Awesome Comparative Income Statement Percentage Formula

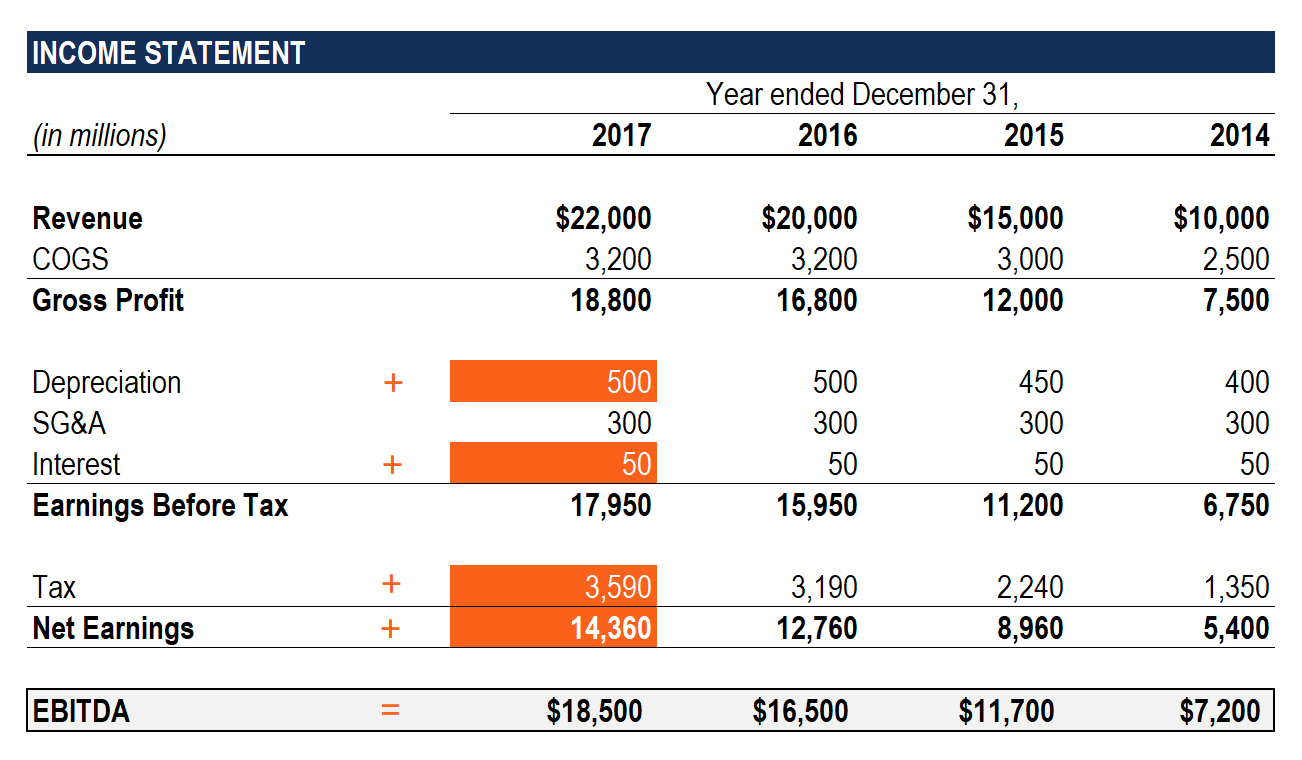

Gross Profit Margin Gross Profit Sales 100.

Comparative income statement percentage formula. COGS divided by 100000 is 50 operating profit divided by. If you made 45000 in 2015 and 50000 in 2016 the dollar change is 5000. Years amount as the base.

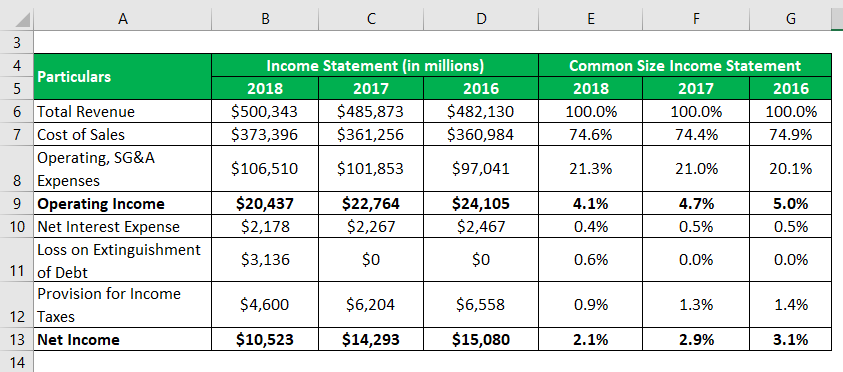

These ratios compare various profits of the business gross profit operating profit net profit etc with its sales. To find the percentage change first calculate the dollar change between each period. To common size an income statement analysts divide each line item eg.

