First Class Contingent Liability Note

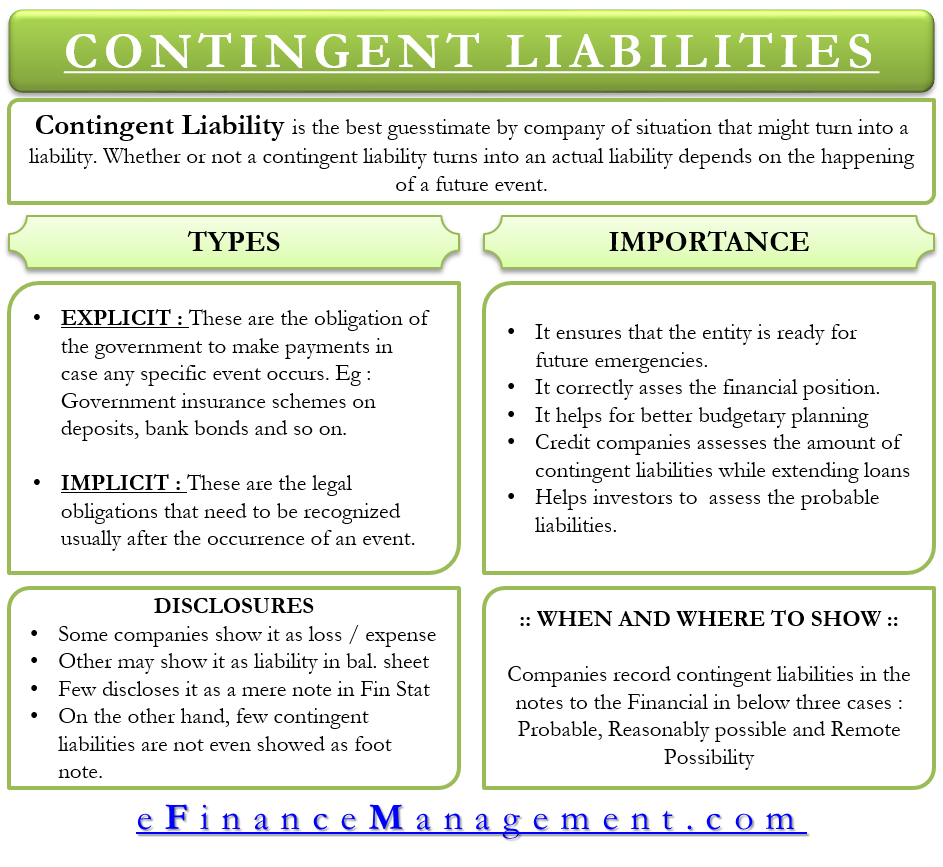

Introduction of Contingent Liability.

