Spectacular Revaluation Loss Journal Entry

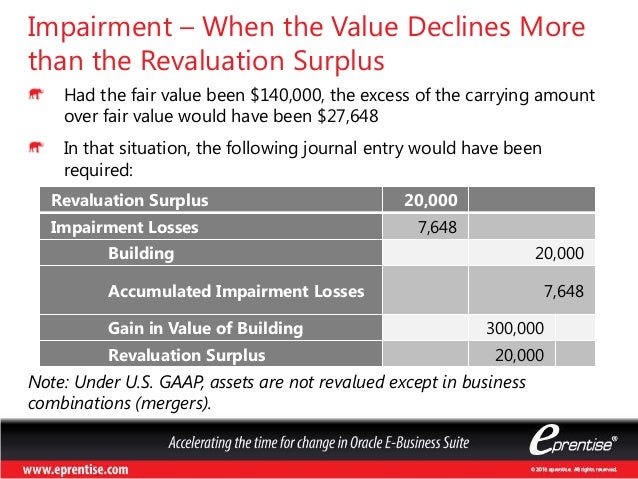

Impairment loss is more than revaluation surplus.

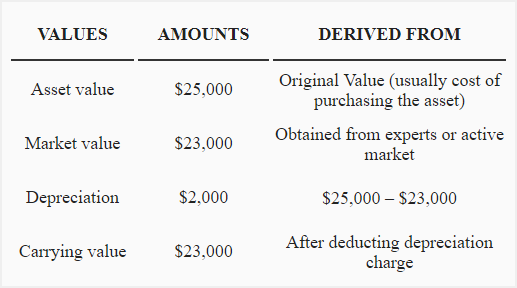

Revaluation loss journal entry. Assume on December 31 2010 the company intends to switch to revaluation model and carries out a revaluation exercise which estimates the fair value of the building to be 190000 as at December 31 2010. Instead an equity account is credited and called a Revaluation Surplus. It should be kept on its historical book cost value.

If the revaluation reserve accumulated in the past for the specific item of PPE exceeds its revaluation loss a single entry must be made in the general journal. When you revalue profit and loss accounts the sum of all transactions that occur within the date interval are revalued. A revaluation loss should be charged against any related revaluation surplus to the extent that the decrease does not exceed the amount held in the revaluation surplus in respect of the same asset.

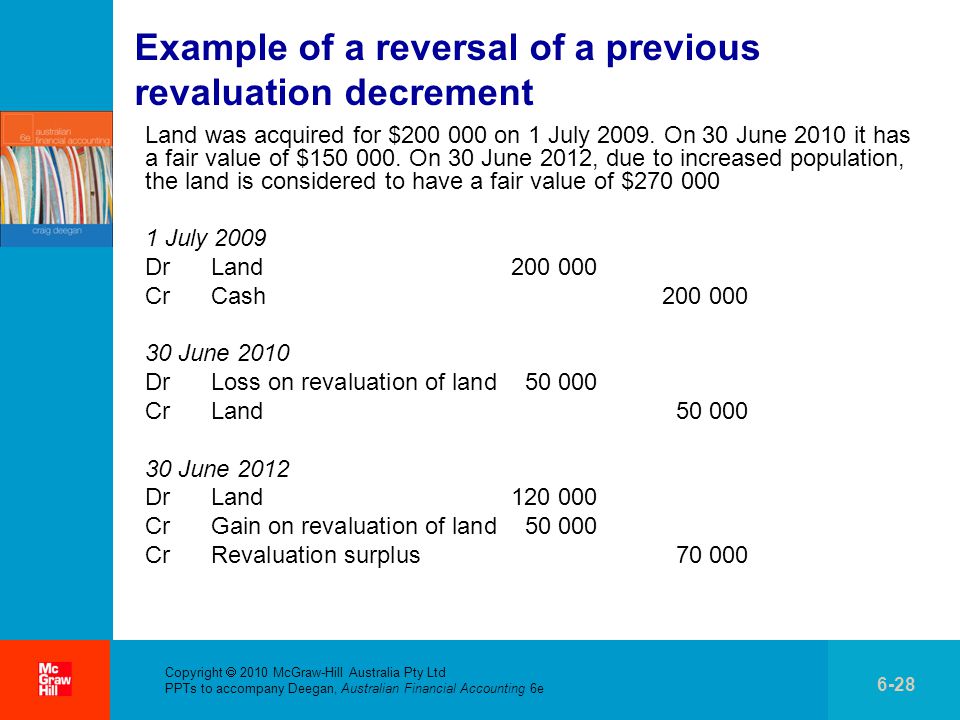

The required journal entries are explained in the example below. You place an asset in service in Year 1 Quarter 1. Revalue Accumulated Depreciation Example 1.

Subsequent to the year end the business receives payment from the overseas customer. So for example there is a USD debtor ledger module. The revaluation reserve is debited for the amount of revaluation reserve accumulated in the past impairment loss is debited for the difference between revaluation loss.

The journal entry for the recognition of the revaluation deficit is as follows. Asset has a carrying amount of 70000 with a previously recognized revaluation loss of 20000 In this case previous revaluation loss will be reversed first and any amount of current gain over exceeding previous loss will be taken to revaluation. As quoted in case of cost model.

The following is a journal entry of downward asset revaluation. In this case the share of retiring or deceased partner of profit or loss from revaluation of assets and liabilities is adjusted in the remaining partners capital accounts in their gaining ratio. For month end for year end i want know the status of each GL involved in like.