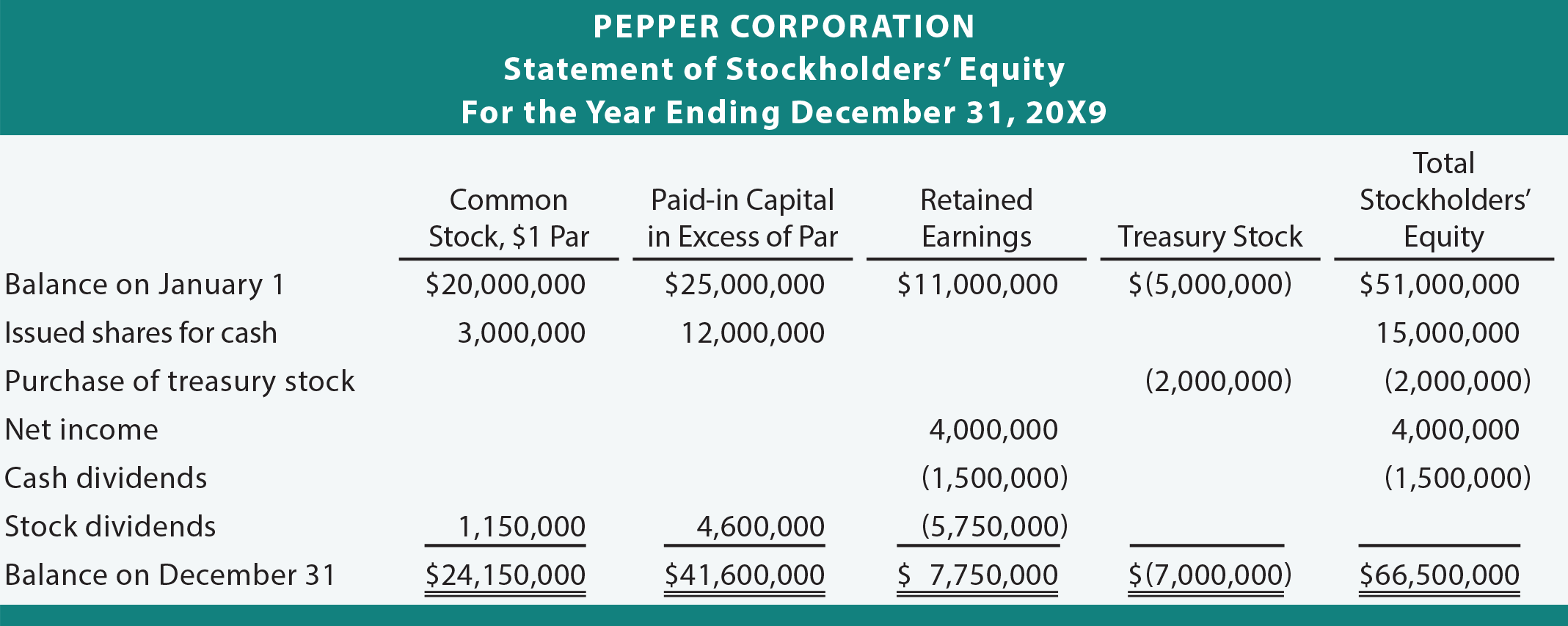

Amazing Change In Stockholders Equity

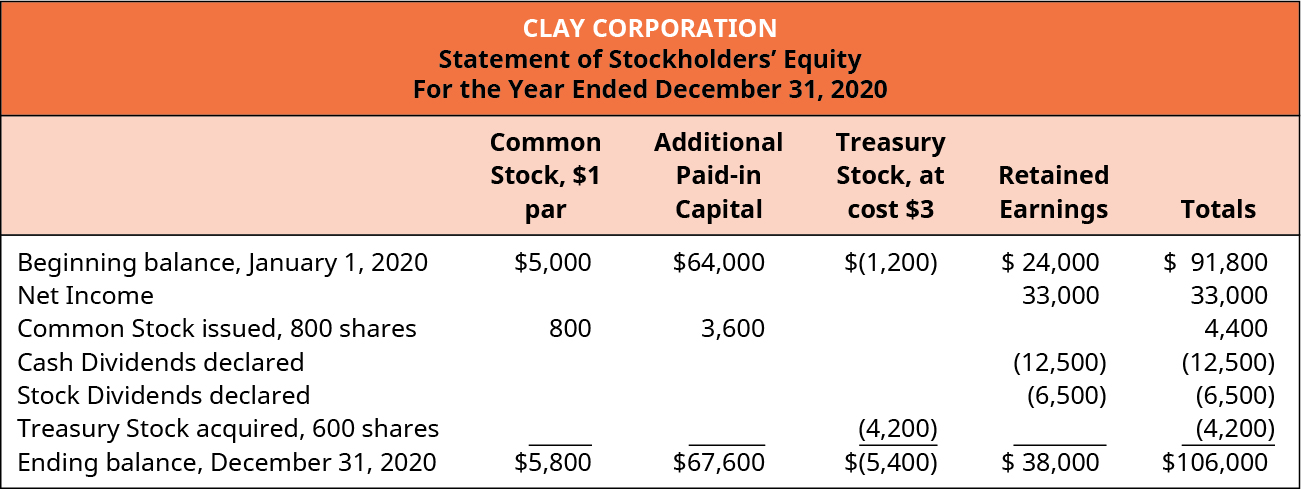

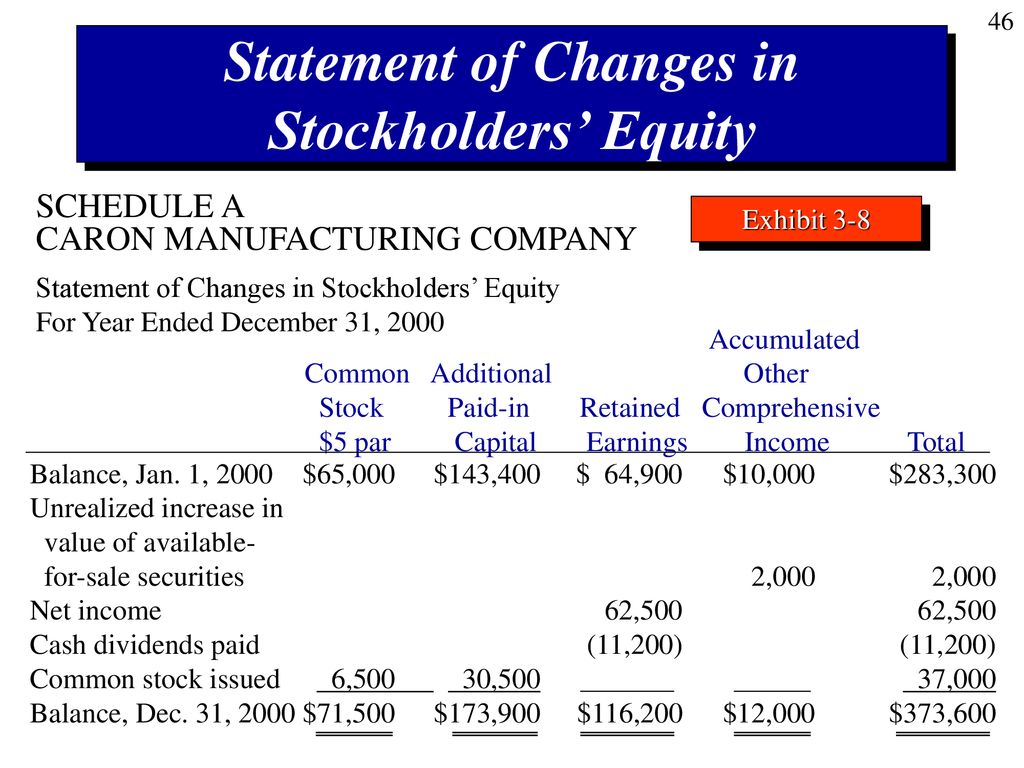

Rule 3-04 permits the disclosure of changes in stockholders equity including dividend-per-share amounts to be made either in a separate financial statement or in the notes to the financial statements.