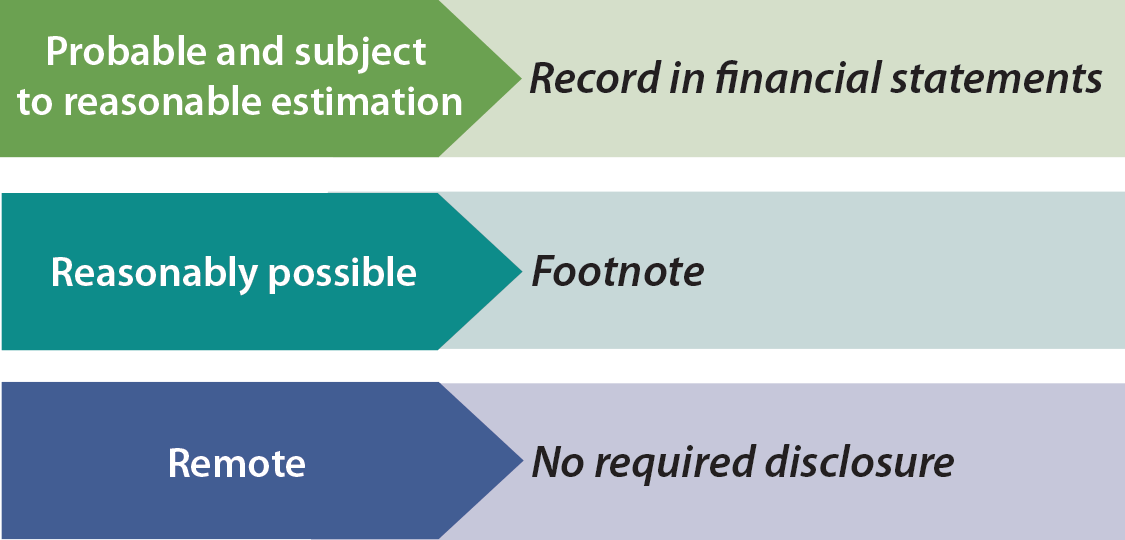

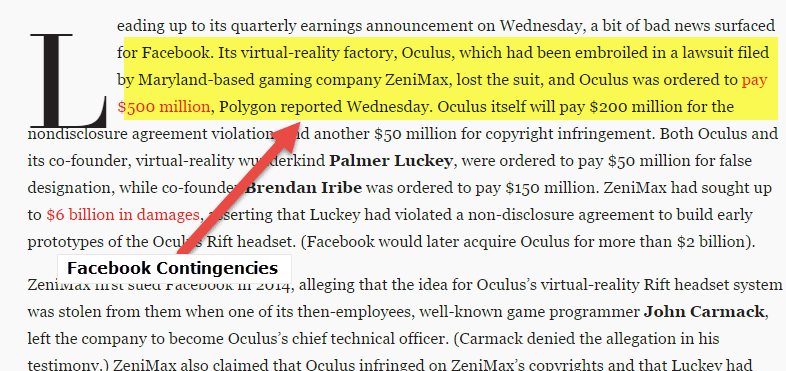

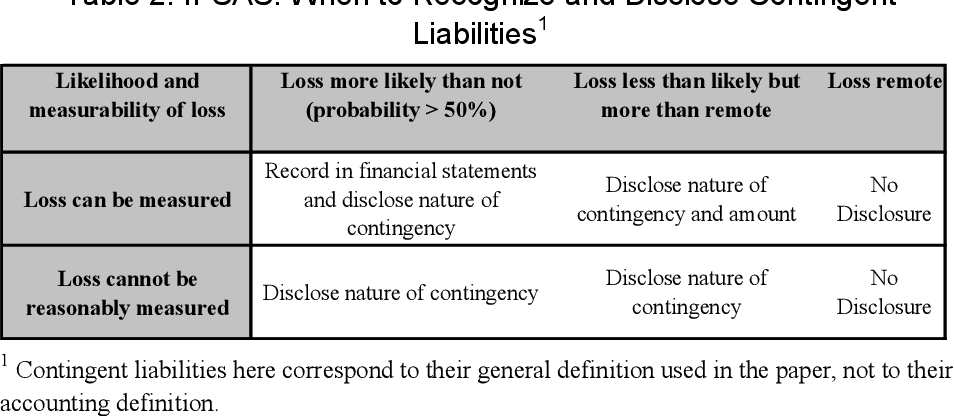

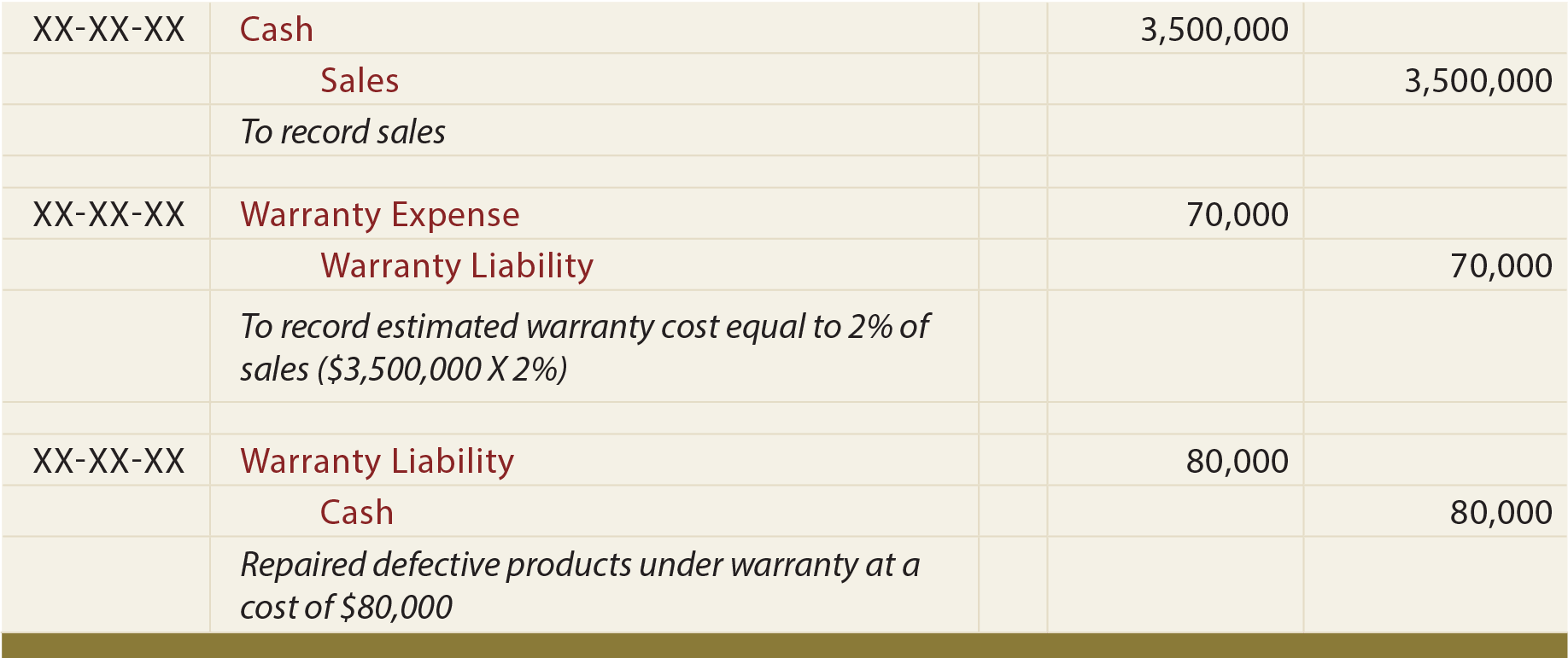

Contingent liability note. Ad Find Buy Liability Insurance. A contingent liability is a liability that may occur depending on the outcome of an uncertain future event. A possible obligation depending on whether some uncertain future event occurs or a present obligation but payment is not probable or.

Search a wide range of information from across the web with topsearchco. Ad Find Visit Today and Find More Results. Please refer to Note 26a for the accounting policy on goodwill on acquisition of subsidiaries.

