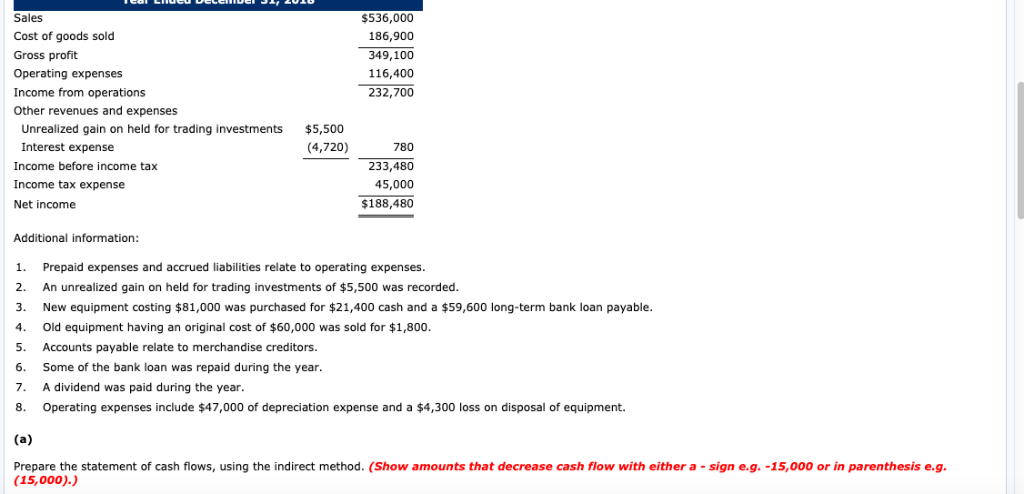

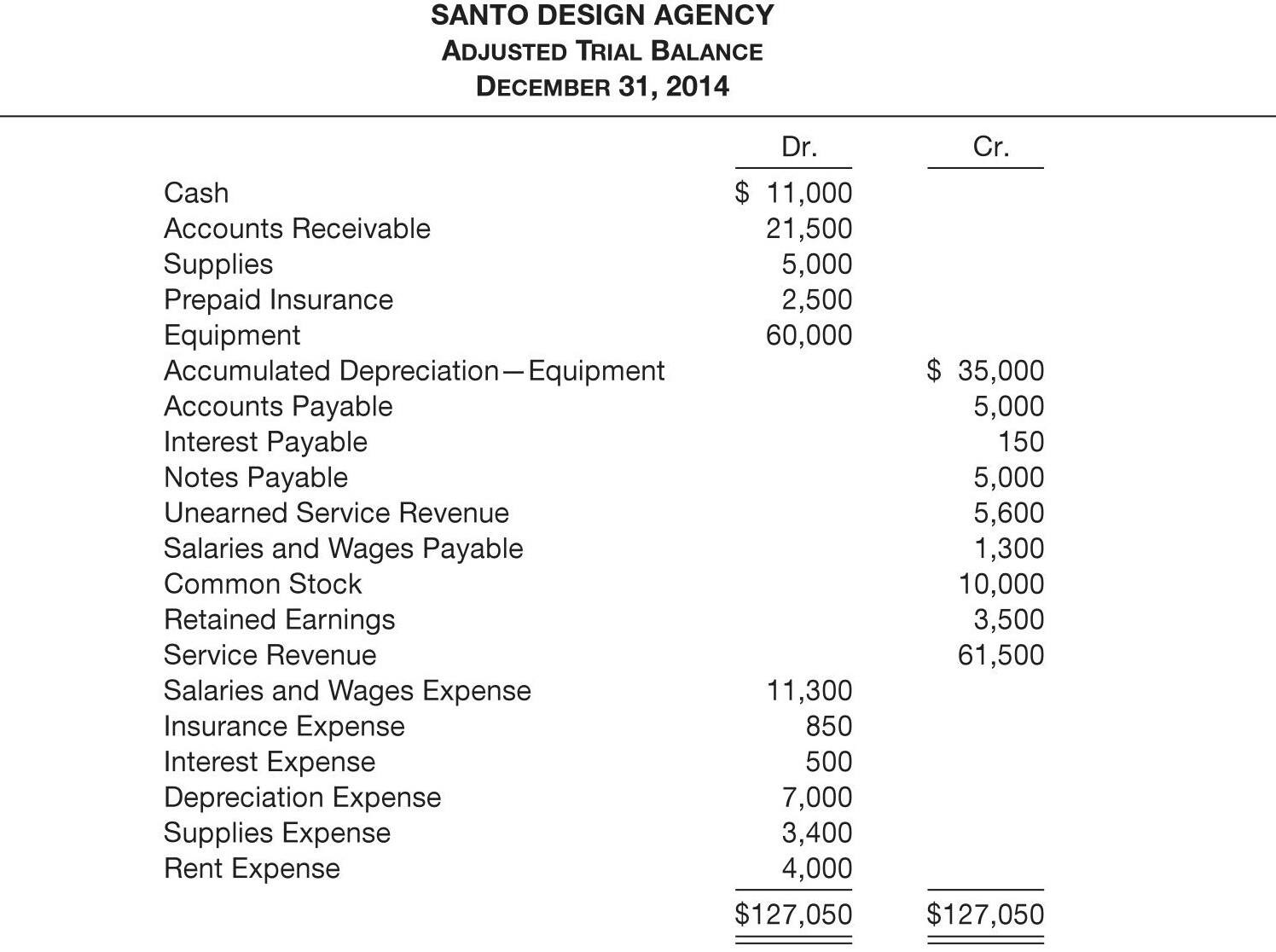

Looking Good Unclassified Income Statement

A classified income statement organizes information better than a single-step income statement where revenue and expense line items are simply listed in sequence with no attempt to present sub-totals.