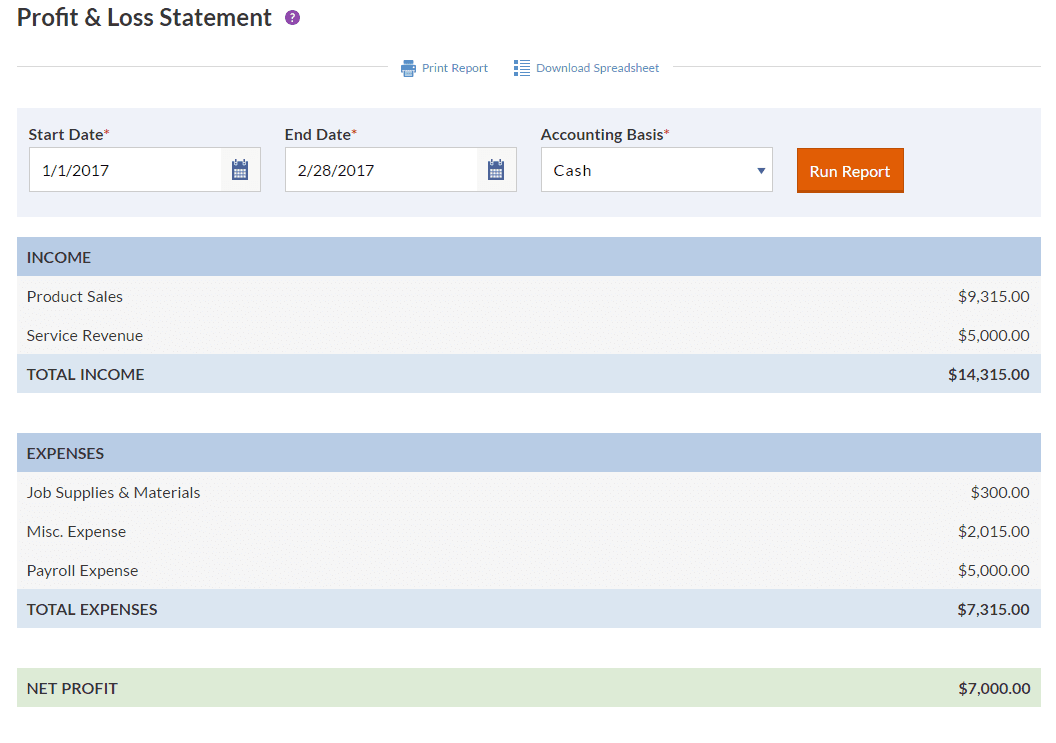

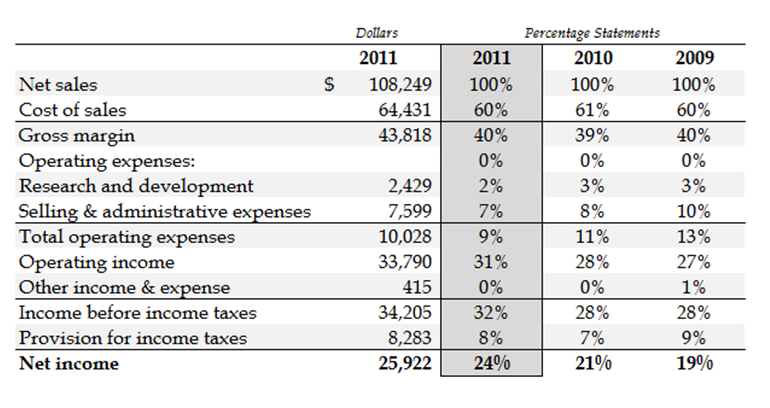

Due to this 100 increase in gross profit has decreased up to 66 increase in net profit. Gross profit operating income marketing expenses by revenue or sales. A two-year comparative income statement shows revenue and expenses over the current and previous years how much revenue and expenses have increased or decreased and the percentage they have increased or decreased.

Use this template to create a two-year comparative income statement. Comparative statements provide several advantages not included in the standard financial statements. Percentage Change Absolute Increase or DecreaseAbsolute Figure of the Previous Years Item 100.

The nine income statement ratios below are the ratios that can be calculated using the publicly available financial statements of the company. So lets understand a comparative balance sheet through an example. Common Size Income Statement Formula.

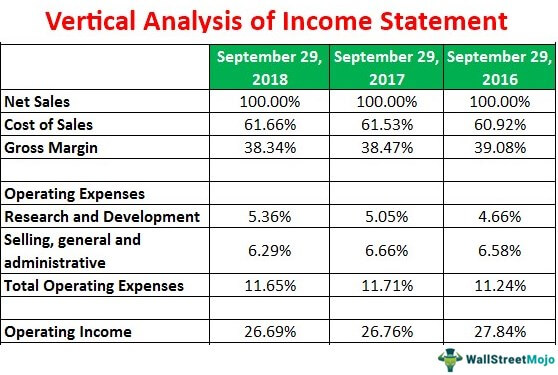

For example gross margin is calculated by dividing gross profit by sales. Comparative income statement with vertical analysis. Consider the following balance sheets of Ms Kapoor and Co as on December 31st 2017.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)