Perfect Ppp Loan Disclosure In Financial Statements

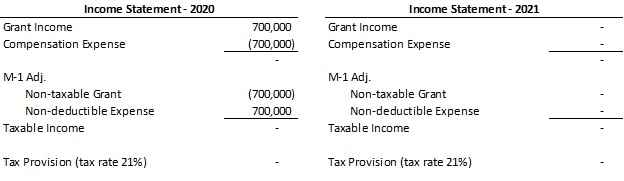

Under ASC 450-30 there are no specific disclosure requirements.

Ppp loan disclosure in financial statements. Which guidance to follow on presentation of the loan is. Ad Find Quality Results Related To Financial Loan. Ad Find Financial Loan.

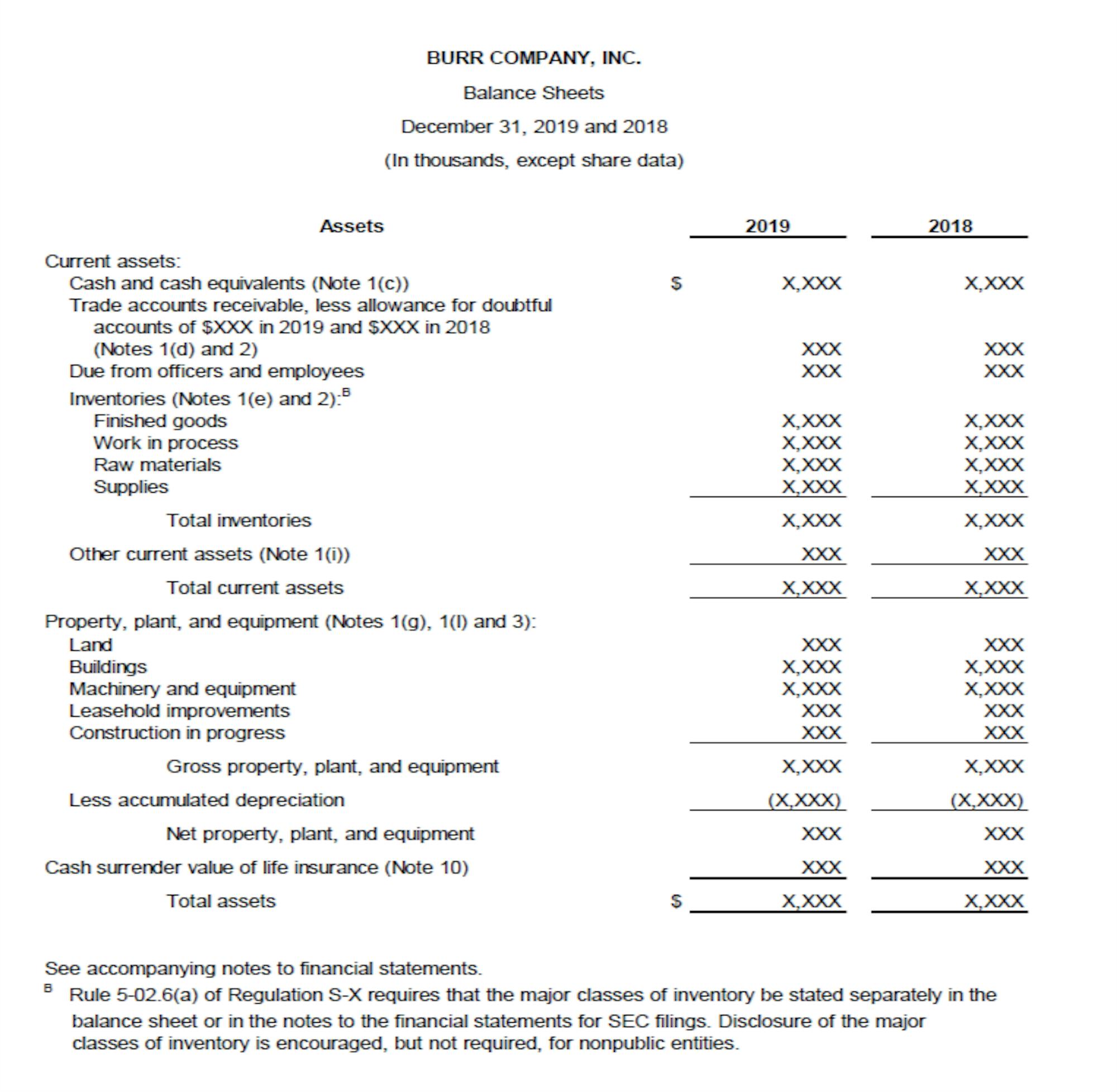

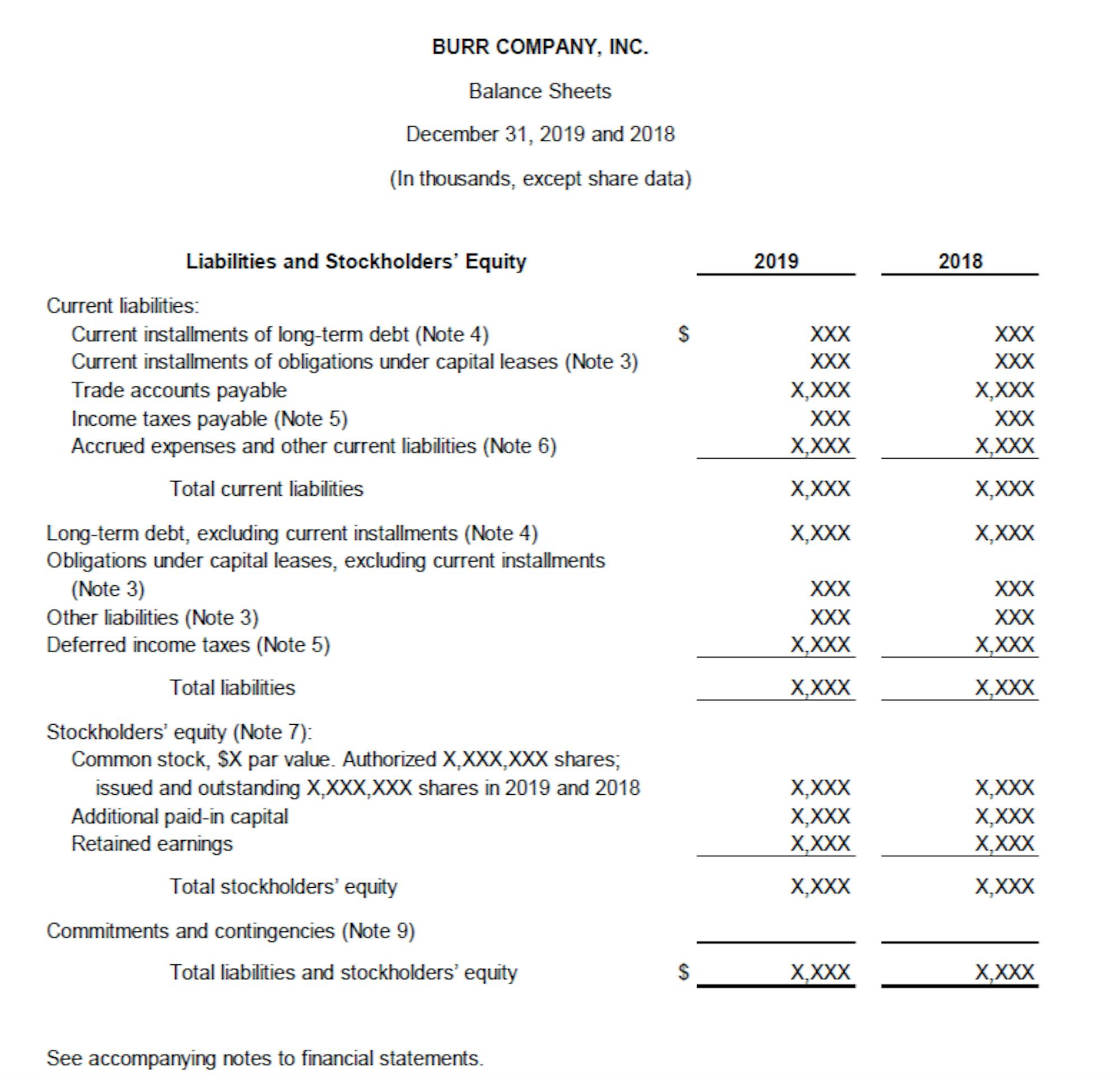

