Fantastic Off The Balance Sheet Financing

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)

Published on January 27 2017 January 27 2017 20 Likes 1 Comments.

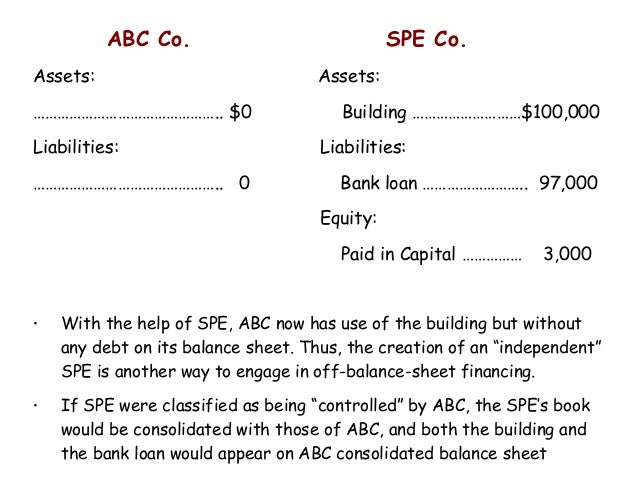

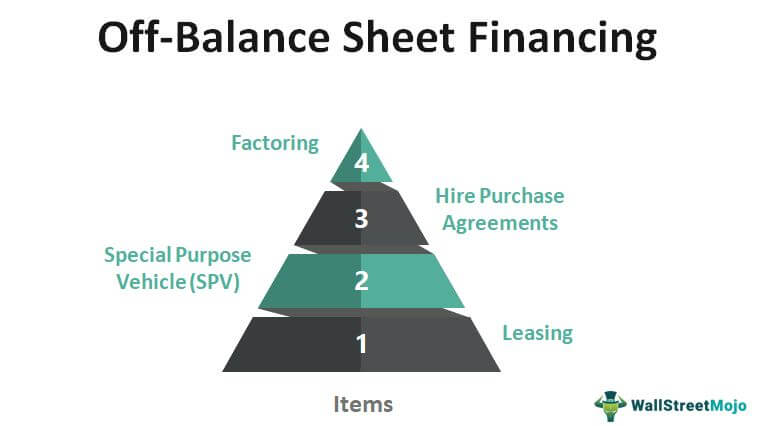

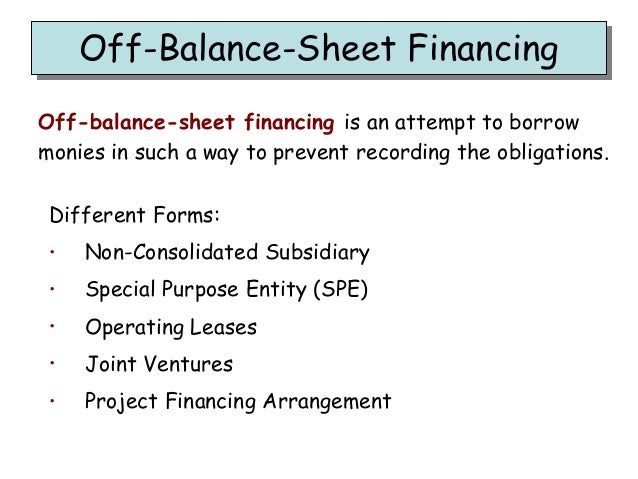

Off the balance sheet financing. The financial obligations that result from OBSF are known as off-balance-sheet liabilities. Off balance sheet financing is an accounting practice where the company can finance its activities without reflection in the balance sheet in a legal manner. There are various approaches to off-balance sheet financing available on the market including Commercial PACE C-PACE on-bill tariffs Efficiency Service Agreements ESAs and.

Off-Balance Sheet is very attractive to all companies but especially to those that are already highly levered. Off-balance sheet financing refers to an arrangement in which a business obtains funds or equipment from external sources but does not report the transaction as an asset or a liability on its balance sheet. However the business may mention the transaction in the notes to its accounts.

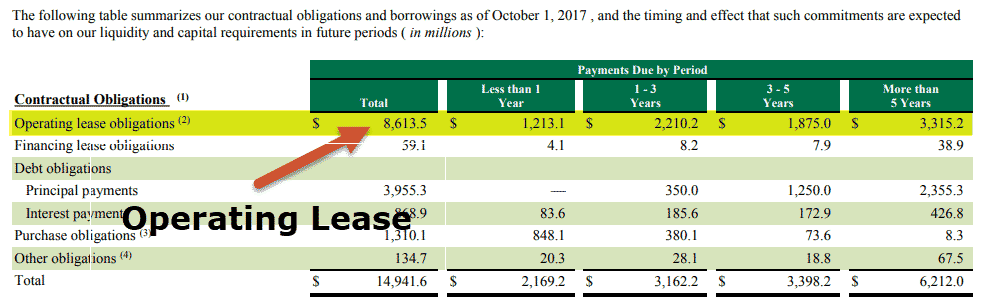

Off balance sheet refers to the assets debts or financing activities that are not presented on the balance sheet of an entity. Off Balance Sheet Debt - 1 Off-Balance Sheet Financing Techniques 1 Leases Firms which have noncancelable operating leases have de facto debt. When a company takes out a loan from a bank or a line of credit from a vendor it records a liability for the loan and records the cash received from the financing.

The purpose behind the sheet financing is to keep the faith of investors by showing a low debt equity ratio as direct financing can affect the liabilities of the company as well as its level of debt. Why Use Off-Balance Sheet Financing. Off-balance sheet financing means a company does not include a liability on its balance sheet.

Off-balance sheet activities and the financial crisis. Off balance sheet financing allows an entity to borrow being without affecting calculations of measures of indebtedness such as debt to equity DE and leverage ratios low. These traditional sources of financing are always reported on the balance sheet as either a short-term or long-term liability.

The following adjustment procedure is appropriate. The role of OBS activities in the financial crisis of 2007-2008. It is an accounting term and impacts a companys level of debt liability.

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)