Impressive Directors Loan Account Balance Sheet

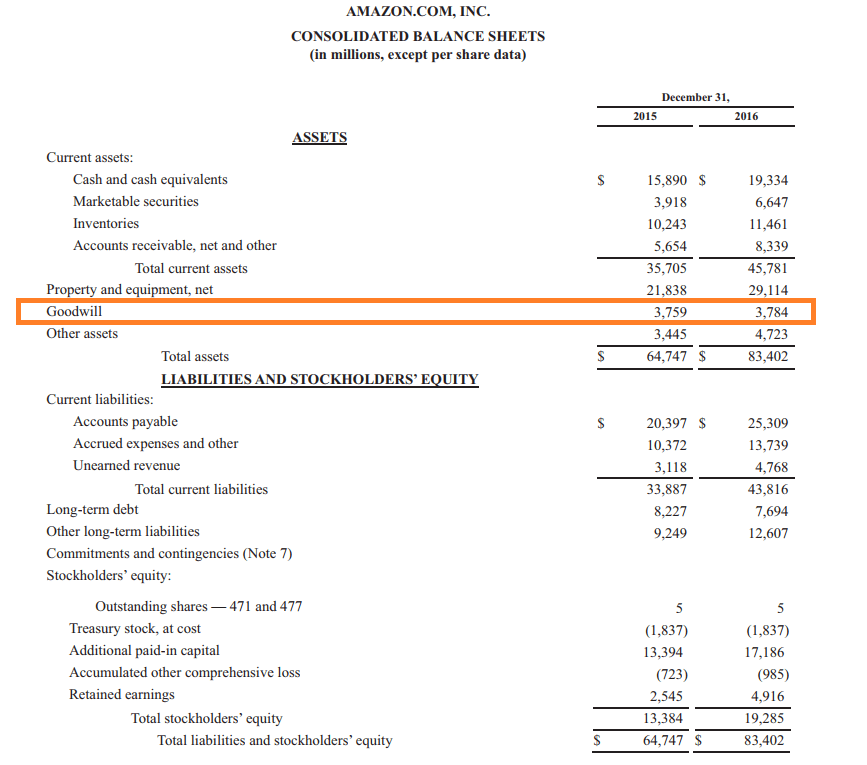

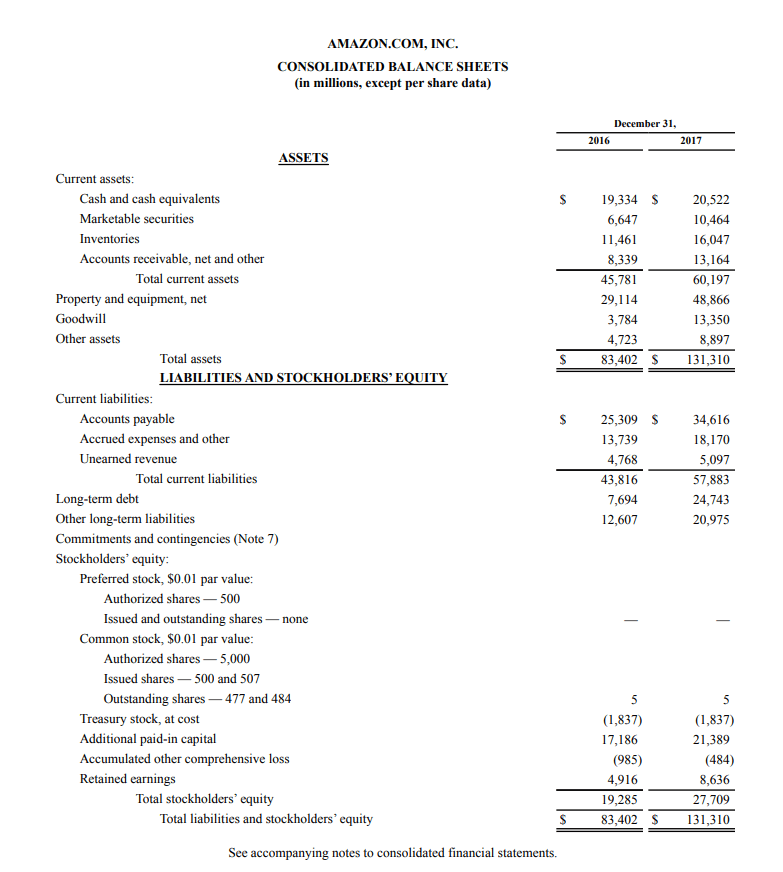

To my surprise the other accountant had recognised a 15k directors loan as a type of equity in this companies balance sheet.

