Amazing Trial Balance Working Capital

In other words working capital is quite literally the amount of capital you have to work with.

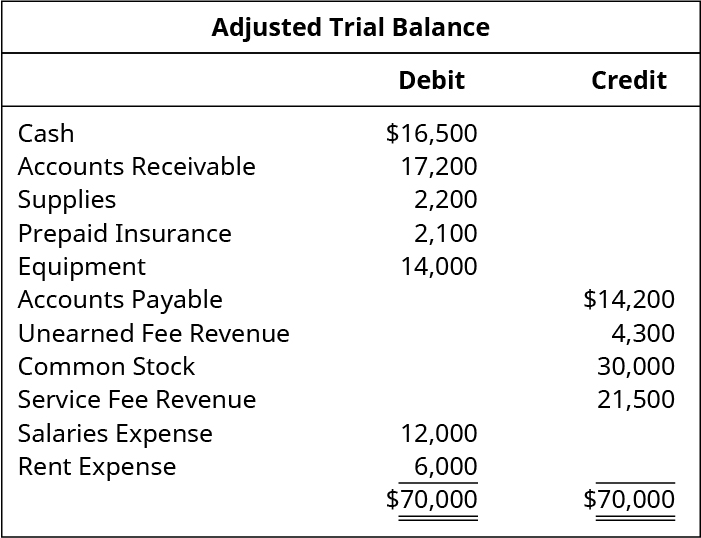

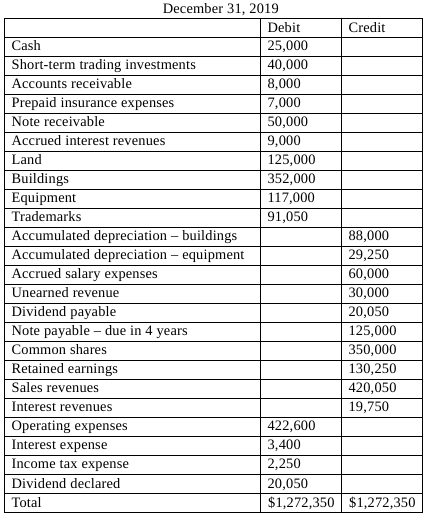

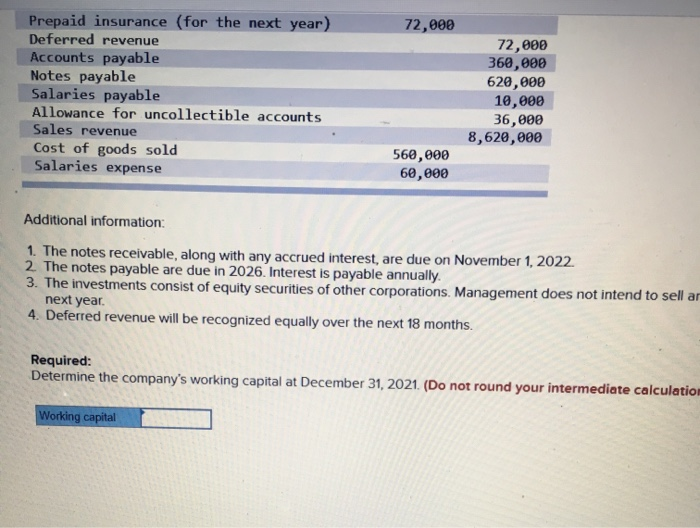

Trial balance working capital. Record the following transactions in the Journal and post them into ledger and prepare a Trail Balance Oct 1 st Neel started business with a capital of 80000. In concept it is an unadjusted trial balance to which is added any adjusting entries needed to close a reporting period such as for the monthly quarterly or annual financial statements. Cash 2100 Accounts Receivable 2800 Supplies 2000 Accounts Payable 1100 Unearned Service Revenue 400 Owners Capital 3160 Service Revenue 3000 Salaries and Wages Expense Miscellaneous Expense 160 Total 7660 7660 Other data.

