Looking Good Auditor Contravention Report

Auditors must report these contraventions to the ATO.

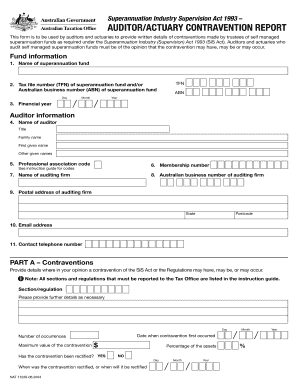

Auditor contravention report. Tax file number TFN of superannuation fund andor. Reporting to ASIC. Name of auditor Other given names First given name Family name Title Fund information 3.

An ALJSkey is not required. About this guide. This guide is for auditors including an individual auditor members of audit firms and audit companies.

SIS Act and Regulations. You do this by lodging an Auditoractuary contravention report ACR within 28 days of completing the audit. Of the Auditoractuary contravention report NAT 11239 ACR visit our website at atogovau and search for audit tool.

Name of superannuation fund 4. Completing the Auditoractuary contravention report. You can also lodge your auditor contravention reports ACRs online using the Business Portal.

The form displays all necessary information needed to lodge a Contravention Report. It also includes the Addendum. Comply with our simple steps to have your Auditor Contravention Report Pdf ready rapidly.

1 As part of the preparation of the report the auditor must report a contravention of a provision of the Superannuation Industry Supervision Act SISA or Superannuation Industry Supervision Regulations 1994 SISR. To assist auditors involved in conducting an audit of a company registered scheme disclosing entity or AFS licensee comply with their obligations under s311 601HG and 990K please refer to Regulatory Guide 34 Auditors obligations. The auditor contravention report has been updated following reforms to whistleblower protection laws which will have implications for SMSF auditors who report information at section G of the ACR.