Beautiful Work Funds Flow Statement Problems

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow and Fund Flow Statement.

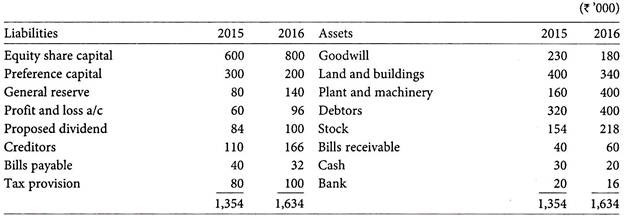

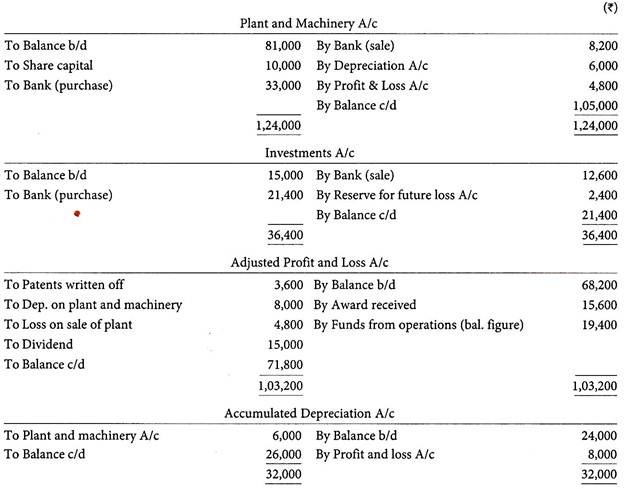

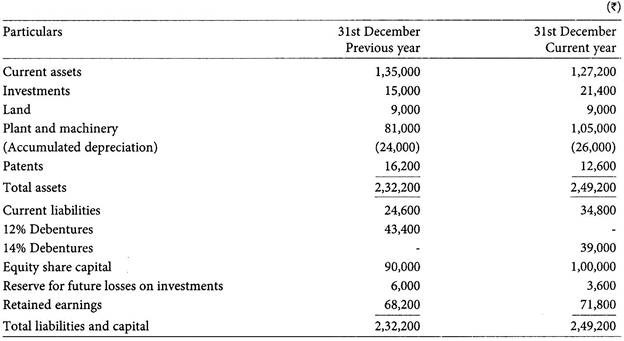

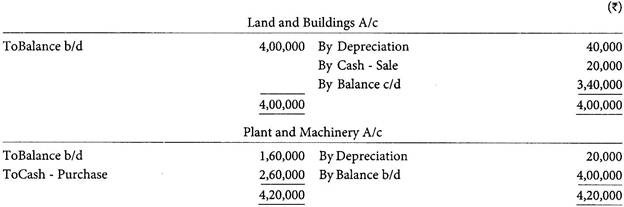

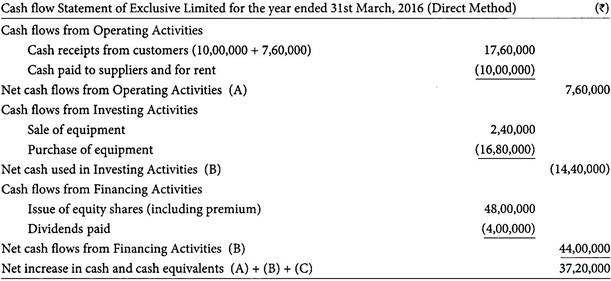

Funds flow statement problems. A If provision for tax and dividend are given in the adjustments alone and nothing is given in the balance sheets the given amount is debited to adjusted profit and loss account. Stood at Rs 2000000 in 2013 and at Rs 26 lac in 2014. Fund Flow statement is said to lack originality because this statement is merely a systematic rearrangement of items in financial statements over two accounting periods.

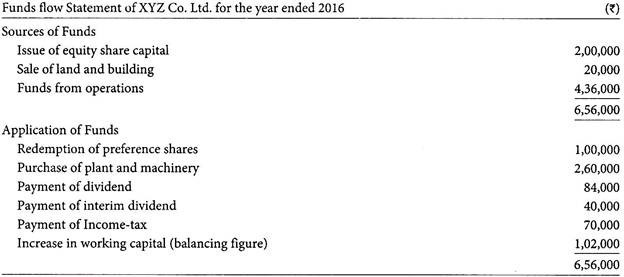

Doesnt the Statement of Changes in Working Capital help in analysing funds flow. Although the fund flow statement is very important and has a lot of advantages there are some limitations also. Funds Flow Statement is prepared.

Examples of Flow of Funds Examples Transactions Involve Between Flow of Funds From 1 Purchase of Machinery for Cash Current Asset and Non-Current Asset Current to Non-Current Account 2 Issue of Share for Cash Current Asset and Capital. The funds flow statement has a number of uses however it has certain limitations also which are listed below. Limitations of Funds Flow Statement.

You are also informed that during the year dividend for the year 2010-2011 and dividend distribution tax together amounting to Rs 575 thousand was paid. During the same period it issued shares of Rs200000 and redeemed debentures of Rs150000. In spite of several essential utilities financial analysts encounter some Funds Flow Statement problems indicating at the limitations to its use.

It provides only some additional information as regards changes in working capital. And Non-Current Liabilities Examples of Flow of Funds and No Flow of Funds The following are the few examples of flow of funds and no flow of funds. The share capital of A Ltd.

Also shares might have been allotted in an earlier period and in the period for which Funds Flow Statement is prepared only a call might have been made. Here is a compilation of top six accounting problems on fund flow statement with its relevant illustrations. BALANCE SHEET AS AT 31121996 Rs.