In addition these financial statements illustrate many disclosures that are applicable only to public companies as defined within each Accounting Standards Codification ASC topic and prior to the FASB defining a public business entity PBE. The EY organization surveyed disclosures in the IFRS financial statements of more than 120 companies that published their annual financial statements as of 30 June 2020. Ad Find Financial Loan.

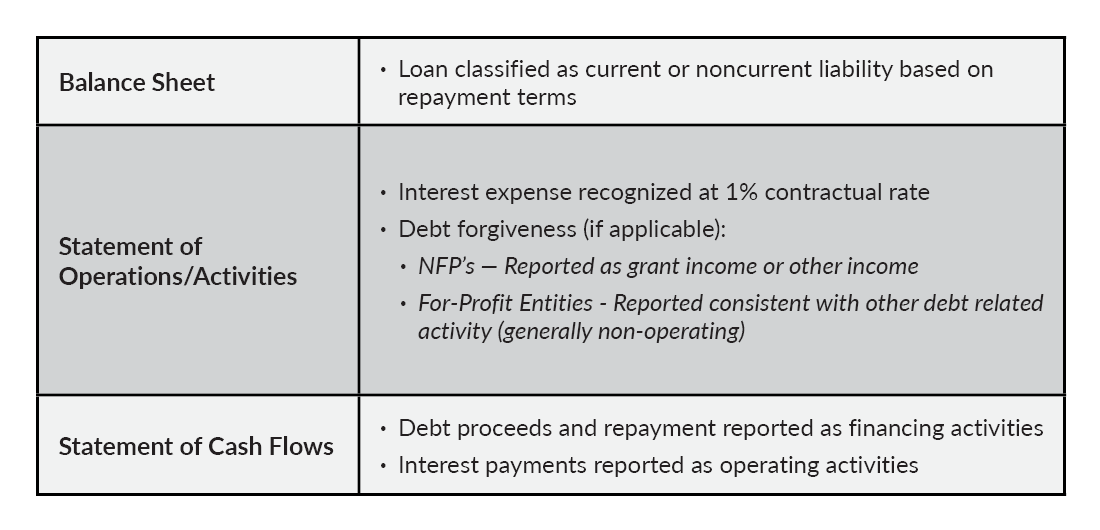

In addition to the extent a PPP loan remains outstanding as of a financial statement reporting period entities should consider disclosing uncertainties related to eligibility tax deductibility and complexity surrounding the PPP loan forgiveness process. Maturity date of two years with the ability to prepay earlier with no fees. Disclosures applicable to public companies and public business entities are indicated by shaded text.

