Favorite Tax Recoverable In Balance Sheet

TDS Recoverable amount is in the nature of Advance.

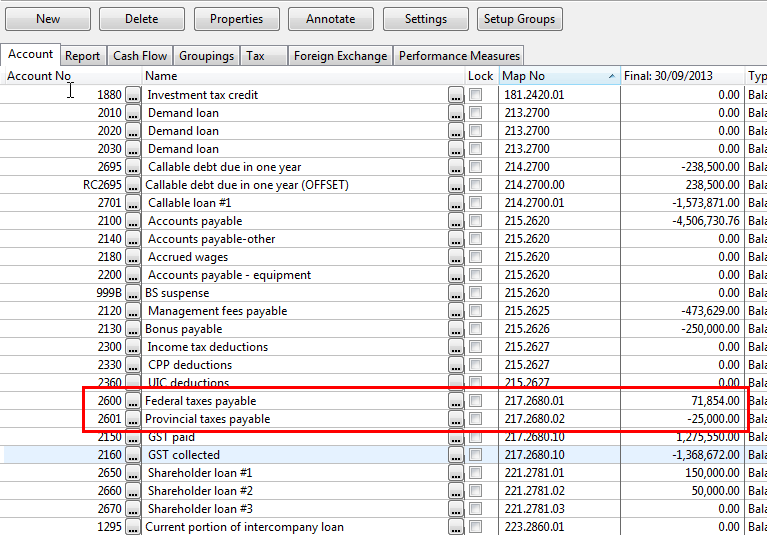

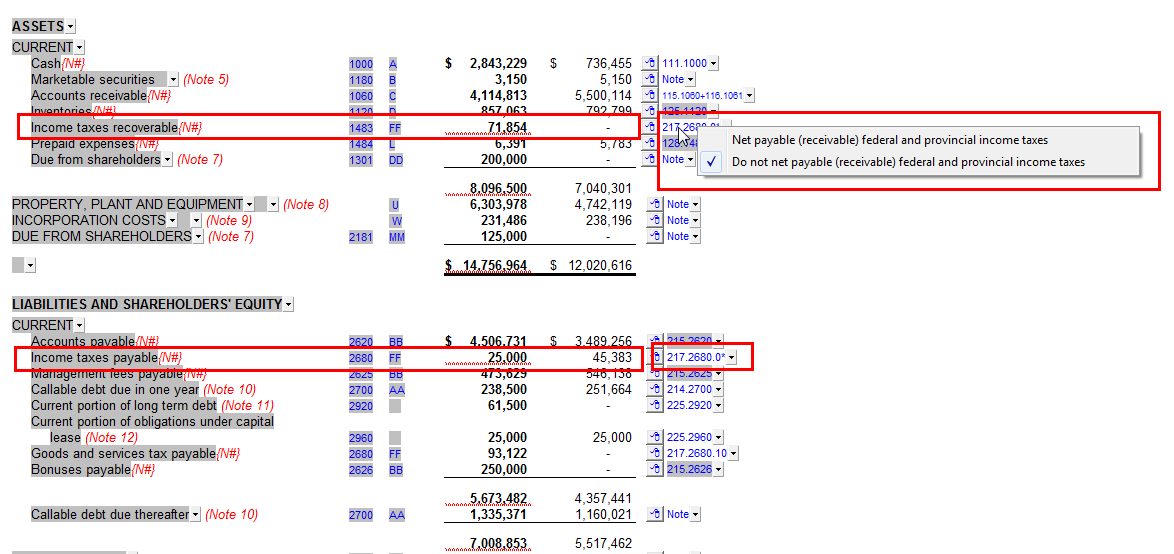

Tax recoverable in balance sheet. In the state where Paula does business theres a sales tax called Tax 2 T2. Your business may receive business tax credits that reduce your tax. Generally the sum of TDS advance income tax remains more than provision of income tax.