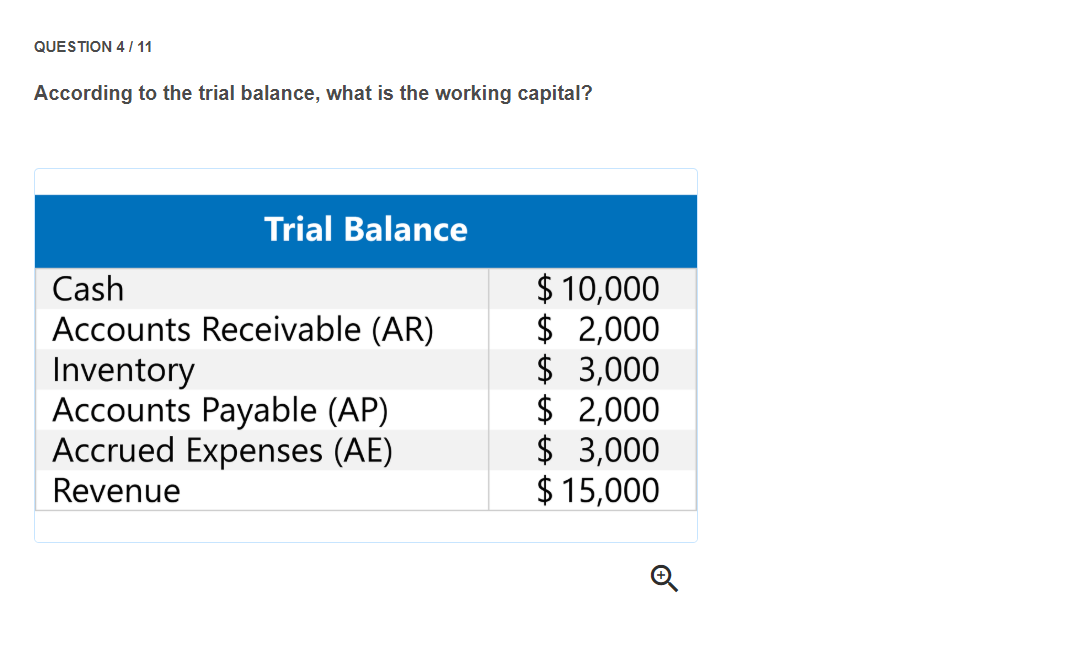

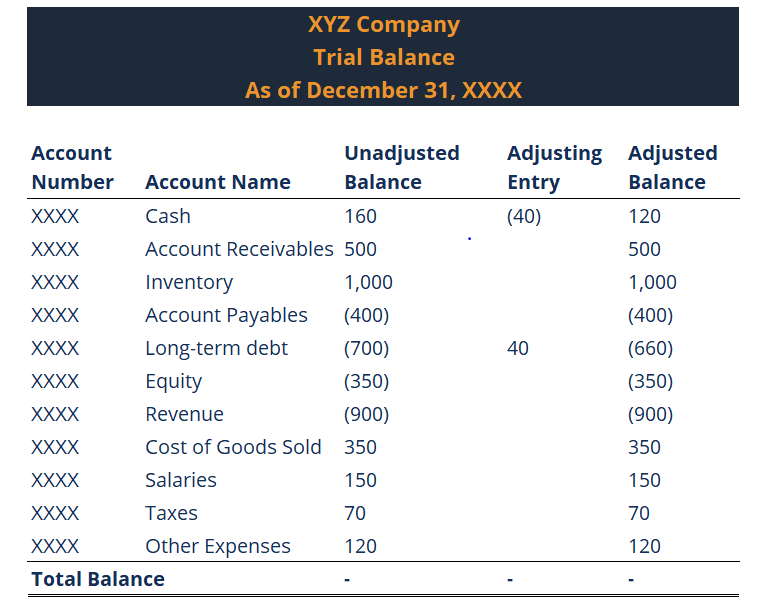

The following trial balance example combines the debit and credit totals into the second column so that the summary balance for the total is and should be zero. Working capital tells you if a company can pay its short-term debts and have money left over for operations and growth. The working capital formula is.

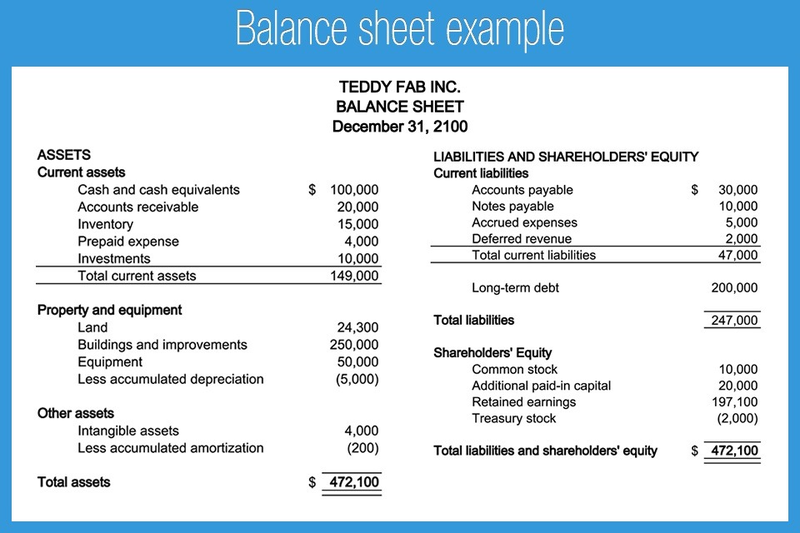

In addition to calculating the amount of working capital it is common to compute two related financial ratios. Accounting questions and answers. Electricity and Telephone 1500.

