Fantastic Disney Financial Ratios

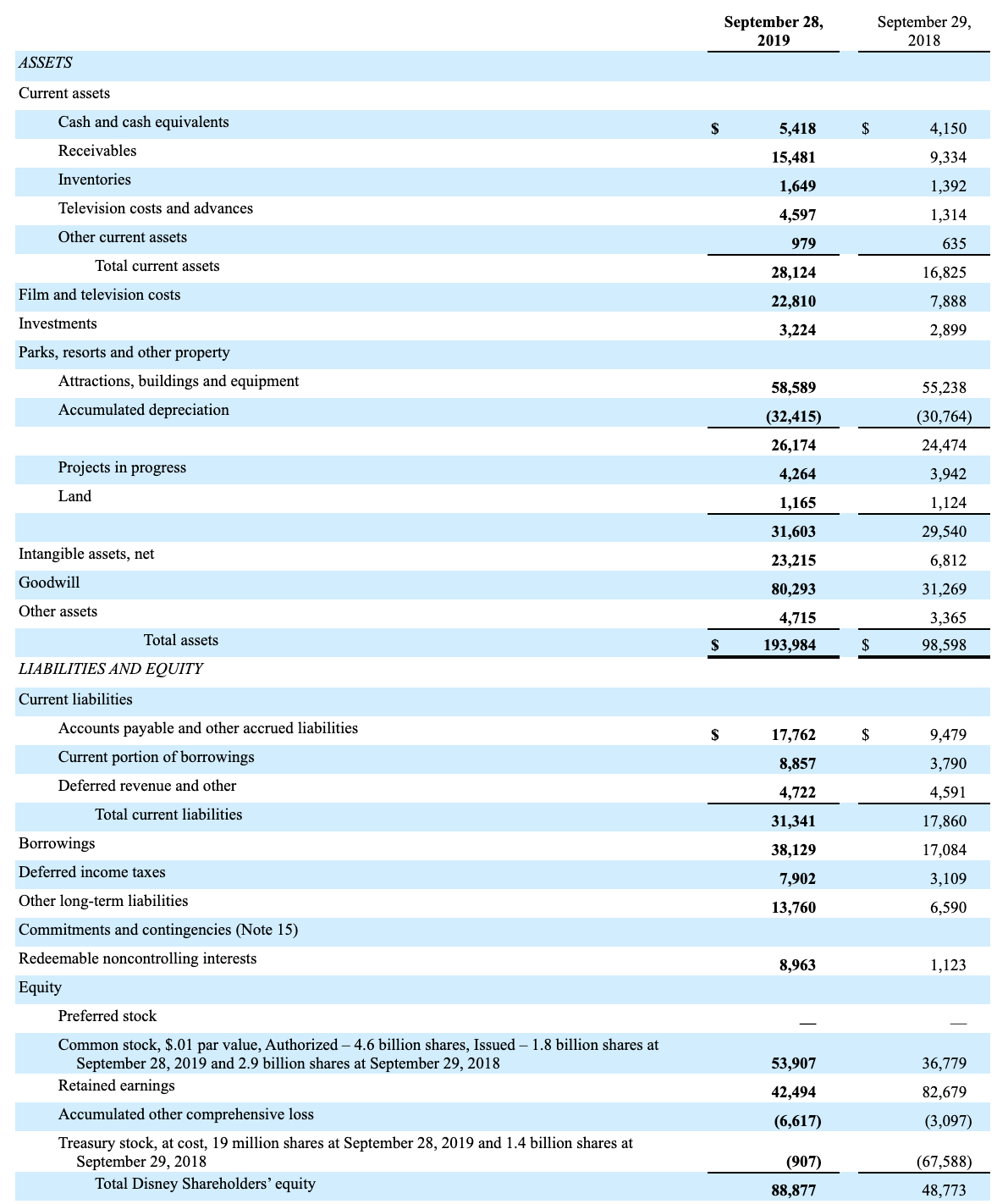

Disneys debt ratio ended 2016 at 179.

Disney financial ratios. Rating as of Jul 9 2021. In the next two years the organizations debt ratio would continue to fall ending 2019 at 162. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Walt Disney Companys.