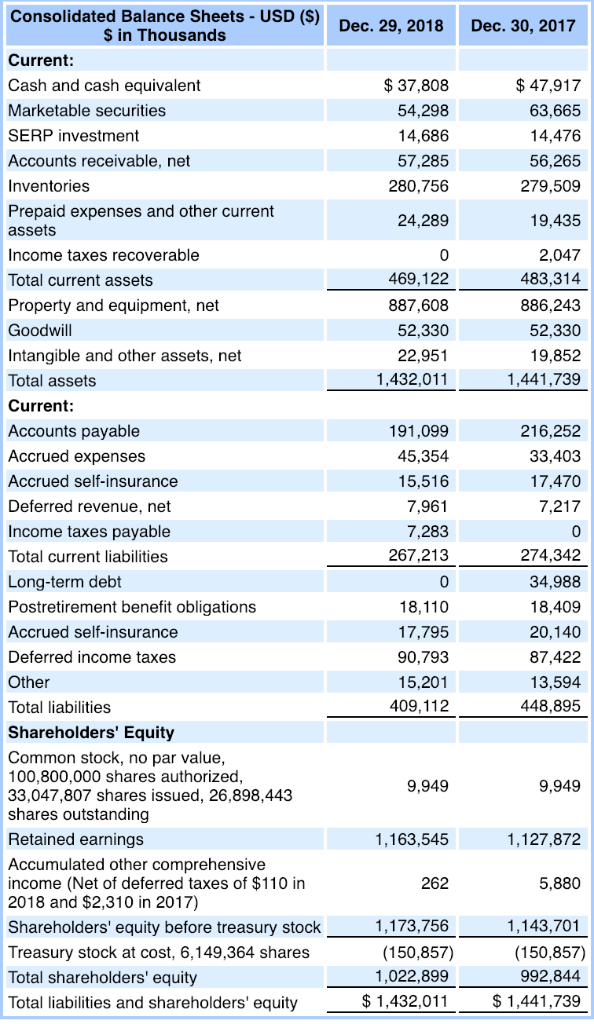

TDS recoverable also showed with advance income tax at Property Assets side of Balance sheet. In any case the Income Taxes Recoverable are considered cash as its money recoverable from the government. For example if a business tax for the coming tax period is recognized to be 1500 then the balance sheet will reflect a tax payable amount of 1500 which needs to be paid by its due date.