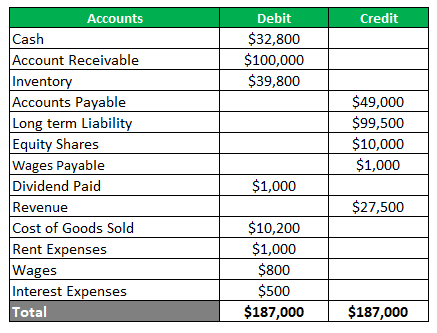

Working capital is the amount of capital your business has thats uncommitted to paying off short-term liabilities. A working trial balance is a trial balance that is in the process of being adjusted. Trial Balance Cash Accounts Receivable AR Inventory Accounts Payable AP Accrued Expenses AE Revenue.

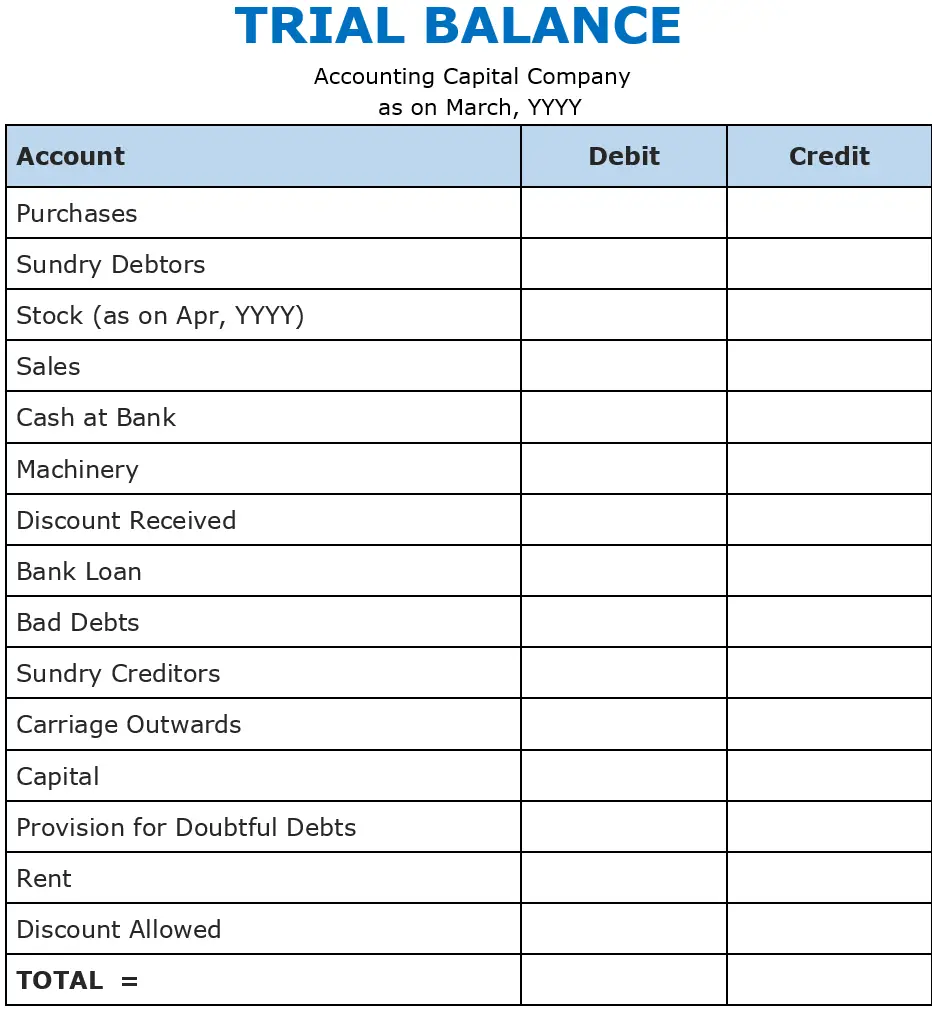

Cash at Bank 9850. Of course your business should strive to have as much capital. The debits and credits include all business.

Working capital is the amount of money a company has left over after subtracting current liabilities from current assets. Ivanhoe Company Worksheet For the Month Ended June 30 2020 Trial Balance Account Titles Dr. Meaning of Trial Balance in Accounting As per the accounting cycle preparing a trial balance is the next step after posting and balancing ledger accounts.