Wonderful Accrual Basis Of Accounting Is Most Useful For

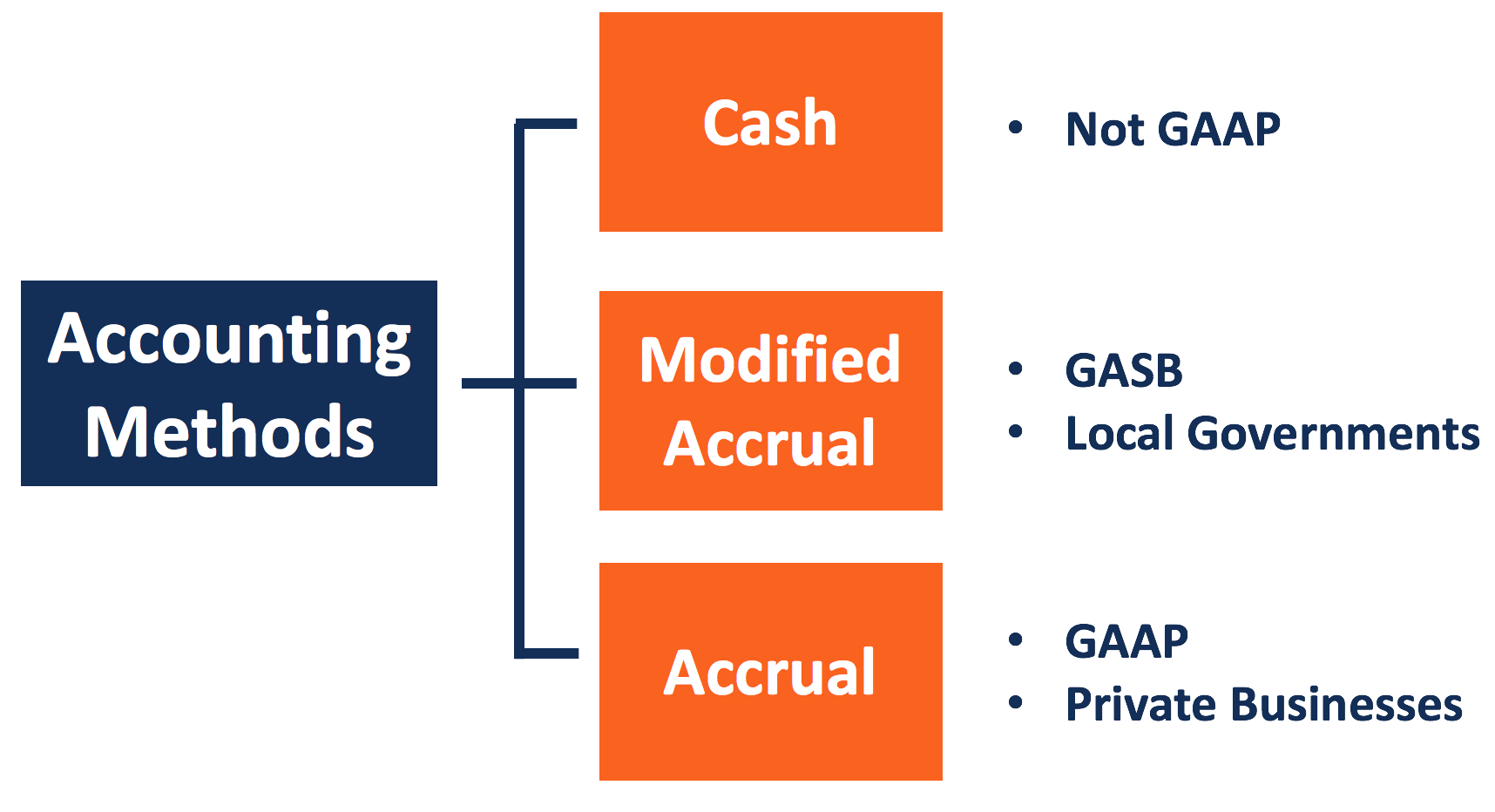

Accrual accounting is one of two accounting method s.

