Ideal Interpreting Balance Sheet

Interpreting the Balance Sheet.

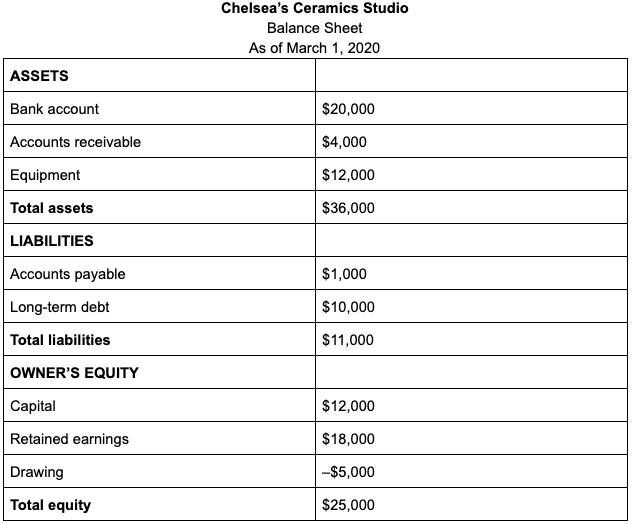

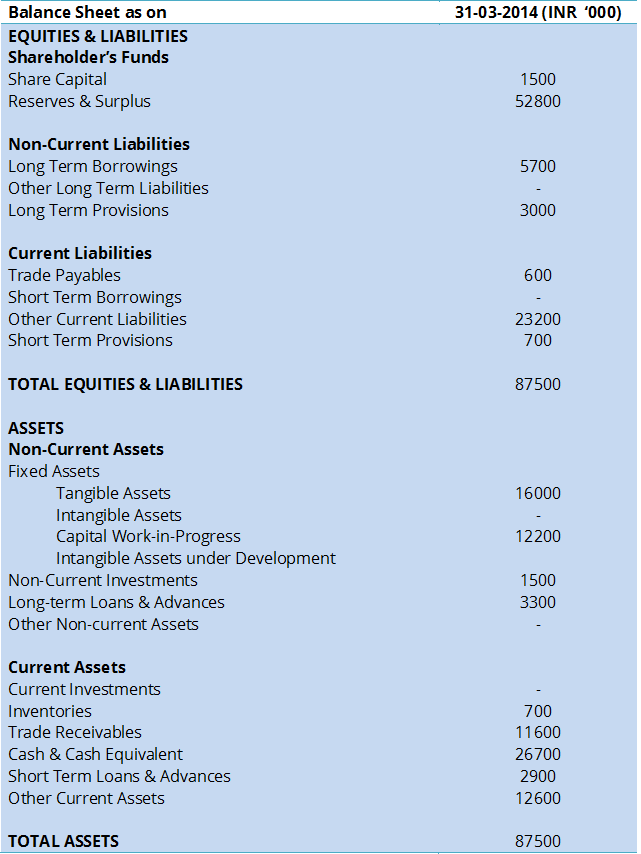

Interpreting balance sheet. To read a balance sheet you need to analyze your businesss reported assets liabilities and equity to get a clear picture of what your company owns and owes on a single date. Balance sheet income statement statement of retained earnings and statement of cash flow. It is also a condensed version of the account balances within a company.