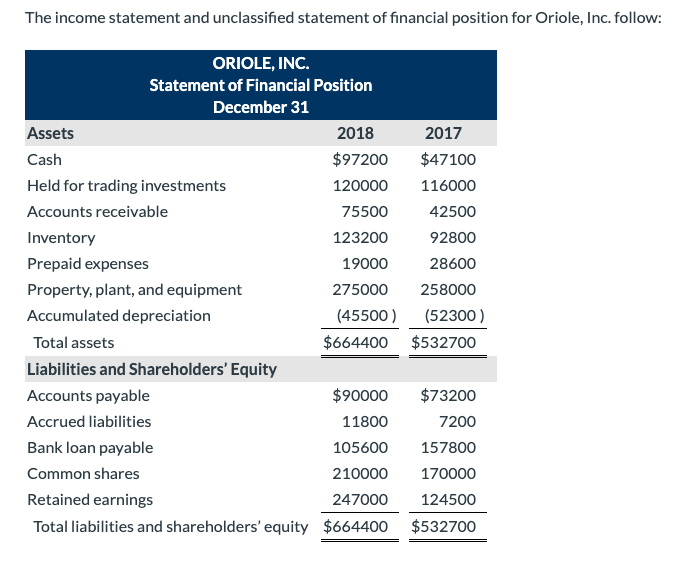

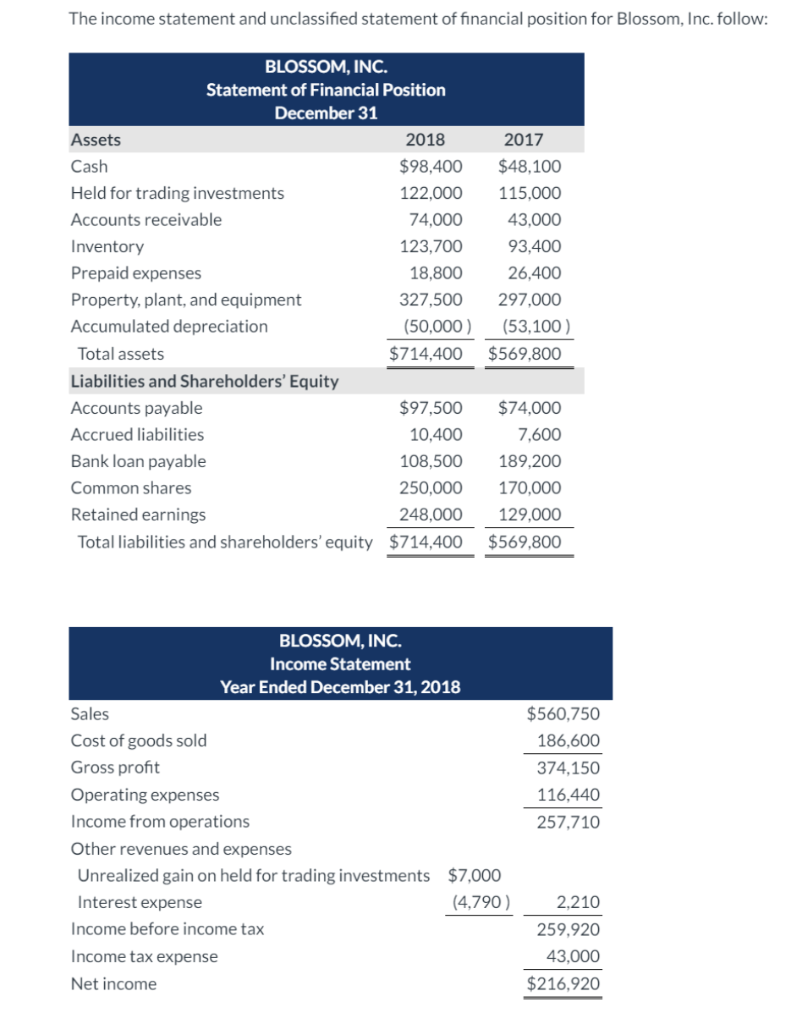

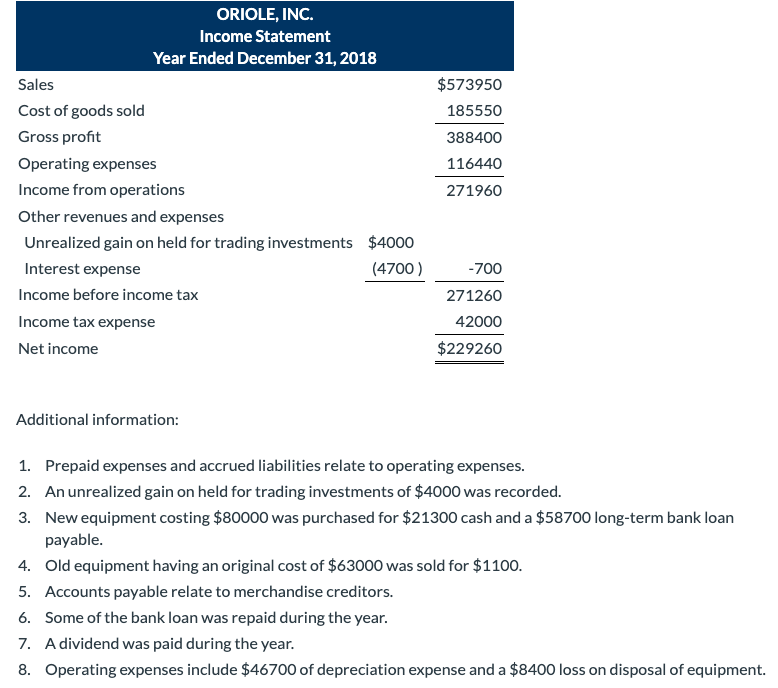

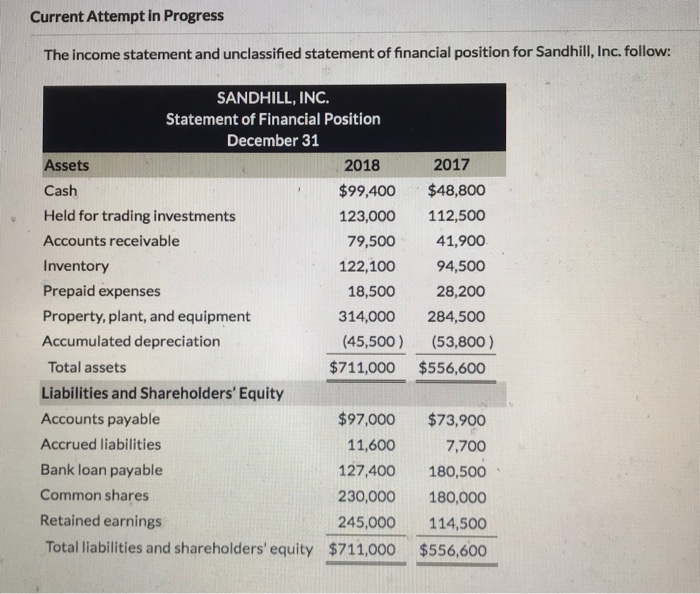

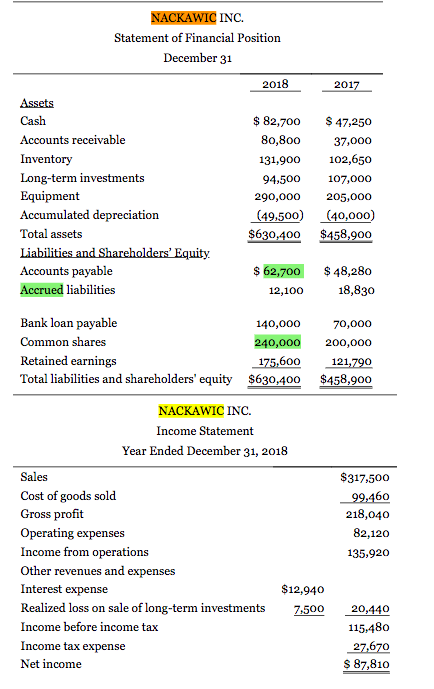

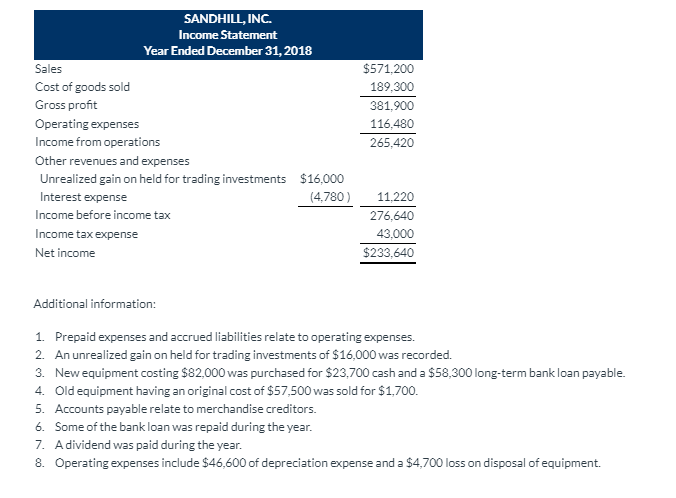

Unclassified income statement. Ad Find Income Statement Template. Statement of Financial Position December 31 Assets 2018 2017 Cash 97200 48000 Held for trading investments 122000 115000 Accounts receivable 79500 42500 Inventory 122500 95000 Prepaid expenses 18100 27 000 Property plant and equipment. In contrast a classified income statement divides both revenues and expenses into operating and non operating items.