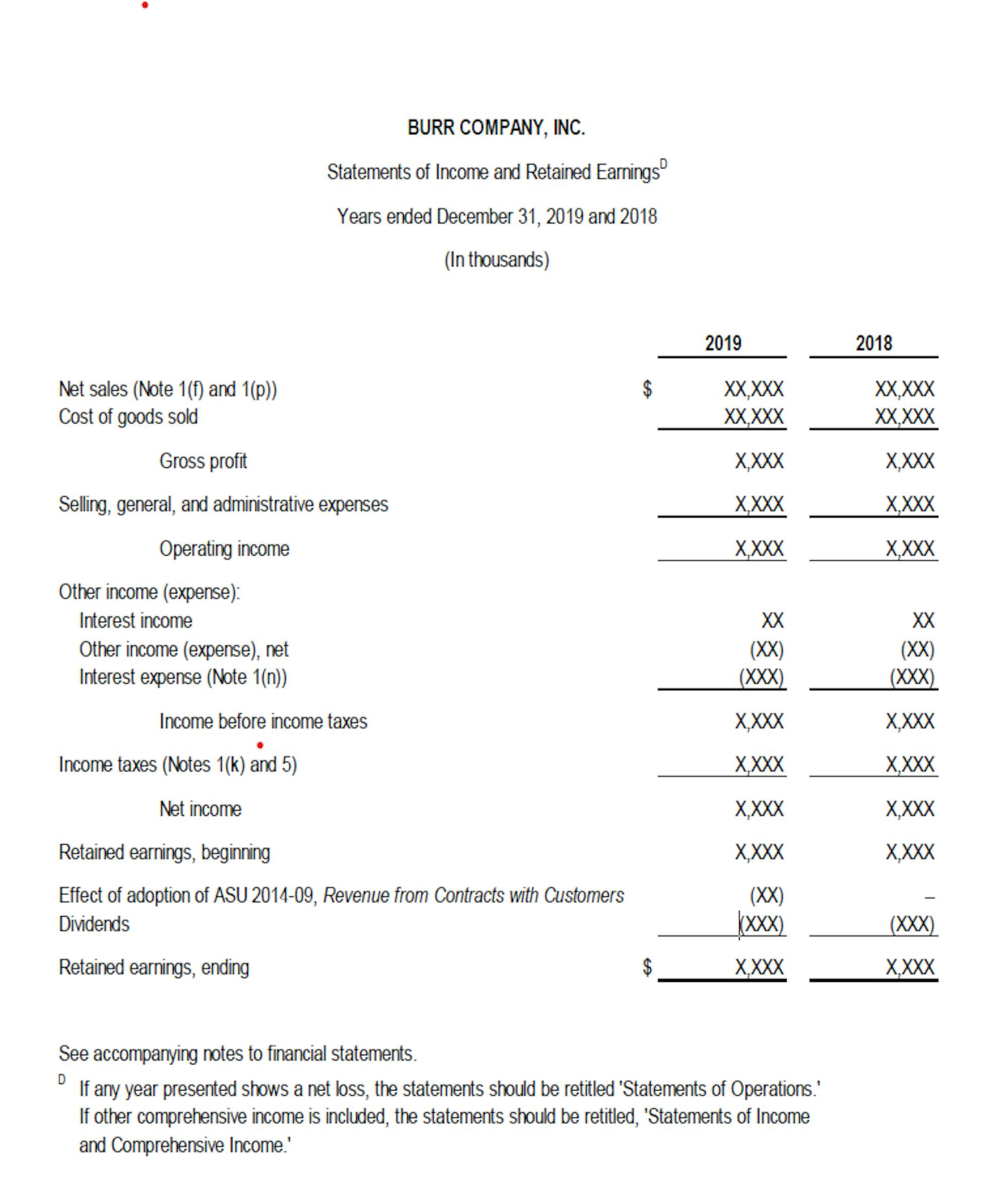

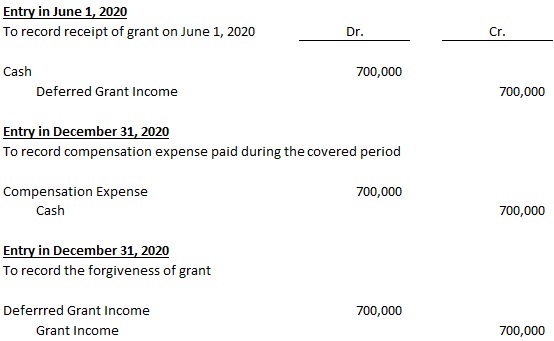

Borrowers should provide transparent disclosure regarding the accounting conclusions for PPP loans and the resulting impact to the financial statements and also consider potential impacts to risk factor and liquidity disclosures when applicable. Its important to note that material PPP loans should adequately disclose all key terms of the loan in the notes to the financial statements. Ad Find Financial Loan.

Disclosures should include issue date face amount carrying amount description of borrowing interest rate interest paid and maturities. Ad Find Financial loan. In the aggregate amount of 10000000 pursuant to the Paycheck Protection Program the PPP under Division A Title I of the CARES Act which was.

