Beautiful Disposal Of Equipment Cash Flow Statement

The cost of the office equipment is 1100 and is paid in cash.

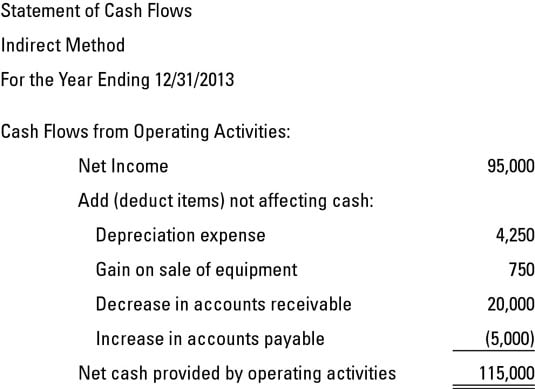

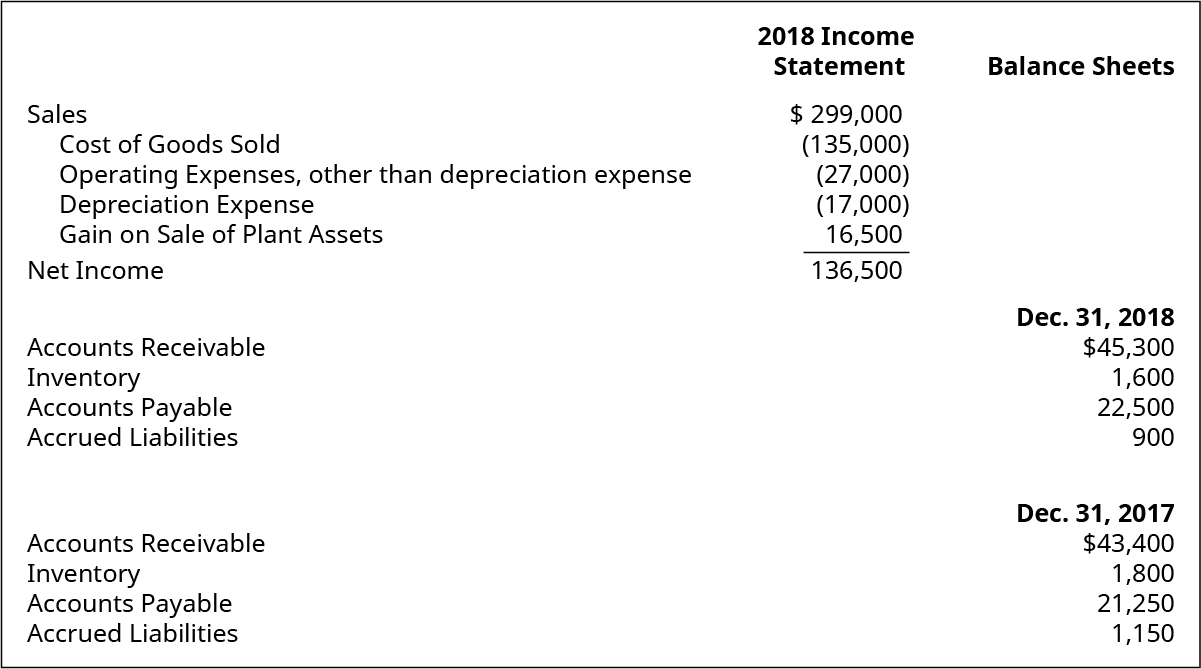

Disposal of equipment cash flow statement. STATEMENT OF CASH FLOWS Year Ended June 30 2014 See accompanying notes to financial statements. 100000 of equipment was purchased by issuing a note payable. 4000 of equipment value was consumed.

Proceeds from the disposal of certain. Cash received from customers 36000 Cash paid for supplies 20000. Cash Flow from Operations.

Supplemental disclosure of cash flow information. Instead record an asset purchase entry on your business balance sheet and cash flow statement. Purchase of equipment on balance sheet and cash flow statement.

