Sensational Audit Committee And Financial Reporting Quality

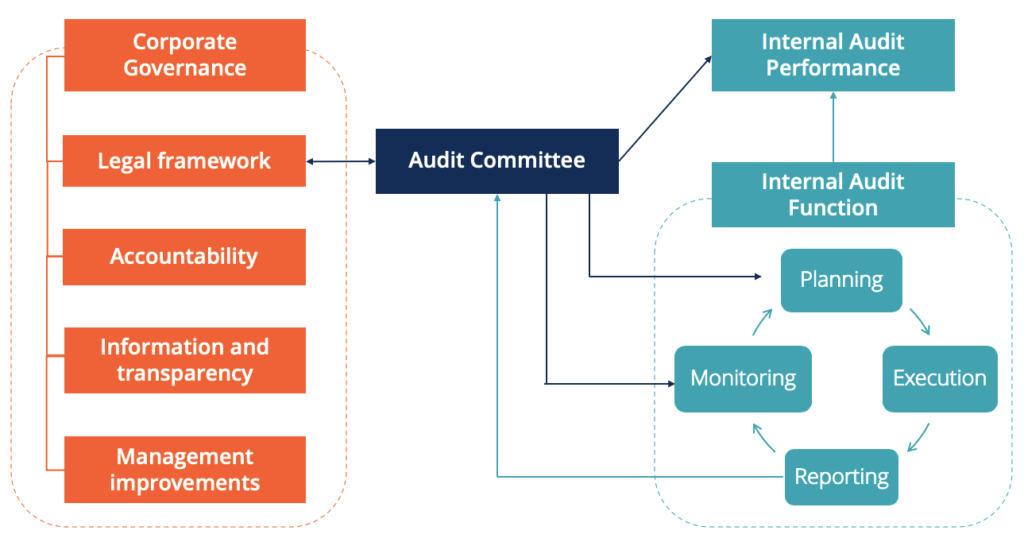

When studied in relation to audit committee effectiveness financial reporting quality has been measured using a disparate range of variables.

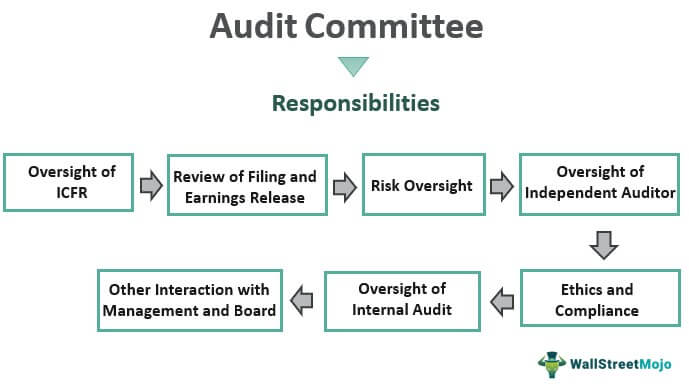

Audit committee and financial reporting quality. Firms involved in fraudulent financial reporting are less likely to have an audit committee Dechow et al 1996 McMullen 1996. We investigate whether new audit committee AC chairs provide more effective monitoring of the financial reporting process when they have firm-specific knowledge proxied for by prior service on the firms AC. This paper performs an ordinary least squares regression to examine the moderating effect of audit quality on the relationship between financial reporting quality.

Consistent with practitioner and governance experts views on the importance of firm-specific knowledge we find that firms are less likely. A Study of Selected Indian Companies Kanukuntla Shankaraiaha Seyed Masoud Sajjadian Amirib abDepartment of Commerce Osmania University. Thus it may be inferred that the companies may improve the financial reporting quality by managing the board size audit committee meetings and size as these characteristics have significant relationship with financial reporting quality.

The relationship between corporate governance mechanisms Received in revised form 15th December 2016 board characteristics audit committees board independence board size and growth and financial Accepted 24th January 2017 reporting quality was observed. The 8th Directive has had a positive effect on corporate governance quality and in turn FRQ in the EU. Whilst management is responsible for preparing financial reports audit committees help ensure the integrity and transparency of the statements.

Based on the findings of extant research that there are different factors that may have implications for the AC effectiveness the authors posit an association between the aforementioned financial aspects. Audit Committee Financial Reporting Quality Performance Discretionary Accruals. This study also informs regulators and policy makers of the importance of audit price in limiting earnings manipulation and boosting audit quality which in turn enhances financial reporting quality.

Audit committee existence is just a necessary but not a sufficient condition for enhancing FRQ. Also the audit price partially and significantly mediates the link between the audit committee and financial reporting quality. This thesis examines the impact of audit committee characteristics on financial reporting quality in the context of a large sample of UK companies over the period 2007-2010.

SEC requirements echo those of SAS 61 and require a letter from the audit committee discussing both the quality of the applied accounting principles and a judgment on how they affect the companys financial statements. Audit quality was found to be positively. The audit committee independence and expertise are found to significantly associate with improved financial reporting quality.