Smart Offsetting Assets And Liabilities

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

Stakeholders have told the Board that because the scope in Update 2011-11 is unclear diversity in practice may result.

Offsetting assets and liabilities. Assets and Financial Liabilities Amendments to IAS 32. An entity shall apply those amendments for annual periods beginning on or after 1 January 2014. ASC 210-20 includes the following overview of the Subtopic.

Offsetting Financial Assets and Financial Liabilities Amendments to IAS 32 issued in NZ February 2012 deleted paragraph AG38 and added paragraphs AG38AAG38F. The amendments to IFRS 7 apply to annual periods beginning on or after 1 January 2013 and interim periods within those periods. The guidance states that it is a general principle of accounting that the offsetting of assets and liabilities in the balance sheet is improper except where a right of setoff exists A right of setoff is a debtors legal right by contract or otherwise to discharge all or a portion of the debt owed to another party by applying against the debt an amount that the other party owes to the debtor.

ASC 210-20 describes the concept of offsetting assets and liabilities in the balance sheet and notes the limited circumstances when it is allowed. The offsetting model in IAS 32 Financial Instruments. When you offset you replace some of your assets and liabilities with one.

May trigger a new window or tab to open. Presentation requires an entity to offset a financial asset and financial liability when and only when an entity currently has a legally enforceable right of set-off and intends either to settle on a net basis or to realise the financial asset and settle the financial liability simultaneously. On 16 December 2011 the International Accounting Standards Board IASB and the US Financial Accounting Standards Board FASB issued DisclosuresOffsetting Financial Assets and Financial Liabilities Amendments to IFRS 7.

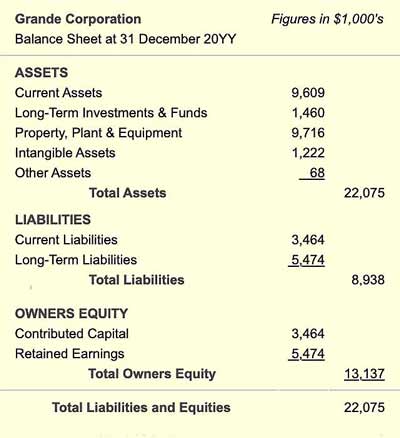

The classic balance sheet has assets on one side of the accounting equation and liabilities on the other. May trigger a new window or tab to open. Earlier application is permitted.

It specifies that a financial asset and a financial liability should be offset and the net amount reported when and only when an enterprise IAS 32 42. These Amendments clarify the offsetting criteria in IAS 32 to address inconsistencies in their application. Modeling Offsetting Assets and Liabilities Because entities may make different accounting policies concerning whether or not to offset cash collateral against derivative balances the Taxonomy provides four elements two for derivative assets and two for derivative liabilities to report cash collateral.

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)