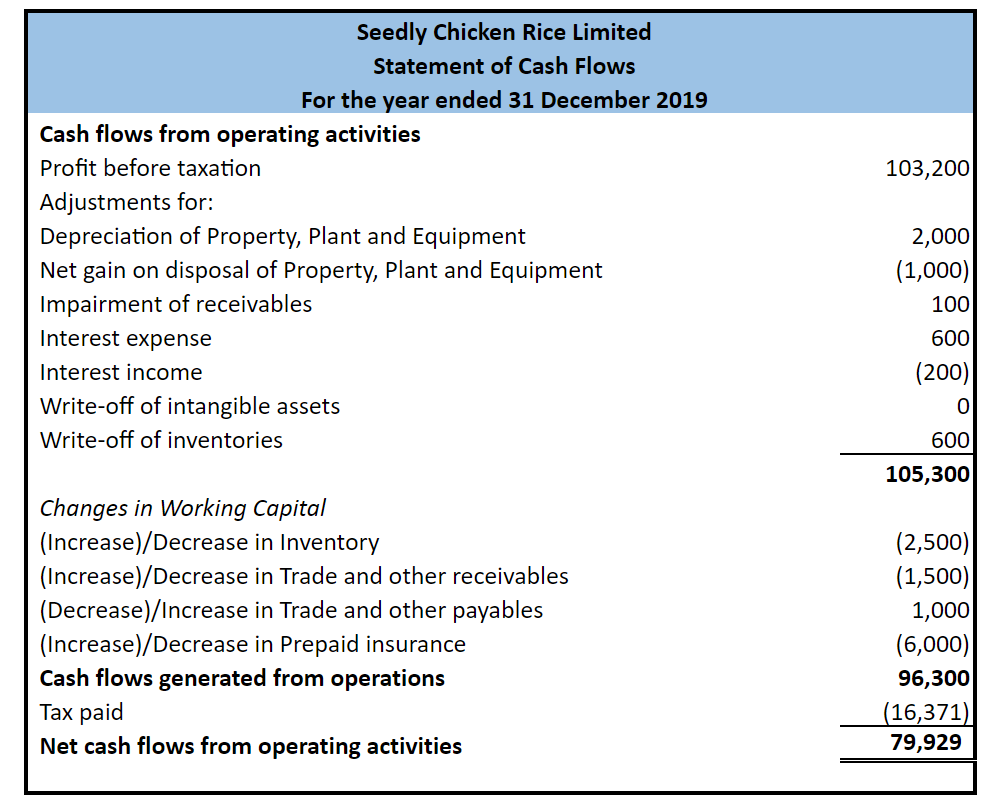

We could construct the following statement of cash flow. May Transactions and Financial Statements. Gain on disposal of equipment 20500 Decrease in accounts receivable.

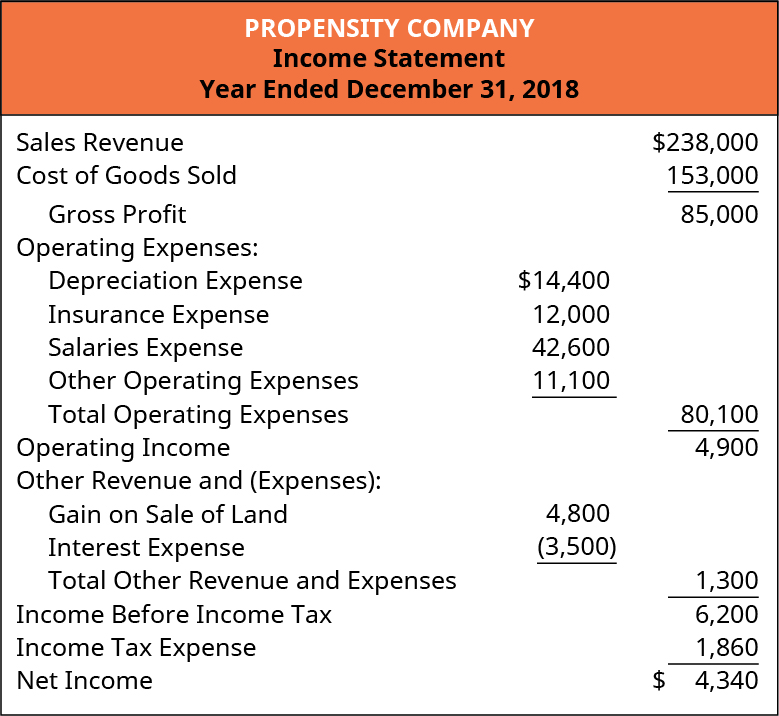

On May 30 Good Deal pays its accounts payable of 150. The documentation of these cash flows is how the cash flow statement connects the income statement to the balance sheet. Fixed assets are integral to a statement of financial position also known as a balance sheet.