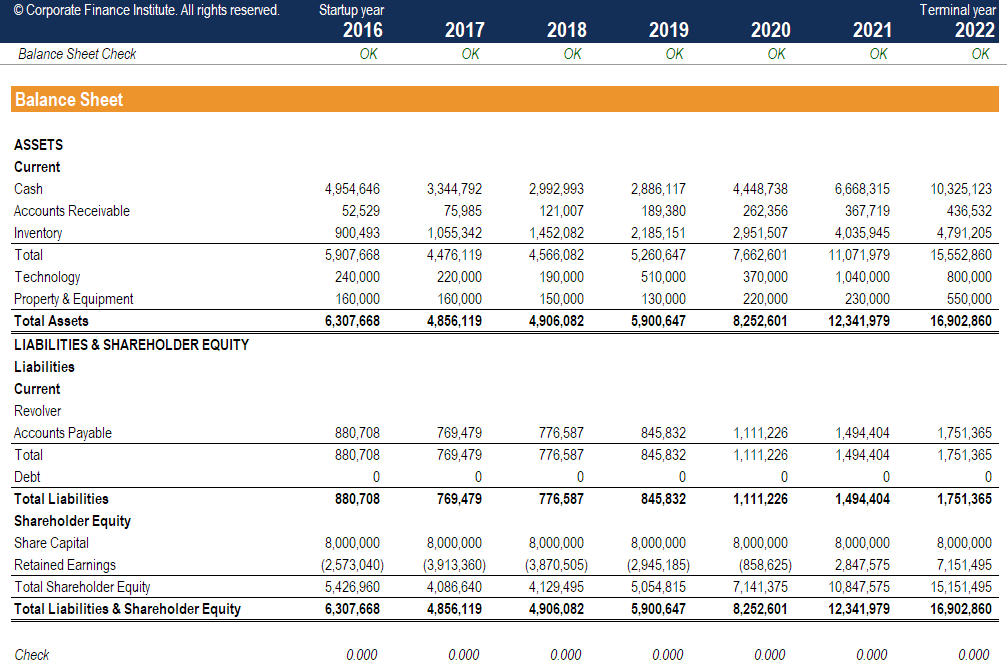

Change in stockholders equity. Statement of Changes in Equity often referred to as Statement of Retained Earnings in US. Dividends are paid out and Retained Earnings is debited and decreases. In most cases the financing section is shorter than the operating and investing sections of the statement of cash flows.

Retained earnings 30000 restricted by treasury stock 400000. Changes in stockholders equity can lead to cash inflows or outflows depending on the specific activity. Like all vehicles that truck will depreciate -- lose value over time.

And changes that result from changes in total comprehensive income such as net income for the period revaluation of fixed assets changes in fair value of certain investments etc. However the effect of dividends changes. Since stockholders equity represents the value of the companys assets minus any liabilities it naturally follows that if the companys assets decrease its book value will decrease too.

Movement in shareholders equity over an accounting period comprises the following elements. When a company pays cash dividends to its shareholders its stockholders equity is decreased by the total value of all dividends paid. Stockholders equity can increase in two ways.

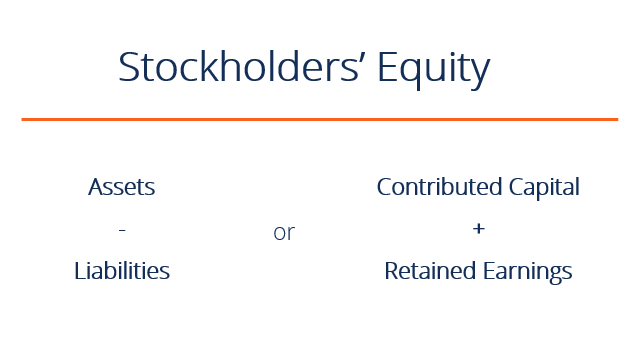

The basic formula for stockholders equity is assets minus liabilities. Stockholders equity can decrease in two ways. An increase in stockholders equity may simply indicate a change in the method of valuing assets or an adjustment to previous accounting.

See the appendix below for examples of two financial statement presentation options for these interim disclosures. The rise in cash from the companys earnings will. Looking at the same period one year earlier we can see that the year-on-year change in equity was a decrease of 2515.

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)