Supreme Aasb 16 Special Purpose Financial Statements

June and December 2017.

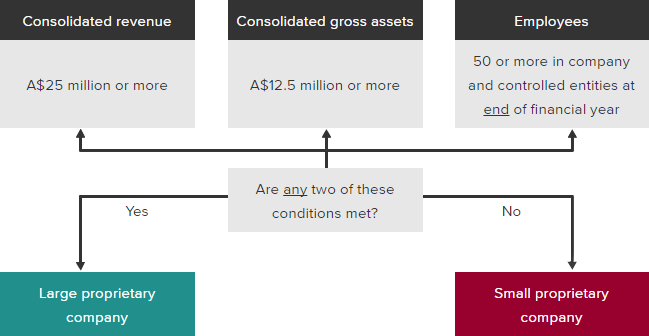

Aasb 16 special purpose financial statements. Accordingly the proposals do not apply to. Lets pose a scenario that prior to the date of initial application of AASB 16 a company had 30 employees revenues of 60 million and total assets of 10 million. These special purpose financial statements have been prepared for the sole purpose of distributing a financial report to.

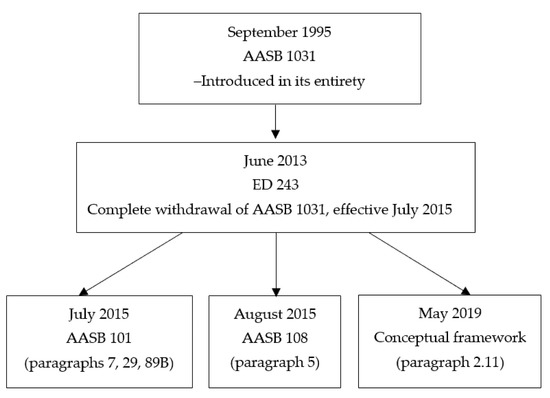

The Australian Accounting Standards Board makes Accounting Standard AASB 2020-2 Amendments to Australian Accounting Standards Removal of Special Purpose Financial Statements for Certain For-Profit Private Sector Entities under section 334 of the Corporations Act 2001. The Baptist Union of Queensland trading as Queensland Baptists is a not-for-profit entity for the purpose of preparing financial statements under Australian. The standard replaces AASB 117 Leases and for lessees.

Most SMEs Small to Medium Enterprises and not-for profit entities will produce a simple. TaxCompliance Jotham Lian 16 July 2019 1. December 2018 special purpose model financial statements.

The reporting periods ending 31 December 2020 and 30 June 2021 represent an opportunity for most Australian entities to take stock of their financial statements after a frenzied period of significant change ensuring financial reports accurately reflect the requirements of AASB 16 Leases AASB 15 Revenue from Contracts with Customers AASB 9 Financial Instruments and Interpretation 12. More significant changes are on their way with AASB 15 and AASB 1058 Income of Not-for-Profit Entities not-for-profit entities and AASB 16 Leases for-profit and not-for-profit entities coming into effect. Entities using special-purpose financial statements could soon be required to explicitly state if accounting policies comply with recognition and measurement requirements.

These proposals are contained in ED 302 Disclosures in special purpose financial statements of certain for profit private sector entities and will impact entities within the scope of AASB 2020-2 that choose not to early adopt the requirements of this standard in their 30 June 2021 financial statements adoption is mandatory for 30 June 2022. As evident in the name of the exposure draft the AASB is proposing to scrap SPFS but at this stage only for for-profit private sector entities. AASB 16 Leases AASB 16 The company has adopted AASB 16 from 1 July 2019.

For example special-purpose financial statements are prepared for tax reporting bank reporting and industry-specific reporting. December 2017 model financial statements Tier 1 and Tier 2 RDR December 2017 model half-year report. AASB 15 Revenue from Contracts with Customers for-profit entities and AASB 9 Financial Instruments for-profit and not-for-profit entities apply for the first time this reporting period.