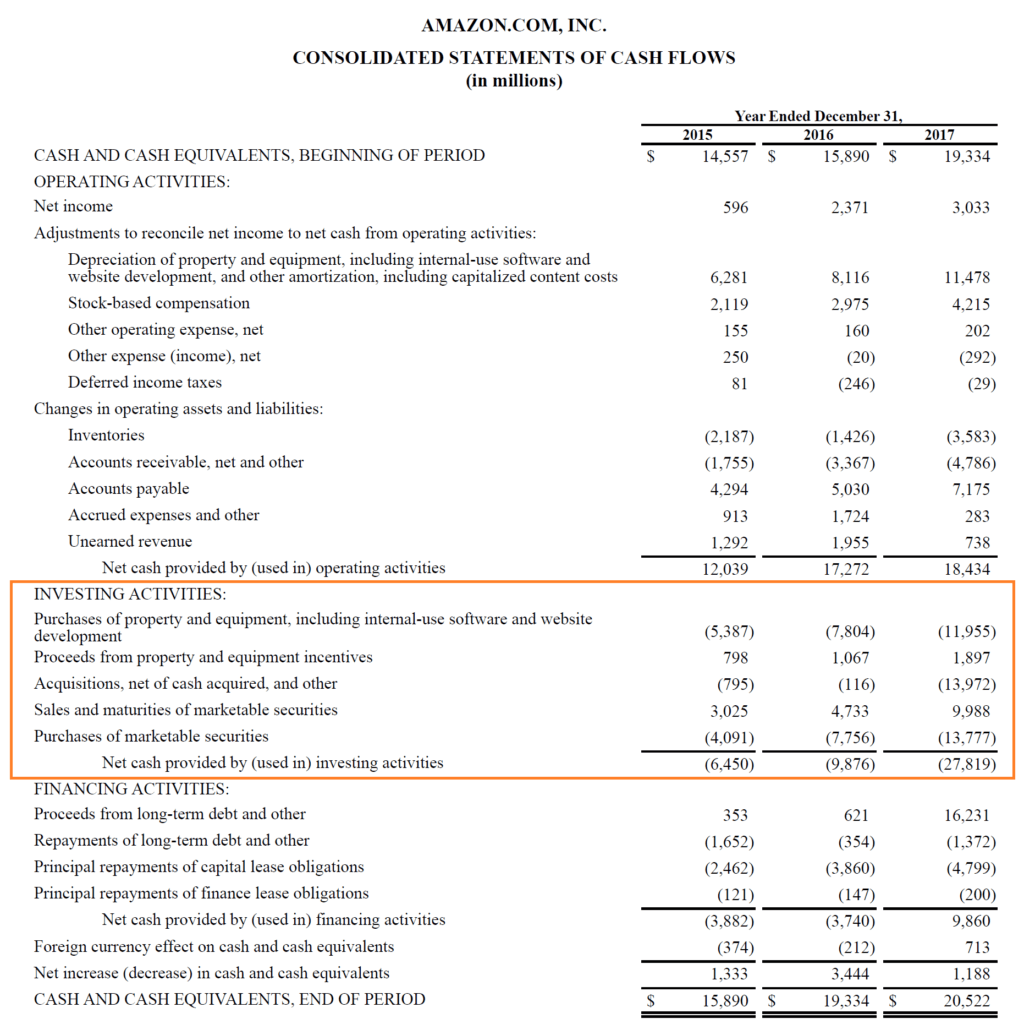

Financing cash flows include proceeds. Decrease in accounts. It is a statement showing the cash inflow and cash outflow of a company.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)