Wonderful Errors That Cause A Trial Balance To Disagree

The preparation of Trial Balance and the method of locating such errors.

Errors that cause a trial balance to disagree. At other times the balance calculated may be smaller than the real balance. This is an error where a transaction is completely omitted from the books. 26150 instead of Rs.

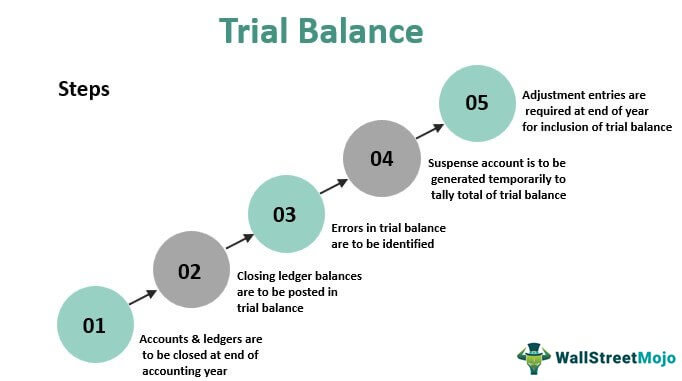

KASNEB CPA 2019 Nov Financial Accounting - Question One CLink to question. To make the Trial Balance agree a suspense account is used as a balancing figure. Earlier in my article on Suspense account I.

Sometimes the balance calculated may be bigger than the real balance. The trial balance is a report that include all the general accounts USD and their balances and it is used to identify some proseccing errors. In this case trial balance will show immediately that there is an error in the posting if total debit does not equal total credit.

These balances may at times be wrongly calculated. 1Accounting Errors Shown By Trial Balance The errors that effect the agreement of the trial balance are called the errors shown by trial balance. 26250 then the debit in the purchases account would be Rs.

In this article we shall discuss the different type of errors which affect the agreement of the Trial Balance. 26150 as the total from the subsidiary book will be posted to the debit of the purchase account. Errors that Affect the Trial Balance.

The following are the errors that affect the totals of trial balance. The accounting errors based on disclosure by trial balance can be of the following types. The trial balance of a business as at 31 December 2014 showed a shortage of 770 on the credit side.

/accountant03-lg-79ae5efad19a475fa8ef46eeb1edd7fb.jpg)