Ace Explain Ratio Analysis

Name the two major types of financial statement analysis discussed in this.

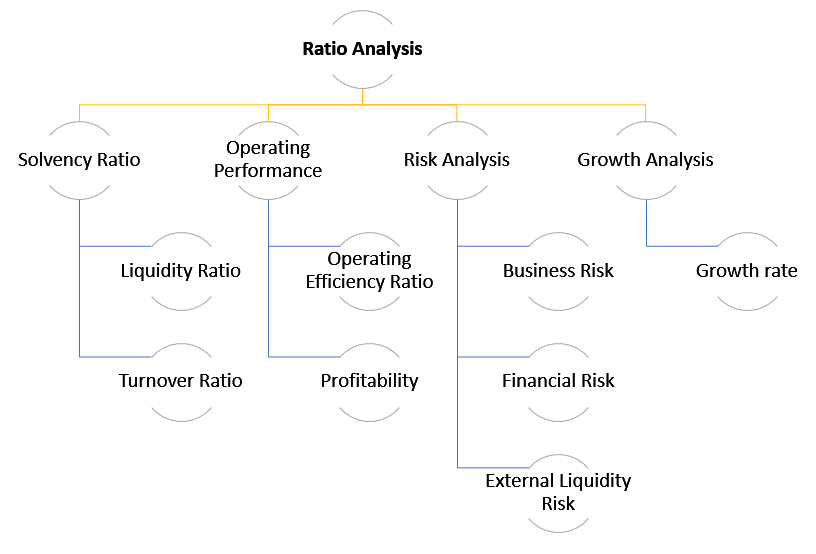

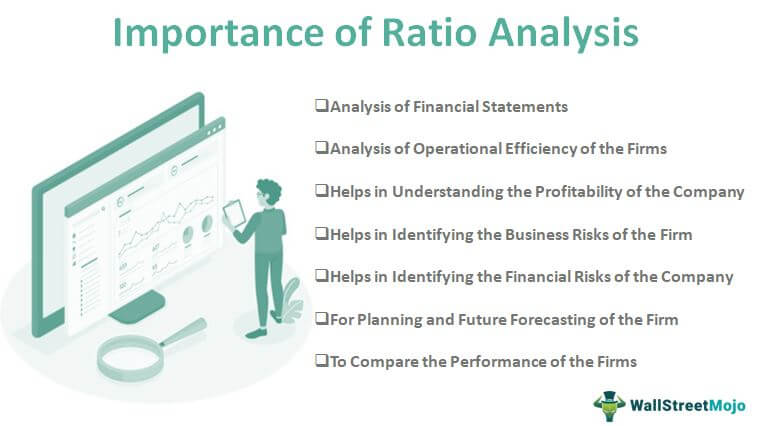

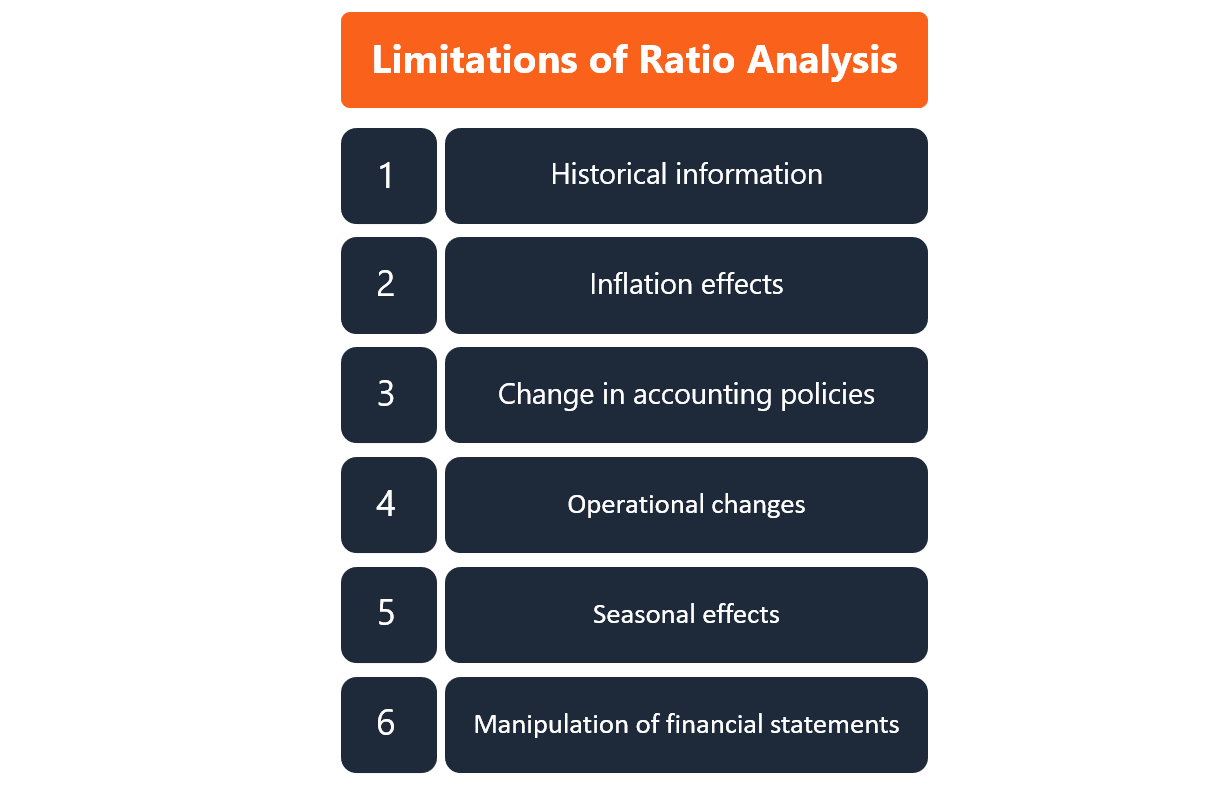

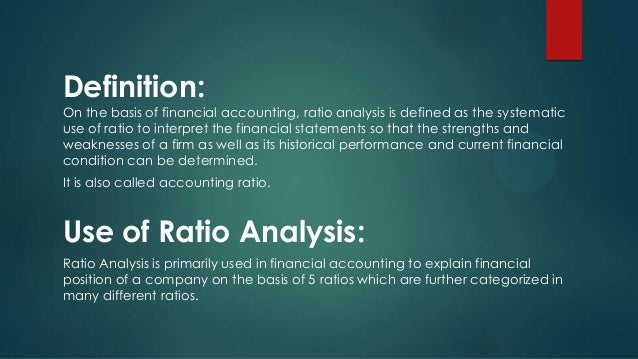

Explain ratio analysis. Ratio analysis is a quantitative method of gaining insight into a companys liquidity operational efficiency and profitability by studying its financial statements such as the balance sheet and. Limitations of ratio analysis are. Given what you have learned about ratio analysis choose one of the businesses from the video Rose Chong Costumes Anro s Floor Maintenance or John Osborne s Gym and Squash Center and identify two ratios that would be helpful for the owner of the business to monitor.