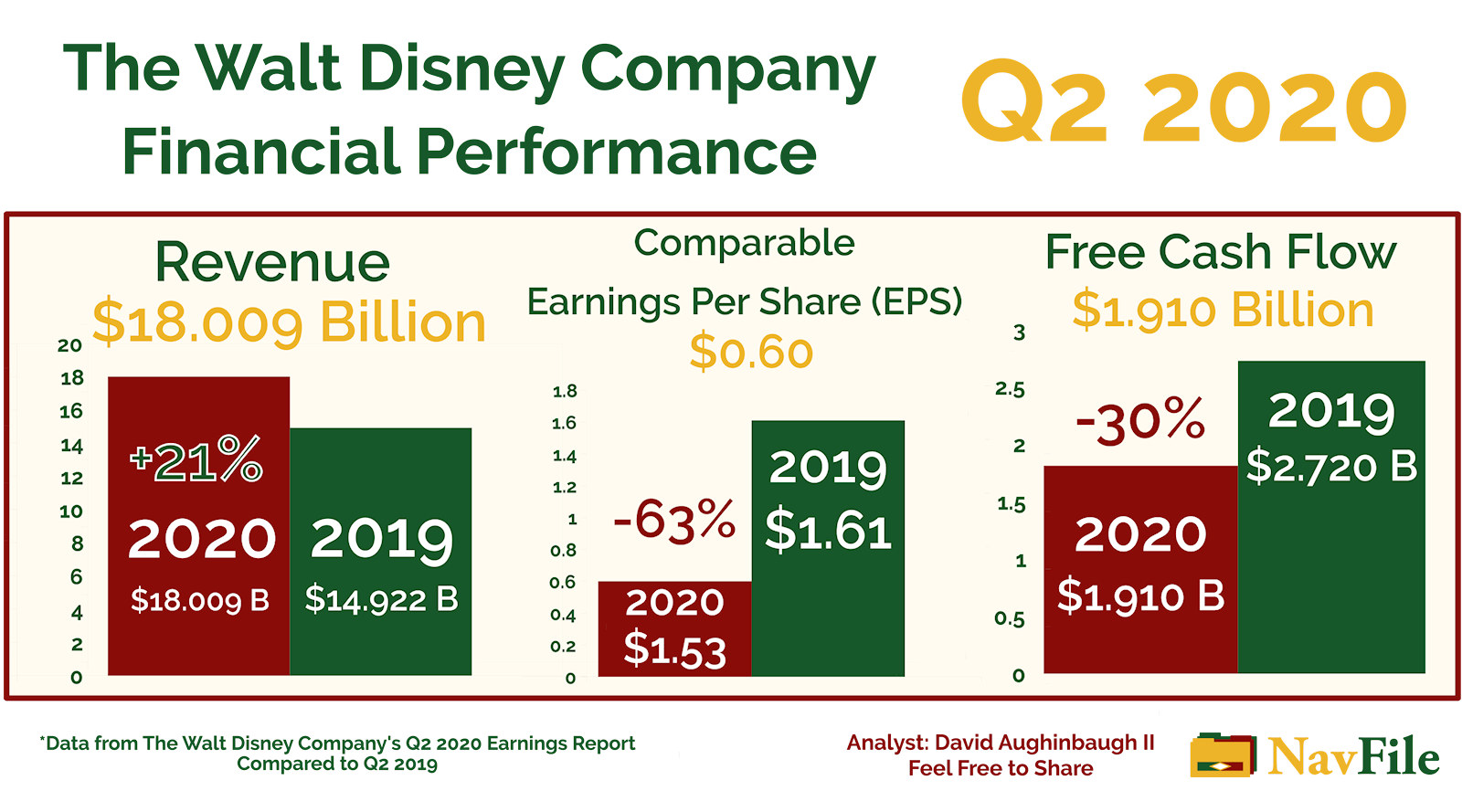

Valuation ratios such as PE PBV PS. Enterprise Value to Sales 430. However in 2020 the organizations debt ratio substantially increased ending the year at.

Quote Stock Analysis News Price vs Fair Value Trailing Returns Financials Valuation Operating Performance Dividends Ownership Executive. Start streaming on Disney. We are maintaining our wide moat rating and 154 fair value estimate.

DIS 18407 065 035. Revenue for the quarter dropped 13 year over year to 156 billion. Income statements balance sheets cash flow statements and key ratios.

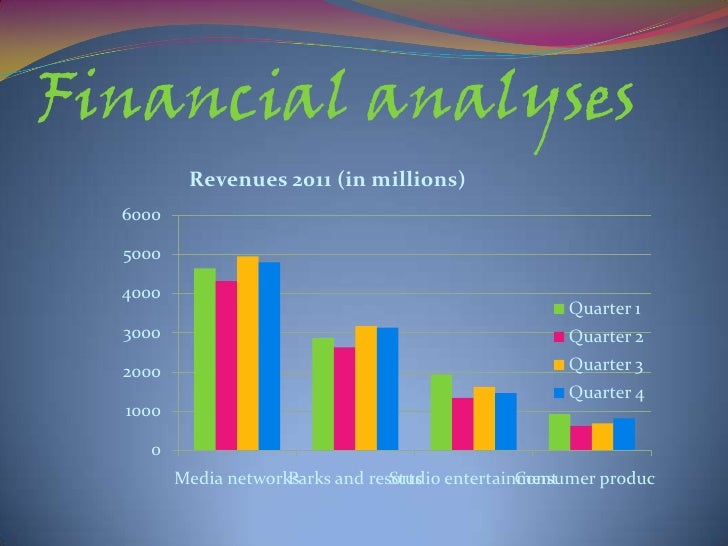

In 2016 Disneys fixed asset turnover was 203. Price to Cash Flow Ratio 2909. Ad The home of Disney Pixar Marvel Star Wars National Geographic and Star.

Walt Disney Co profitability ratios return on investment ROE ROA Oct 3 2015 Oct 1 2016 Sep 30 2017 Sep 29 2018 Sep 28 2019 Oct 3 2020 -10 -05 00 05 10. Ten years of annual and quarterly financial statements and annual report data for Disney DIS. Disney Plus key statistics Disney Plus is projected to make over 10 billion for Disney in 2021 up from an estimated 45 billion in 2020 Disney Plus reached over 100 million subscribers in March 2021 The app has been downloaded over 150 million times since launch.

:max_bytes(150000):strip_icc()/walt_disney_stock_a_dividend_analysis-5bfc343f46e0fb00265d8c1a.jpg)