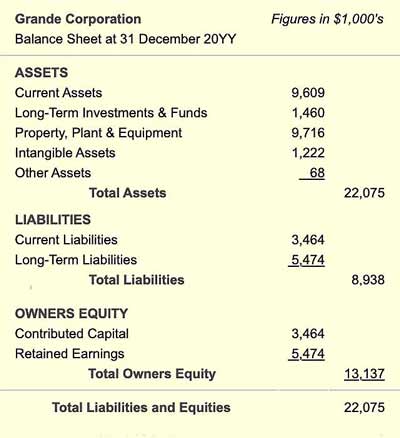

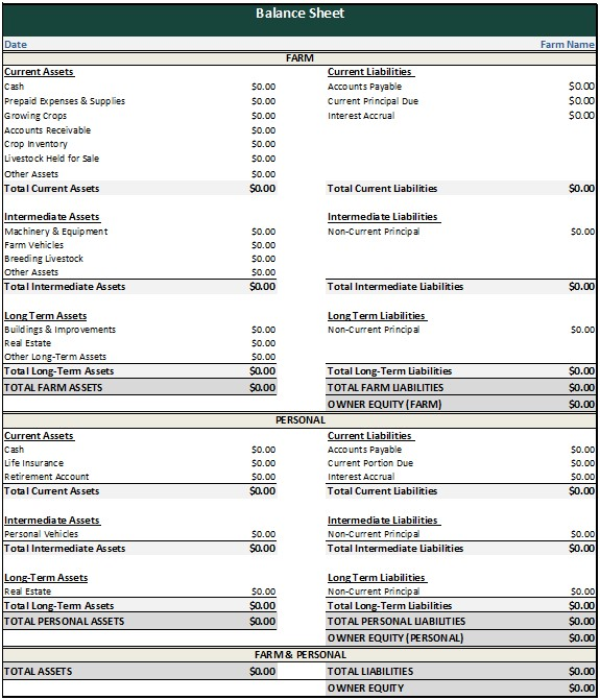

Directors loan account balance sheet. I was reviewing a set of accounts prepared by another accountant for a new client. - Line 2 chose Opening balance equity account and entered the loan amount in Credits. This should be recorded accordingly as an asset or a liability in the balance sheet of your companys annual accounts.

To view the loan account simply select the directors name such as Director Loan Account. If monies have been supplied to a limited company via a directors loan then this would be classified as a creditor on the balance sheet in the accounts as the company owes the director that money. The additional withdrawals will not appear as a wage or directors fee expense in the profit and loss but as a company asset in the form of a Director Loan Account appearing on its balance sheet.

If there are multiple directors in the business each will have a separate directors loan account in the balance sheet. This can also include money paid into the company. Shareholder loans should appear in the liability section of the balance sheet.

If the director has a credit balance available on their directors loan account ie. I took a loan of 4k from my LTD Company as Director and paid back within 9 Months so no Tax implications. ACCOUNTING FOR DIRECTORS LOANS UNDER FRS 102 Updated June 2017 Page 4 of 7 APPENDIX A WORKED EXAMPLES EXAMPLE 1 LOAN FROM DIRECTOR TO COMPANY On 1 January 20X1 a director lends a company 1m at a zero rate of interest.

If a payment is made to a Director and it does not form part of the directors remuneration package or is not an allowable expense for the company the payment must be set against their Directors loan account. Depending on the borrowing repayment activity in your directors loan account at the end of your companys financial year either you will owe the company money or the company will owe you money. Frequently Director Loan Accounts are undocumented and.

Hence the directors loan account. Direcroes Loan seems to be in the wrong place on a balance sheet. If monies have been loaned to the director from the limited company then these would be classified as a debtor on the balance sheet.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)