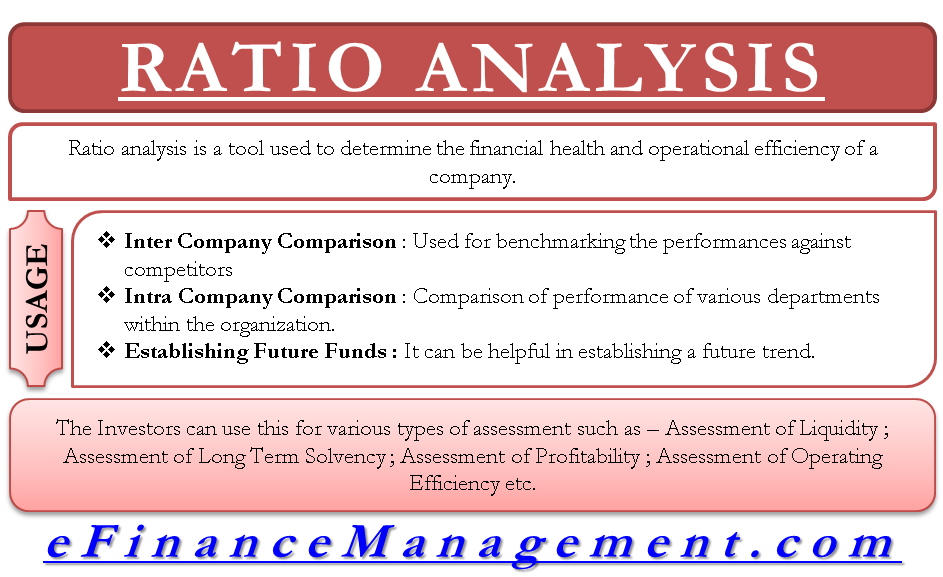

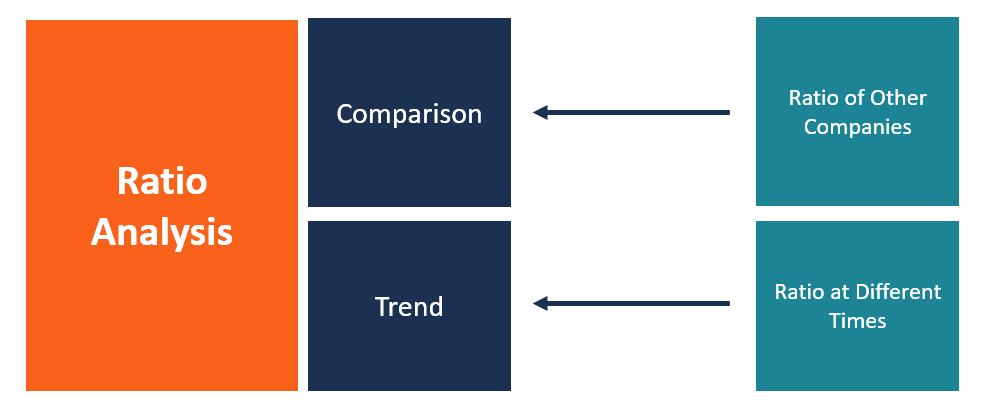

Ratio analysis can be used to compare information taken from financial statements to gain a general understanding of the results financial positions and cash flow of a business. To explain the matter more clearly Ill show screenshots of my stock analysis worksheet to display each ratio more visually. Identify two types of standards used in ratio analysis.

