Fine Beautiful Components Of Comprehensive Income

Components of other comprehensive income.

Components of comprehensive income. Long-term construction contracts and operating and maintenance agreements 4. Basically comprehensive income consists of all of the revenues gains expenses and losses that caused stockholders equity to change during the accounting period. Comprehensive income connotes the detailed income statement where we will also include income from other sources along with the income from the main function of the business.

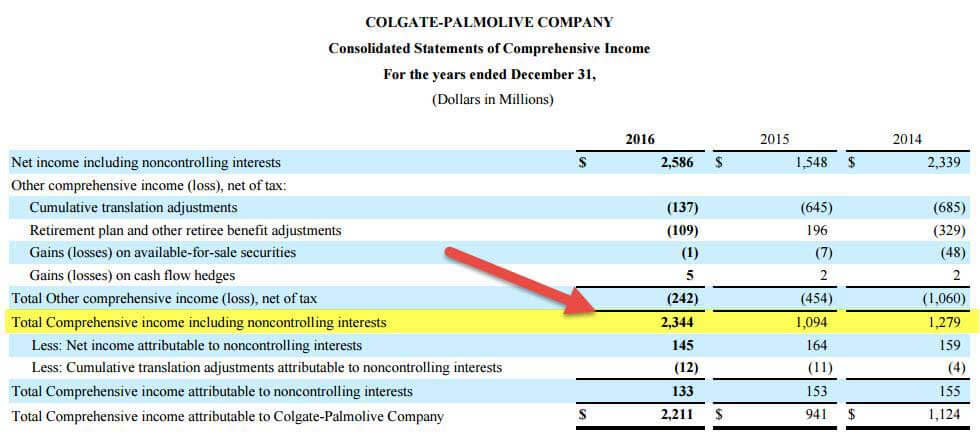

Colgate SEC Filings As seen from the above statement we have to consider two primary components Net income or loss from the income statement of the company. Comprehensive income is the variation in a companys net assets from non-owner sources during a specific period. The amount of net income for the period is added to retained earnings while the amount of other comprehensive income is added to accumulated other comprehensive income.

The statement of comprehensive income covers the same period of time as the income statement and consists of two major sections. Comprehensive income is the change in equity net assets of a business enterprise during a period from transactions and other events and circumstances from non-owners sources. Both before-tax and net-of-tax presentations are permitted provided the entity complies withthe requirements in paragraph 220 10-45-12correspond to the - components of other comprehensive income.

The difference between gross sales and net sales is equal to d. In business accounting other comprehensive income OCI includes revenues expenses gains and losses that have yet to be realized. Comprehensive income includes net income and OCI.

It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners. Material and services 6. The components of comprehensive income usually consist of the following items.

Depreciation amortisation and impairment 8. Present the components either net of related tax effects or before related tax effects with one amount shown for the aggregate income tax expense or benefit. Net income or net earnings from the companys income statement Other comprehensive income which consists of positive andor negative amounts for foreign currency translation and hedges and a few other items.