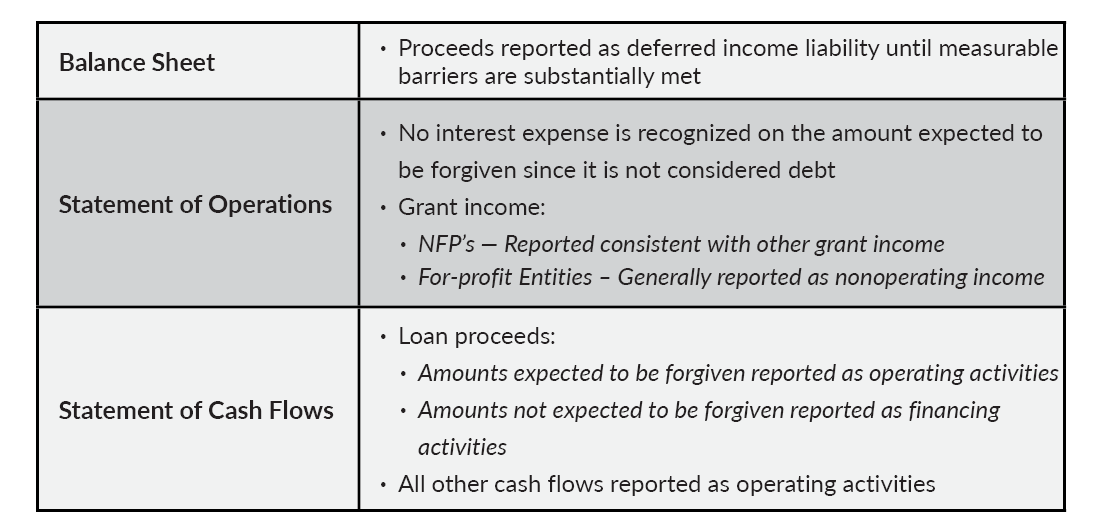

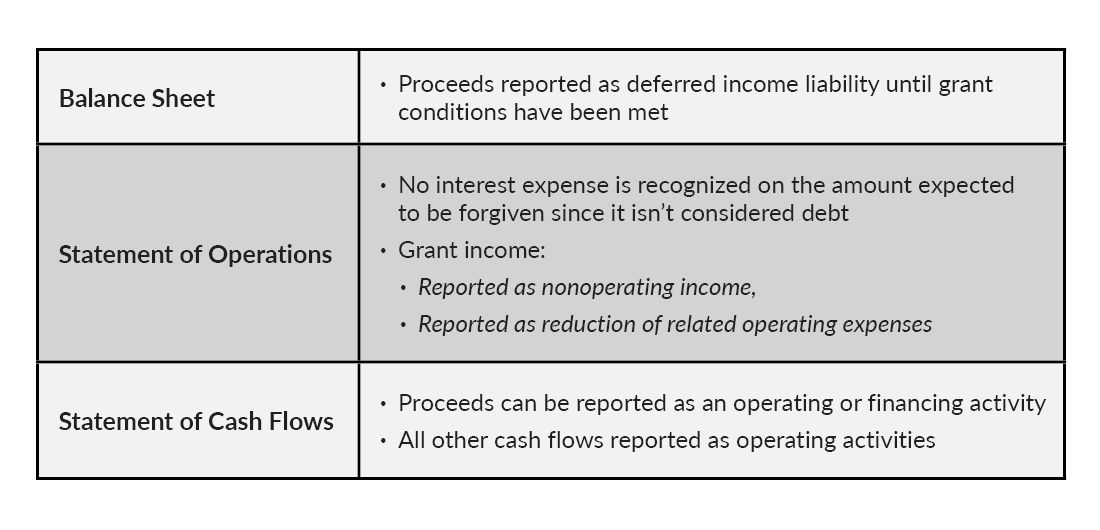

Financial Statement Impact of PPP Loan. 2 Fixed interest rate of 1 percent per annum. Disclosures Regardless of the accounting approach followed by a borrower if the PPP loan is material to the financial statements the borrower should disclose in the footnotes how the PPP loan was accounted for and where the related amounts are presented in the financial statements including the statement of cash flows.