Smart Negative Accounts Receivable On Cash Flow Statement

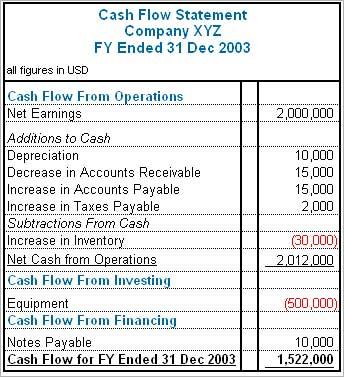

Each method is represented differently on the cash flow statement.

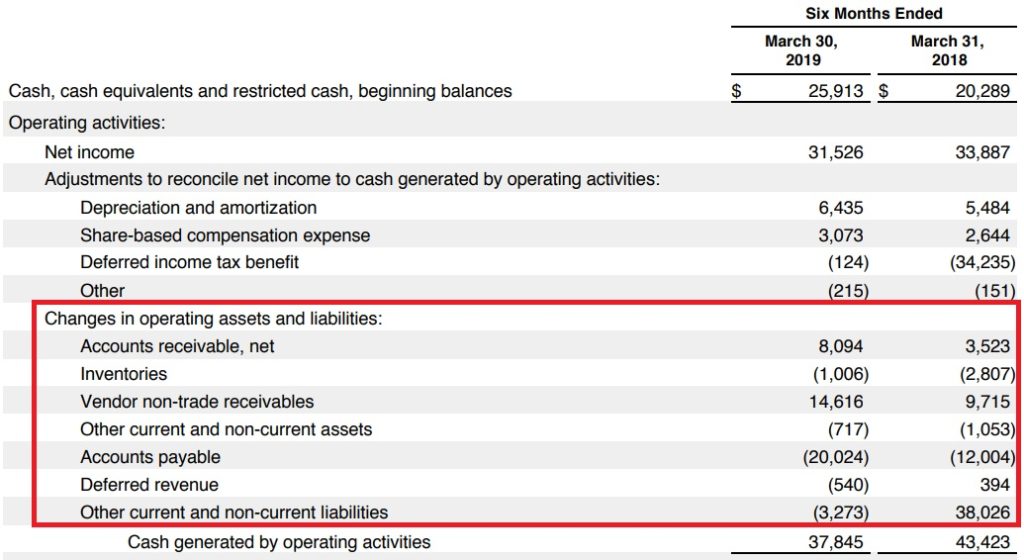

Negative accounts receivable on cash flow statement. The cash flow statement doesnt treat accounts payable as a negative as it is the money that has been put aside to pay outstanding bills as cash on hand that hasnt flowed anywhere else. The accounts receivable is negative on a statement of cash flow when using the indirect method because cash has not flown through the business yet. Accounts receivable has a negative balance when it has more credits than debits because it would be the opposite of its normal balance.

For every debit theres a credit right. In the cash flow statement account payable is treated under the first component. However there are two different methods businesses can use to track accounts payables and accounts receivables.

Impact of Accounts Receivable on Cash Flow and Profit. Automate Your AP With Payer OCR Invoice Processing Approvals For A Clear Audit Trail. We start the cash flow from the positive or negative net income.

A simple way to look at the increase in accounts payable is to ascertain that a company is taking longer to pay its bill this will eventually result in a rise in its cash balance as well as its accounts payable. That difference between selling and getting paid is the reason accounts receivable is a negative for cash flow. For accounts receivable a positive number represents a use of cash so cash flow.

Thats double entry accounting. Ad The Only AP Automation Solution To Streamline The Entire Invoice-To-Pay-To-Reconciliation. This is because businesses need to record accounts payable and accounts receivable which can make tracking cash flow accurately a bit challenging.

Its the exact opposite in the case with payables. And then if there is increase in the account payable during the time for which cash flow statement is preparing. When there is an increase in the accounts receivable over a period it essentially means that cash is stuck in receivables and not yet received.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)