Best Aasb 16 Not For Profit

What has changed compared to AASB 17.

Aasb 16 not for profit. Not-for-profit entities Implementing the new revenue and income standards 20 November 2018. Commonwealth lessees are required to not apply AASB 16 to intangible assets. AASB 16 has also been amended to explicitly require that if an NFP is the lessee in a lease with significantly below-market terms and conditions principally to enable the entity to further its objectives the right-of-use asset is measured at fair value in accordance with AASB 13.

AASB 16 a financial instrument AASB 9 a provision AASB 137 Transfer of financial asset to enable the entity to acquire a. Lease terms are defined in Appendix A of AASB 16 as The non-cancellable period for. Distinguishing a licence from a tax G3 In determining whether a transaction is a licence subject to this Standard as distinct from a tax subject to AASB 1058 Income of Not-for-Profit Entities 1 the following features are pertinent.

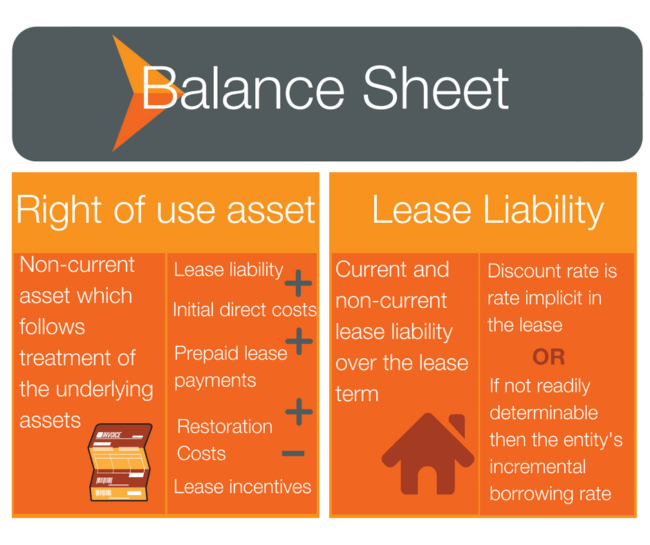

31 December 2019 or 30 June 2020 year ends will change this accounting and require the majority of leases held by lessees to be recorded on the balance sheet. AASB 16 is a new accounting standard that impacts the way operating leases are accounted for on a companys balance sheet. AASB 16 Leases which is effective for annual periods beginning on or after 1 January 2019 ie.

The International Accounting Standards Board issued IFRS 16 Leases the new Standard in January 2016. The AASB provides temporary option for not-for-profits to measure a right-of-use asset arising from applying AASB 16 Leases at fair value or at cost. Your accounting systems and processes should have started catering for the changes well ahead of the 1 January effective date due to the possible impacts.

Main features of this Standard Main requirements. AASB 16 Leases 1 January 2019 Note that they all apply on the same date for both for-profit and not-for-profit entities except for the new revenue standard AASB 15 which is delayed 12 months for NFPs. It is applicable for reporting periods commencing on or after 1 January 2019.

The new Standard introduces a new model requiring lessees to recognise all leases on balance sheet except for short-term leases and leases of low value assets. The new leases standard AASB 16 will bring a number of changes and challenges beyond the financial reporting process. The effective date is 1 January 2019 the same application date as AASB 16 Leases and AASB 1058 Income of Not-for-profit Entities.