An unclassified income statement has merely two categories revenues and expenses. Classified Statement vs. Ad Find Income Statement Form.

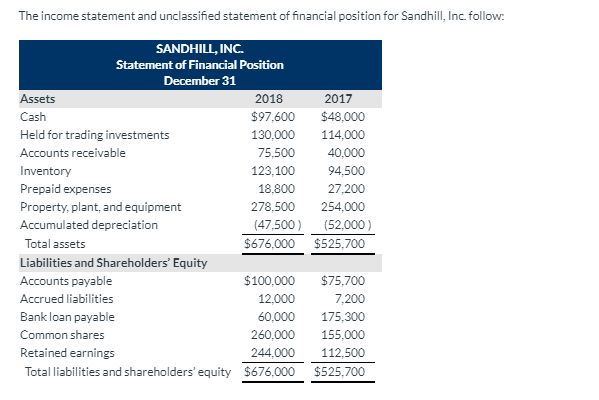

Your balance sheet is one report included in your. Statement of Financial Position December 31 Assets 2018 2017 Cash 99600 48500 Held for trading investments 127000 112000 Accounts receivable 77000 40700 Inventory 122000 92950 Prepaid expenses 18500 28000 Property plant and equipment. The income statement and unclassified statement of financial position for Crane Inc.

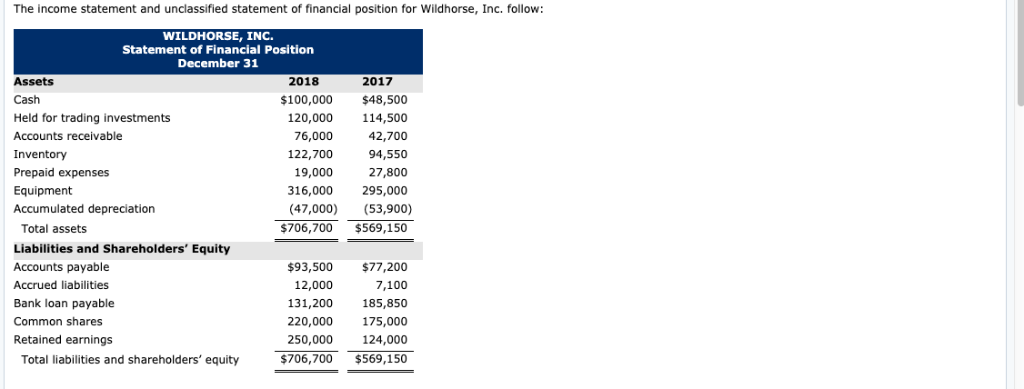

An unclassified income statement has only two categories revenues and expenses. Statement of Financial Position December 31 2017 Assets 2018 Cash 100000 48500 Held for trading investments 120000 114500 Accounts receivable 42700 76000 Inventory 122700 94550 Prepaid expenses 19000 27800 316000 Equipment 295000 Accumulated depreciation 47000 53900 706700 569150 Total assets. The financial statements of your business are comprised of several different reports.

The statement also separates operating expenses into selling and administrative expenses. A classified income statement is also called a multiple-step. Ad Find Income Statement Form.

Ad Find Income Statement Form. In contrast a classified income statement divides both revenues and expenses into operation and non-operating items. An unclassified balance sheet does not provide any sub-classifications of assets liabilities or equity.

.png)