Fabulous Cash Flow Statement As Per As 3 Ias 12 Examples

Under IAS 7 cash flows are classified into operating investing and financing activities in a manner.

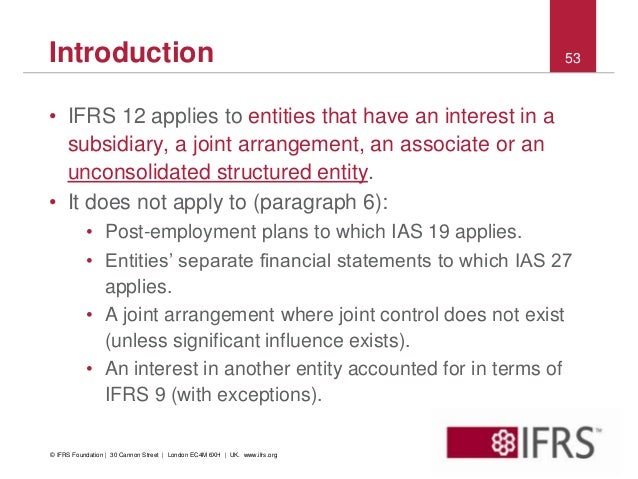

Cash flow statement as per as 3 ias 12 examples. The statement of cash flows is required to be presented by all entities for each period for which financial statements are presented. A cash flow statement when used in conjunction with the other financial statements provides information that enables users to evaluate the changes in net assets of an enterprise its financial structure including its liquidity and solvency and its ability to affect the amounts and timing of cash flows in order to adapt to. These examples represent how some of the disclosures required by IAS 12 in Example 2 - Illustrative disclosure for income taxes.

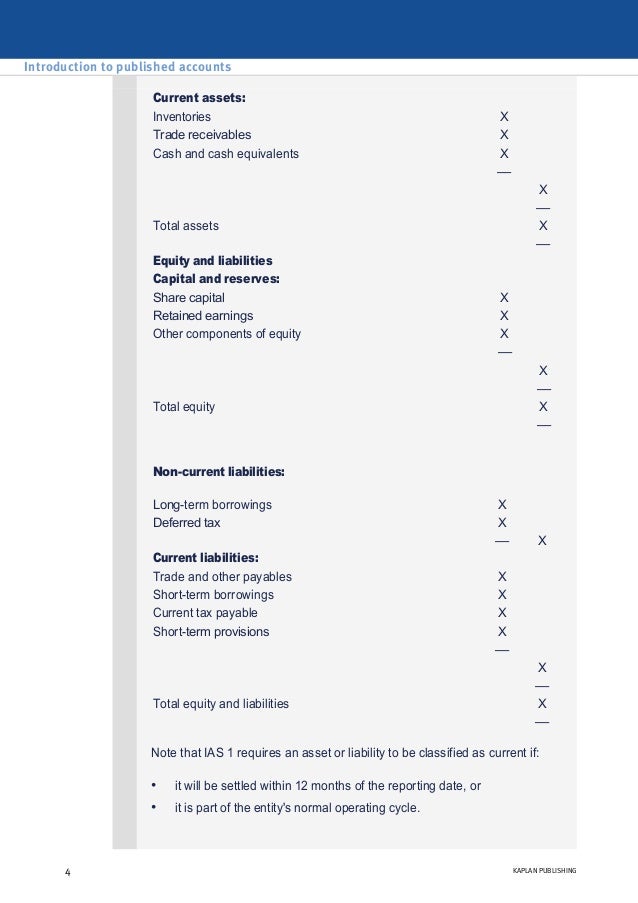

The following are the examples of cash. Cash flows are classified and presented into operating activities either using the direct or indirect method investing activities or financing activities with the latter two categories generally presented on a gross basis. Restricted cash and cash equivalent balances disclosure requirements 31.

There are two different ways of starting the cash flow statement as IAS 7 Statement of Cash Flows permits using either the direct or indirect method for operating activities. Cash From Operating Activities. Cash Flow Statement is a statement which shows inflows and outflows of cash and its equivalent in an enterprise during a specified period of time.

Cash From Financing Activities. Cash equivalents are short-term highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value. Figures given within brackets represent cash outflows.

Statement of cash flows presents inflows and outflows of cash and cash equivalents and is dealt with in IAS 7. This is the cash receipts from customers. Cash flow from investing activities reflects the amount of expenditure made by the entity for the purchase of long term assets to generate economic benefits for a long time period.

If it is a Use Amount will be negative. IAS 71 IAS 721-24 Benefits of cash flow information IAS 73-4 Requirements All entities must prepare a Statement of Cash Flows The Statement of Cash Flows comprises part of an entitys complete set of financial statements under IFRS1 The Statement of Cash Flows must be presented with equal prominence. Examples from IAS 7 representing ways in which the requirements of IAS 7 for the presentation of the statements of cash flows and segment information for cash flows might be met using detailed XBRL tagging.