Ace Interest Receivable In Balance Sheet

You would include the interest for December 29 30 and 31st as an accrued liability.

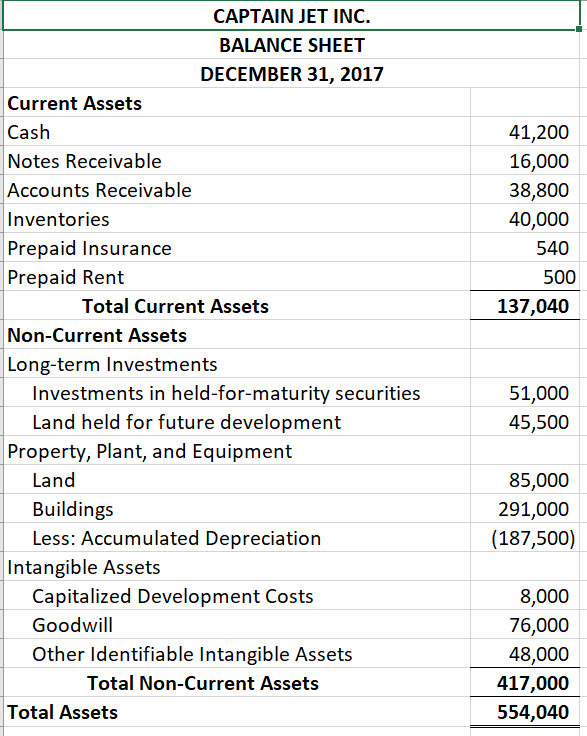

Interest receivable in balance sheet. In this example Company A records a notes receivable entry on its balance sheet while Company B records a notes payable entry on its balance sheet. Interest receivable definition The current asset that represents the amount of interest revenue that was reported as earned but has not yet been received. Is an asset reported on the balance sheet.

In addition the agreed upon interest rate on the note is 10. Put another way interest receivable is the expected interest revenue a company will receive. Accrued interest is interest thats accumulated but not yet been paid.

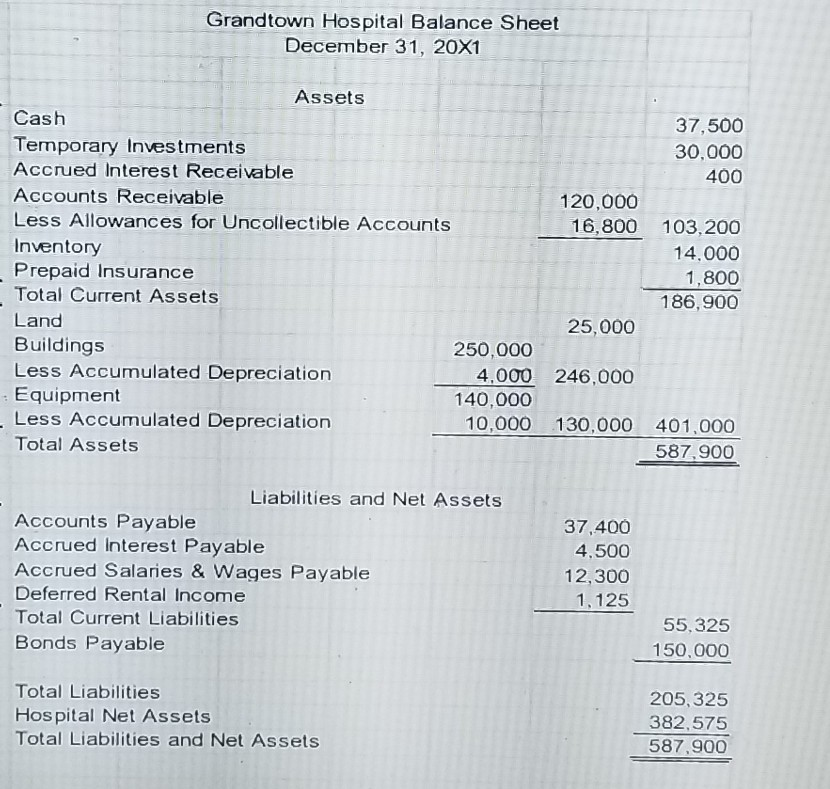

The accrued interest receivable is a current asset if the interest amount is expected to be collected within one year of the balance sheet date. I would expect that even a long-term note receivable that is due in five years will require that the interest on the note be paid quarterly semiannually or annually. Represents the amount of interest the company has received on promissory notes.

As long as it can be reasonably expected to be paid within a year interest receivable. Loans Receivable This is an asset account. Is a temporary account reported on the income statement.

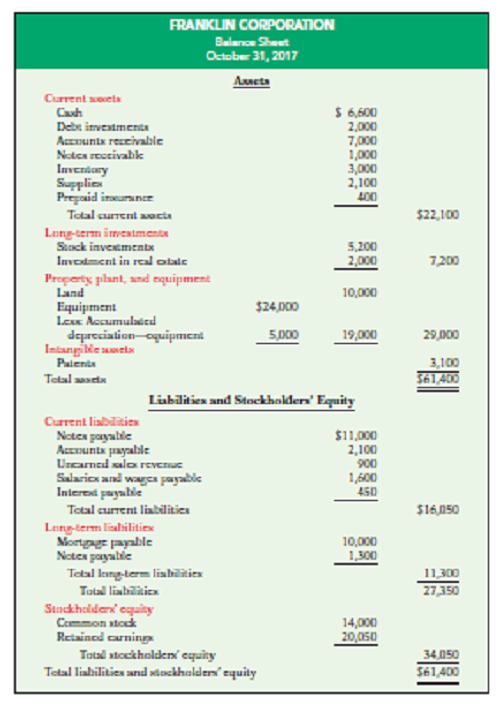

Key Components of Notes Receivable Here are. Reclassified Balance Sheet 362 599800 Custodial Collections Transferred Out to a Treasury Account Symbol Other Than the General Fund of the US. Accrued interest receivable increases the current asset account on a companys balance sheet while interest revenue increases net income.

Example of Journal Entries for Notes Receivable. Put another way interest receivable is the expected interest revenue a company will receive. As long as it can be reasonably expected to be paid within a year interest receivable.