Recommendation Uses Of Profit And Loss Account

They are also known as income statements.

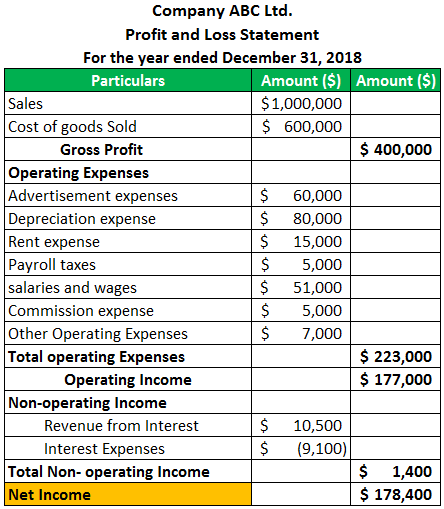

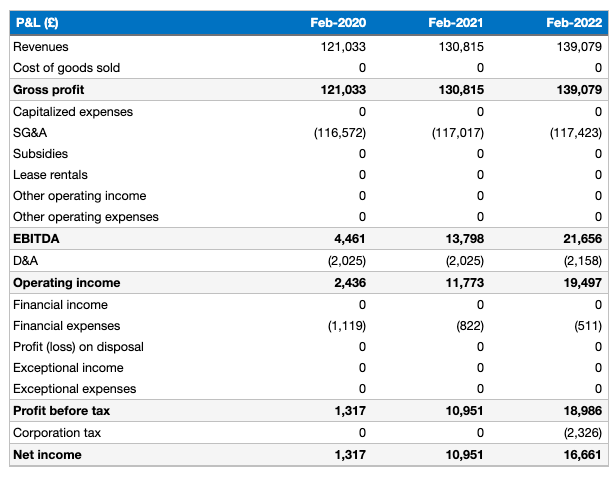

Uses of profit and loss account. It is prepared to find out the Net Profitloss of the business for the particular accounting period. A profit and loss statement PL or income statement or statement of operations is a financial report that provides a summary of a companys revenues expenses and profitslosses over a given period of time. And costs of a business and these are used to work out whether or not the business has made a profit.

The Profit and Loss Account is a Financial Statement which summarizes a companys revenue and expenditure for a specific period of time usually prepared annually or quarterly. A profit and loss account gives you an overview of your businesss trading over a period of time. On that basic level profit and loss is derived from taking your costs away from your sales.

The PL statement shows a companys ability to generate sales manage expenses and create profits. The account through which annual net profit or loss of a business is ascertained is called profit and loss account. Timing Trading Account is prepared first and then profit and loss account is prepared.

We can find net profit or net loss from profit and loss account. The purpose of preparing the profit and loss account is to ascertain the net income performance result of the enterprise for the yearperiod which is the most significant information to be reported for decision making. In the third part the net profit after tax is appropriated to dividends or to reserves retained profit.

Profit and loss account This is often called the PL for short and it shows your businesss income less its day-to-day running costs over a given period of time often a year month or quarter. Here youll find everything you need to know including what records you need to keep plus a profit and loss. ProfitLoss Account is prepared after the trading account is prepared.

The balance of Trading Account is brought down to Profit and Loss Account. Profit and loss account is the base of analyzing the performance of company. This account should not be confused with the typical Profit and Loss Account but rather seen as an extension of it as it is made after making the Profit and Loss Account.