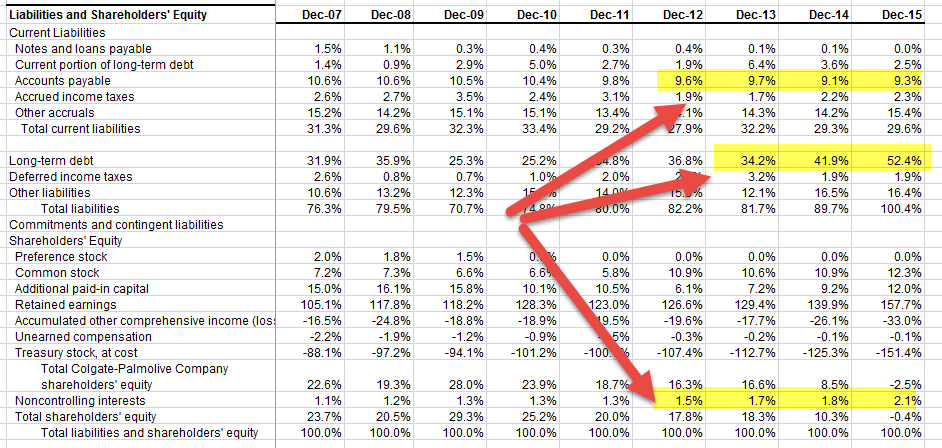

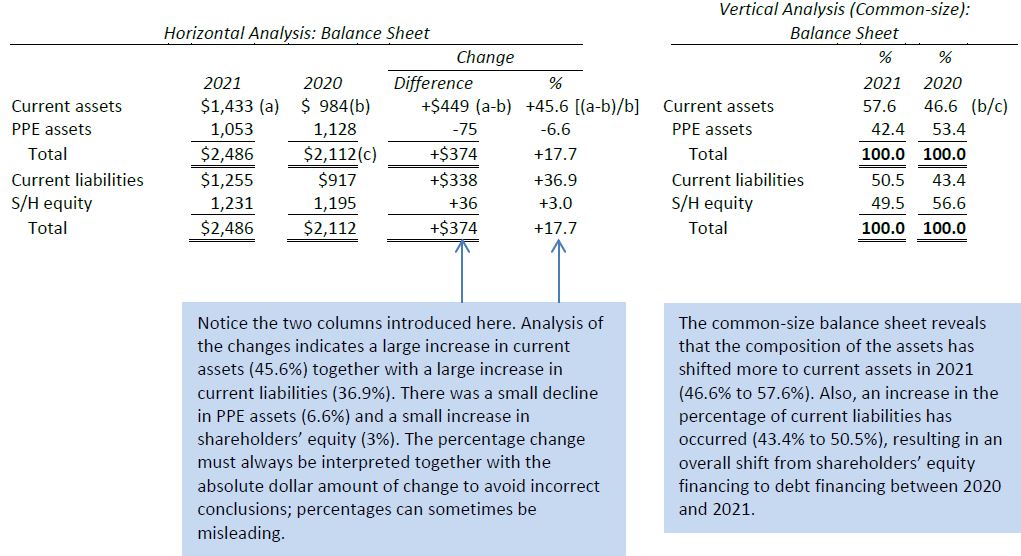

Using a balance sheet from Intel as your case study survey the significance of specific items that typically appear on balance sheets including current assets and intangible assets. A bank balance sheet is a key way to draw conclusions regarding a banks business and the resources used to be able to finance lending. Adding costbook valuation Advanced.

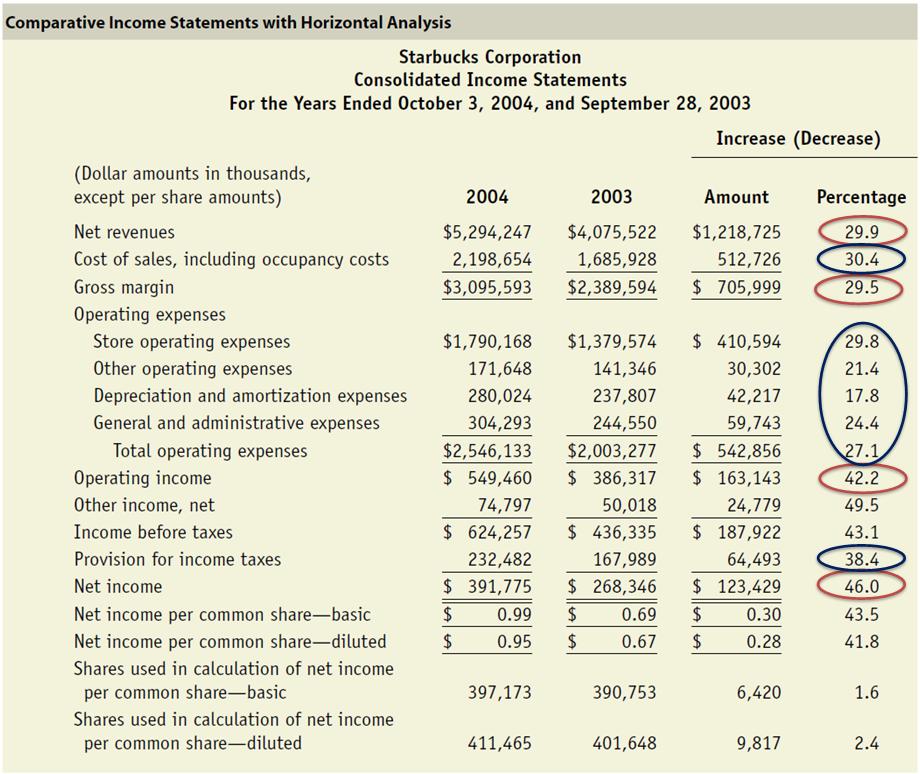

Balance sheet and income statement relationship. A balance sheet along with the income and cash flow statement is an important tool for investors to gain insight into a company and its operations. In essence the balance sheet tells investors what a business owns assets what it owes liabilities and how much investors have invested equity.

The balance sheet is separated with assets on one side and liabilities and owners equity on the other. Interpreting the Balance Sheet. A balance sheet is only a snapshot of a business financial position on one particular day.

Revenue 50272 49694 Cost of goods sold 37611 37534 Restructuring charges - cost of goods sold 24 -- Gross profit 12637 12160 Selling general and administrative. Earned net worth analysis Advanced. Google Classroom Facebook Twitter.

Interpreting Financial Statements and Measures Balance sheet basics Happy new year. 1999 1299. Understanding Analyzing Balance Sheets quantity.

/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)