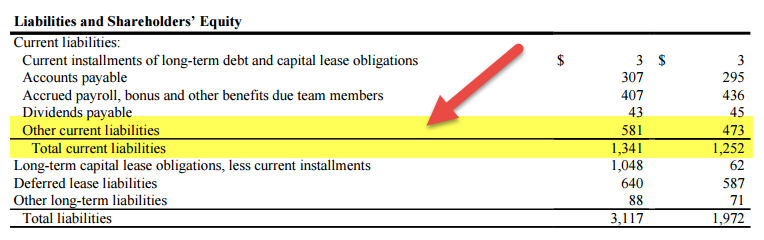

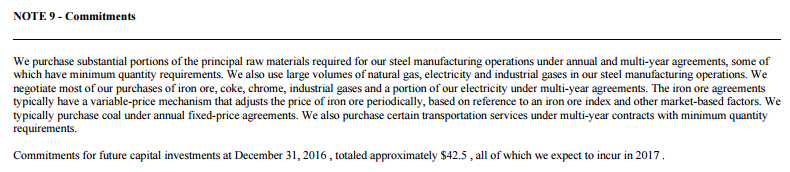

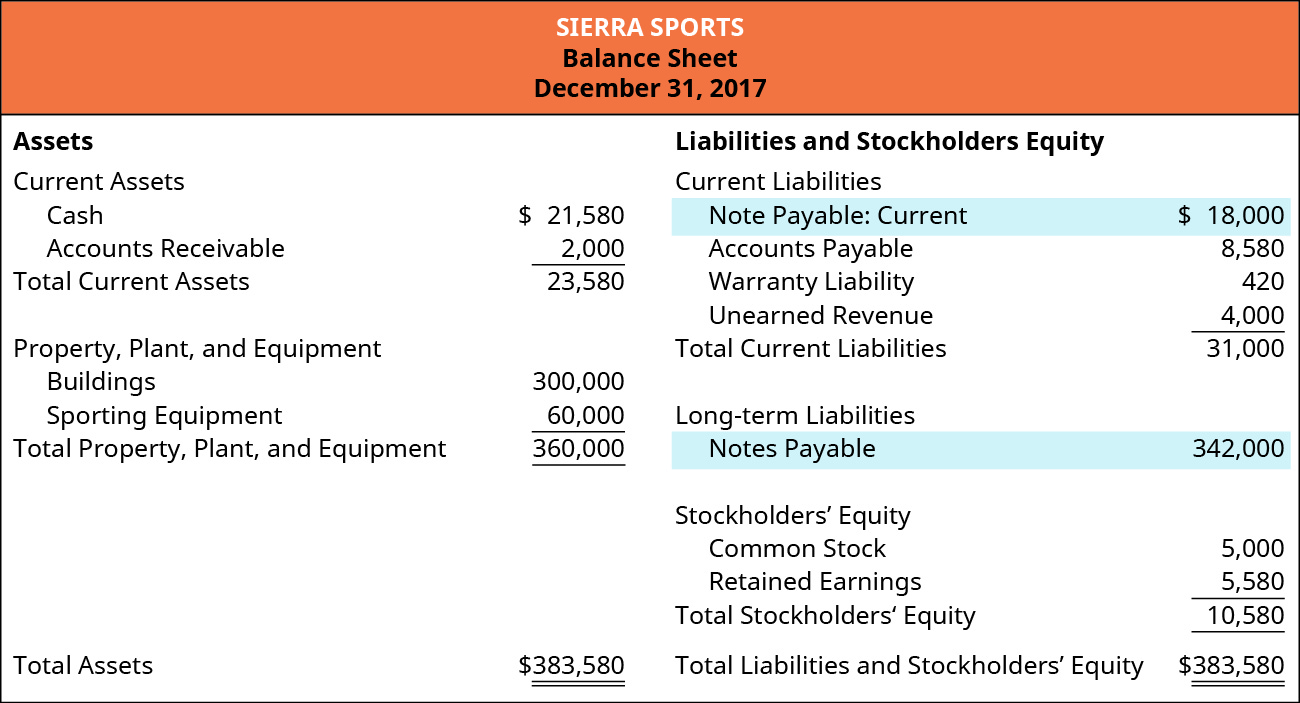

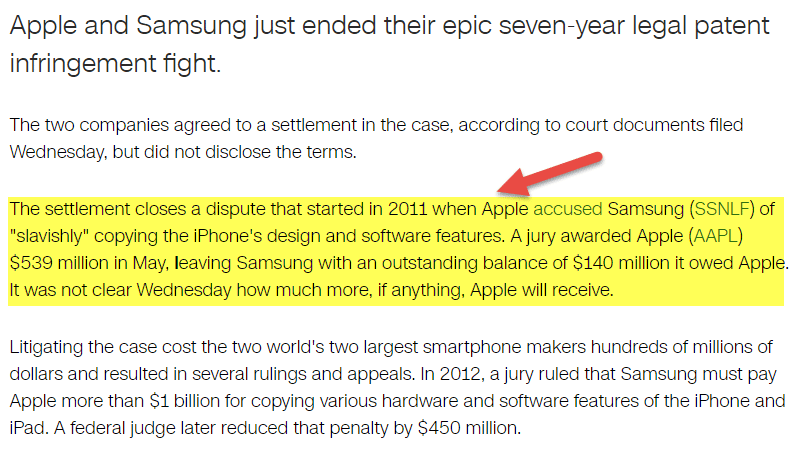

Contingent Liabilities examples are liabilities that are dependent on a future outcome. Trade and other payables. And liabilities and contingent liabilities assumed in a business combination are measured initially at their fair values on the date of acquisition irrespective of the extent of any minority interest.

Possible obligations that arise from past events and whose existence will be confirmed only by the occurrence or nonoccurrence of one or more uncertain future events not wholly within the control of the entity. Due to this reason a contingent liability is also known as a loss contingency. Ad Find Visit Today and Find More Results.

Search a wide range of information from across the web with topsearchco. CONTINGENT ASSETS Objective The objective of this Standard is to ensure that appropriate recognition criteria and measurement bases are applied to provisions contingent liabilities and contingent assets and that sufficient information is disclosed in the notes to. Ad Find Visit Today and Find More Results.

Remuneration of the Supervisory Board and the Board of Management. Visit Today and Find More Results. What is a Contingent Liability.