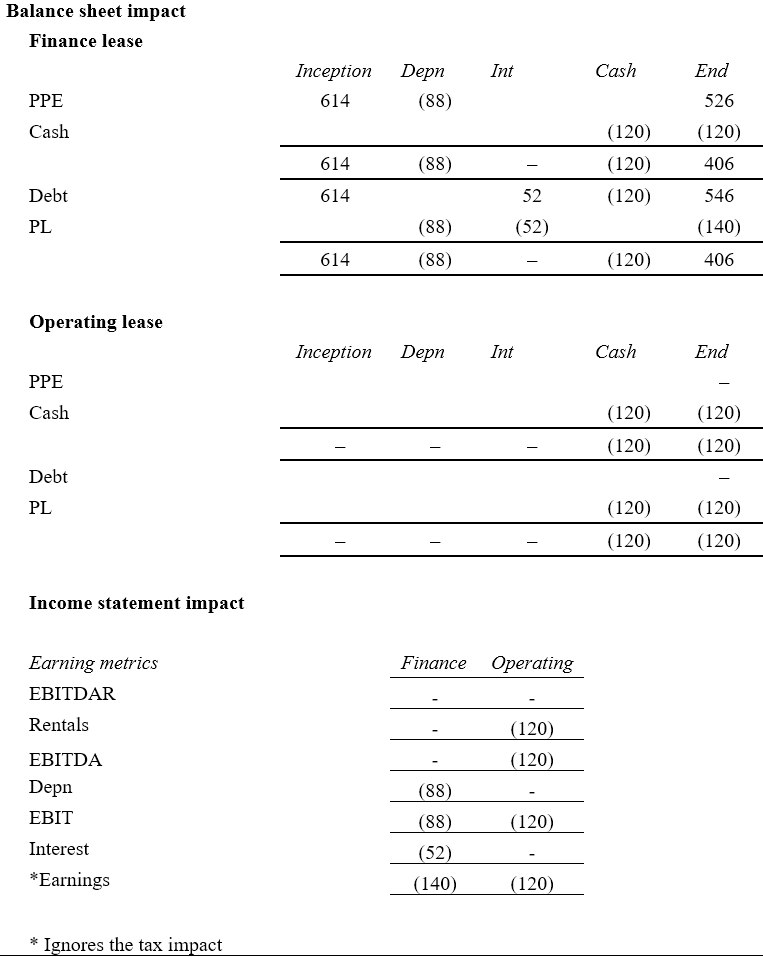

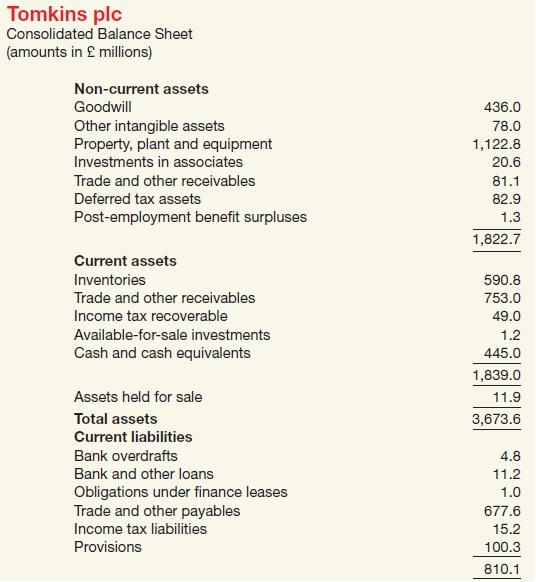

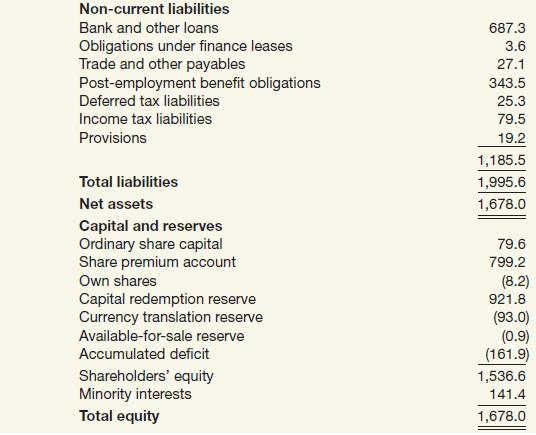

Recoverable income tax is the amount of money a company can expect to receive back from federal or state government as a result of a deferral of tax credits and losses. Any balance in the VAT Credit Receivable Capital Goodsat the end of the year is shown in the as assets in balance sheet under Loans and Advances. Deferred tax typically refers to liabilities wherein the amount entered on the balance sheet is payable at a future time.

A deferred tax asset is an item on the balance sheet that results from overpayment or advance payment of taxes. Increase Interest Income income account on your income statement If you have any working papers you will probably have an analysis of your corporate income tax payable by year. Lets dive into a few reasons why you may receive a refund.

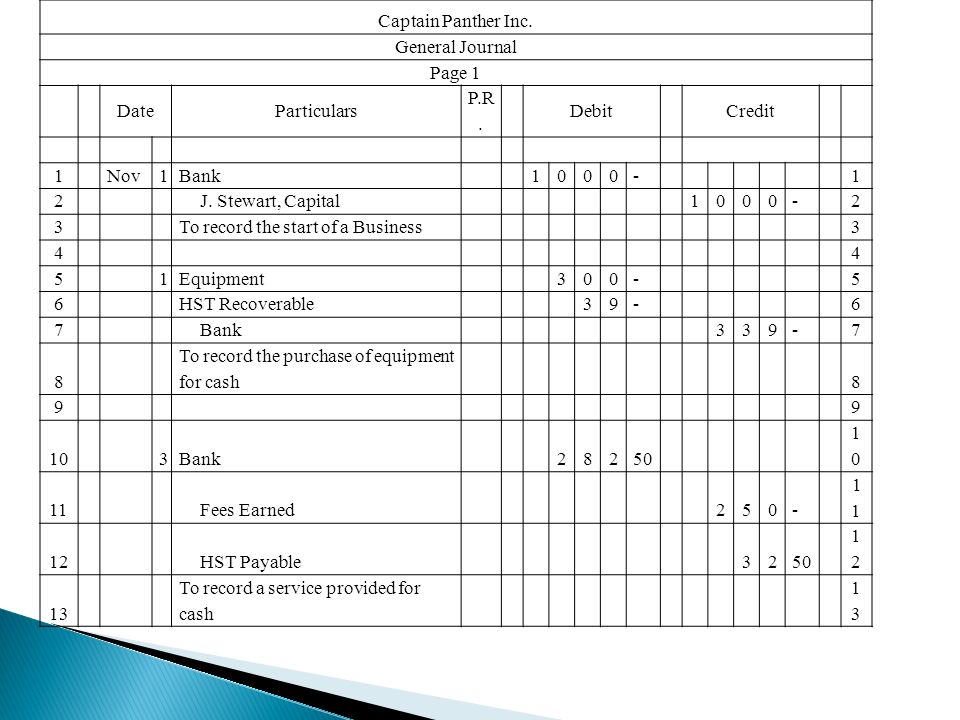

Only the net amount of 250 is posted to the income statement purchases account. Means the tax recoverable account in the current assets account of the Company corresponding to such account in the Companys 2011 Financial Statements less any Non-Recoverable Taxes. Lets imagine another customer Paula who sells gaskets.

Sales taxes are posted as a debit to the sales tax account. IAS 12 Income Taxes implements a so-called comprehensive balance sheet method of accounting for income taxes which recognises both the current tax consequences of transactions and events and the future tax consequences of the future recovery or settlement of the carrying amount of an entitys assets and liabilities. Show Tax Recoverable in the Balance Sheet The journal entry to record a tax refund involved debiting the income tax expense account and crediting the cash account.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/ExxonOilreservesPDF-f07628dcc0c04b21a67b1fe1f0d06a4f.jpg)