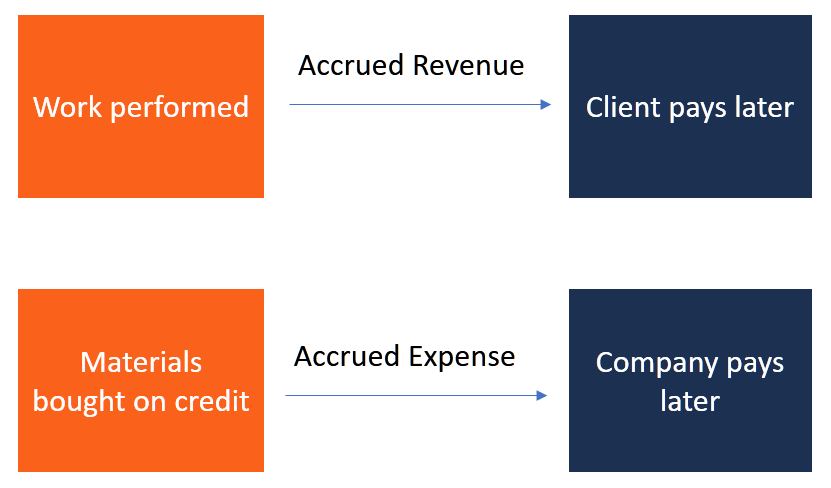

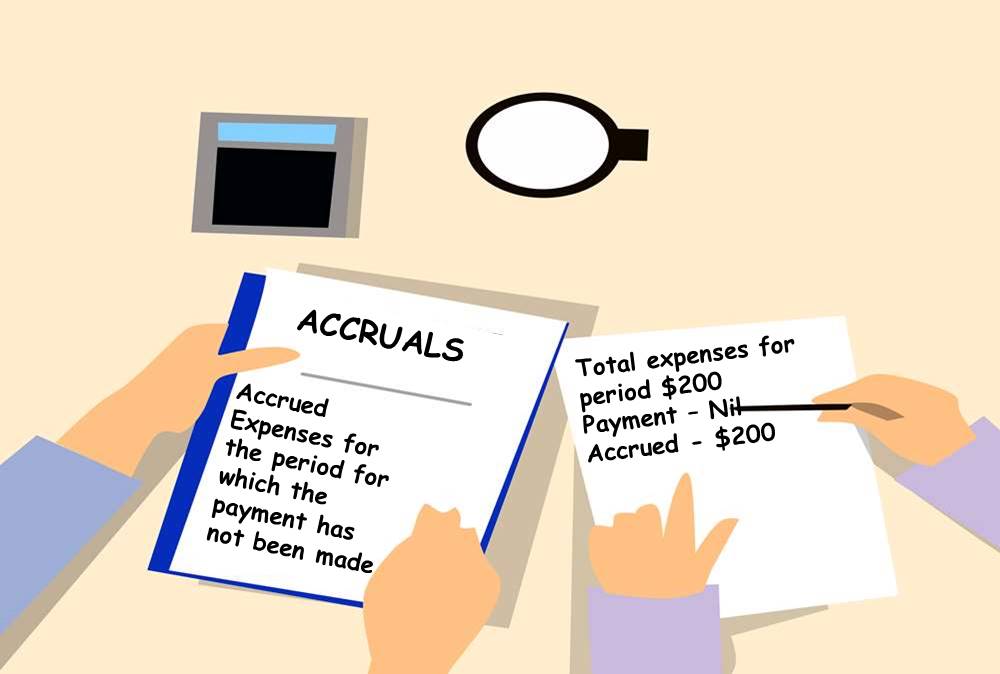

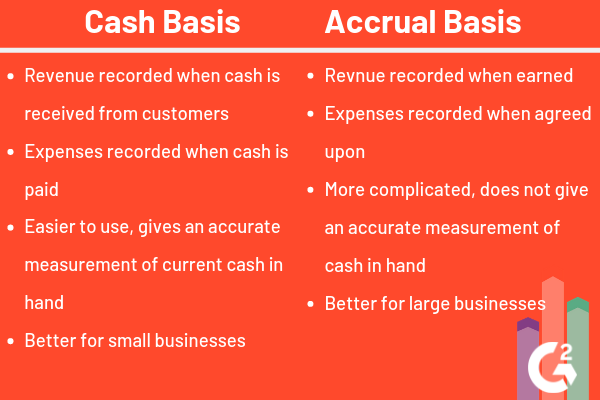

Accrual basis of accounting is most useful for. The accrual basis of accounting recognizes revenues when earned regardless of when cash is received. Expenses are recognized as incurred whether or not cash has been paid out. The most known accounting schools acknowledge these two trends as a paradigm and as some contestable ideologies at the same time since in the history.

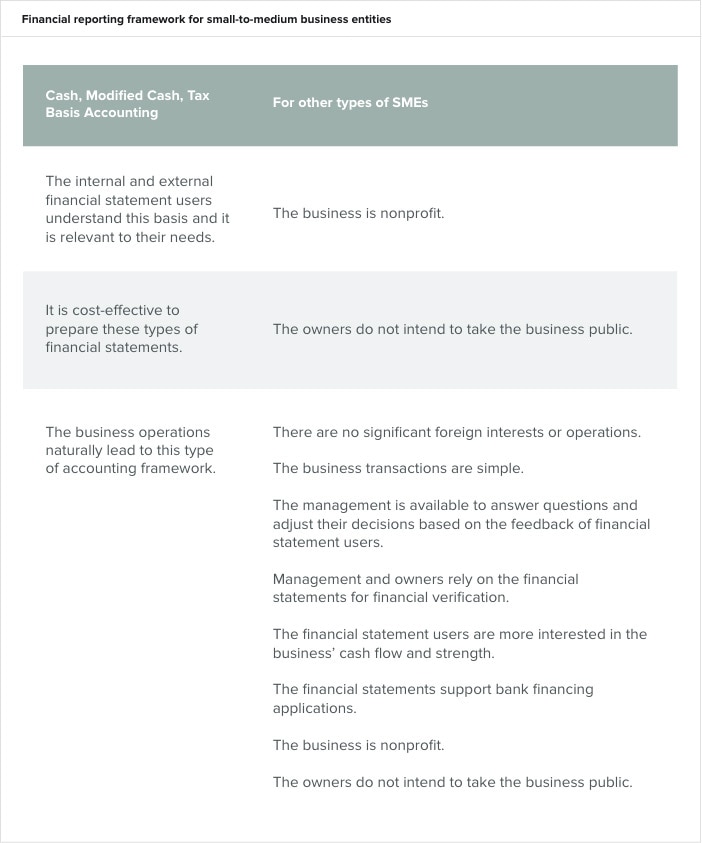

While it may be more complicated than the cash method it provides a more accurate account of a companys overall financial health. Then determine the one 1 that you believe provides the most useful financial information to users. Accrual versus Cash Accounting The public sector accounting is based on two thinking ways cash accounting and accrual accounting.

Example of Reporting Revenues Under the Accrual Basis of Accounting. Determine the one that you believe provides the most useful financial information to users. This accounting method helps to improve the accuracy of a.

It is a particularly useful method in those. The accrual basis of accounting affords several benefits for financial reporting over the cash method of accounting. The accrual basis of accounting A small business that operates on accrual basis accounting matches up income and expenses into the period they are actually incurred regardless of when money changes hands.

Accrual accounting is useful most often for larger businesses that need to see financial gains and losses over a period such as a year. The other is cash accounting. C Recognizes revenues when received in.

Most businesses use the accrual basis of accounting to comply with Generally Accepted Accounting Principles GAAP. When using the accrual based method you record the revenue or expenses during the period the work is performed whether or not you received or paid any money during that period. Do you need a similar assignment done for you from scratch.

(152).jpg)