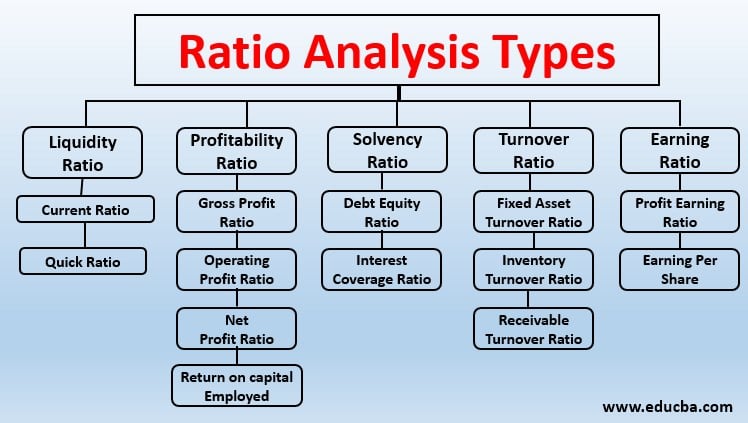

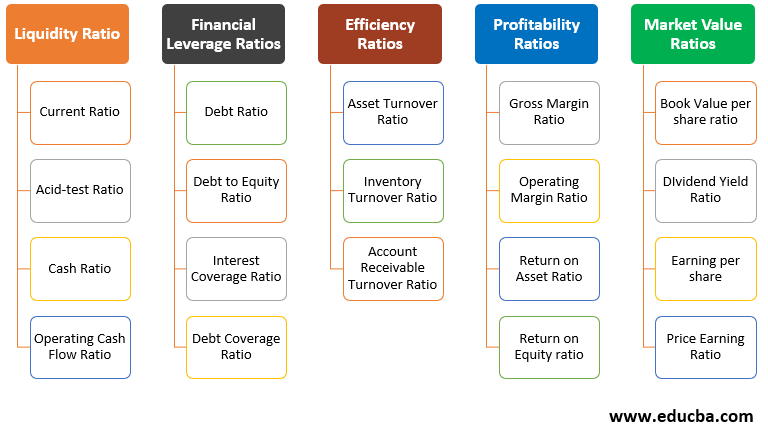

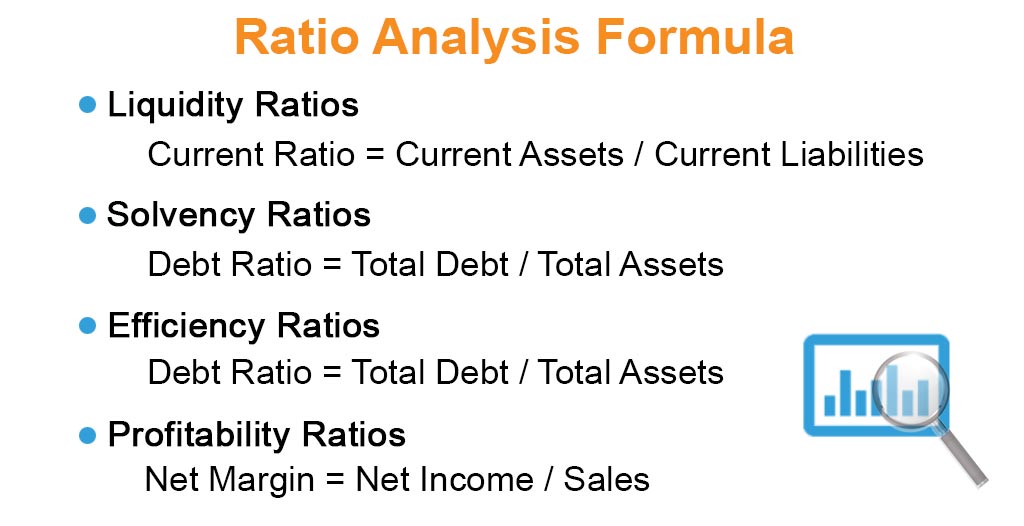

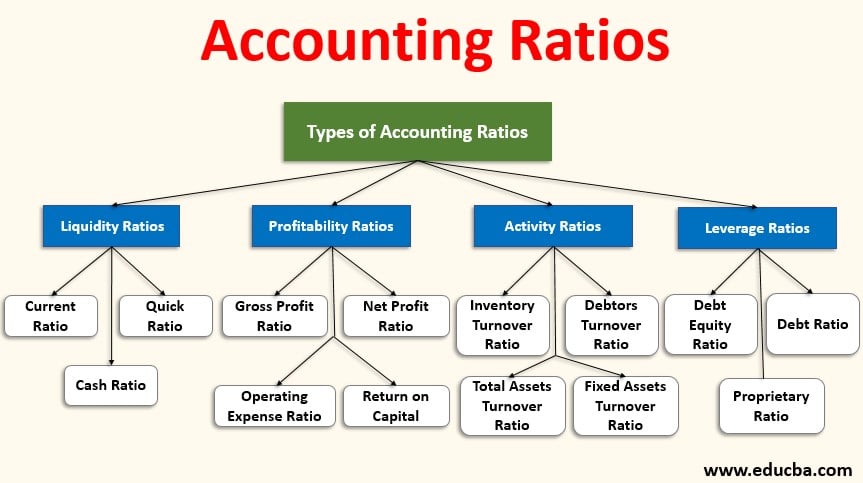

It can be used to check various factors of a business such as profitability liquidity solvency and efficiency of the company or the business. So it takes time. Ratio Analysis Ratio analysis is referred to as the study or analysis of the line items present in the financial statements of the company.

Which of the following actions could help to improve that ratio. It is used to assess multiple perspectives of an enterprises working and financial performance such as its liquidity turnover solvency and profitability. Ratio analysis is a technique of financial analysis to compare data from financial statements to history or competitors.

The correct option is A. Checking all the ratios for a company is an exhaustive work. Pedee Companys inventory turnover in days is 80 days.

Early gang research relied on the use of. Ratio analysis is useful in exploring trends of the business. Be sure to explain what the ratio would tell the owner and how it can be.