered as something like Security Deposits Receivable Say the company placed a 1000 security deposit when it rented a piece of equipment. Since the security deposit is refundable and th. Financing Activities 17.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)