Divine Fair Value Through Profit And Loss Journal Entries

Year 2 Present Value of the Cash Flow 50000 50000 105 2 45351.

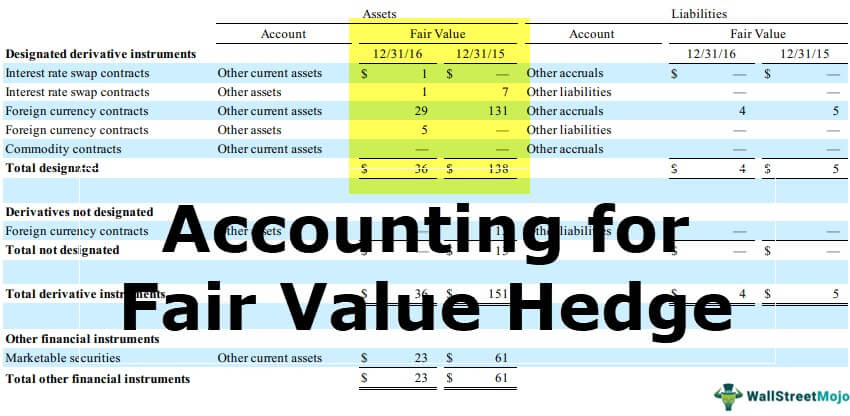

Fair value through profit and loss journal entries. Credit Liabilities from financial guarantees. Accounting for Fair Value Hedges. In such a scenario the investment must be accounted for using fair value through profit and loss method.

ZChanges in the fair value of available for sale assets are recognised directly in equity. Dividend income on a qualifying investment in profit and loss with no recycling of changes in fair value accumulated in equity through OCI. Fair value through profit or loss A financial liability is classified as a financial liability at fair value through profit or loss FVTPL if it meets one of the following conditions.

A fair value hedge is a hedge of the exposure to changes in the fair value of an asset or liability or any such item that is attributable to a particular risk and can result in either profit or loss. The fair value of your. It is held for trading or It is designated by the entity as being at FVTPL note that such a designation is only permitted if specified conditions are met.

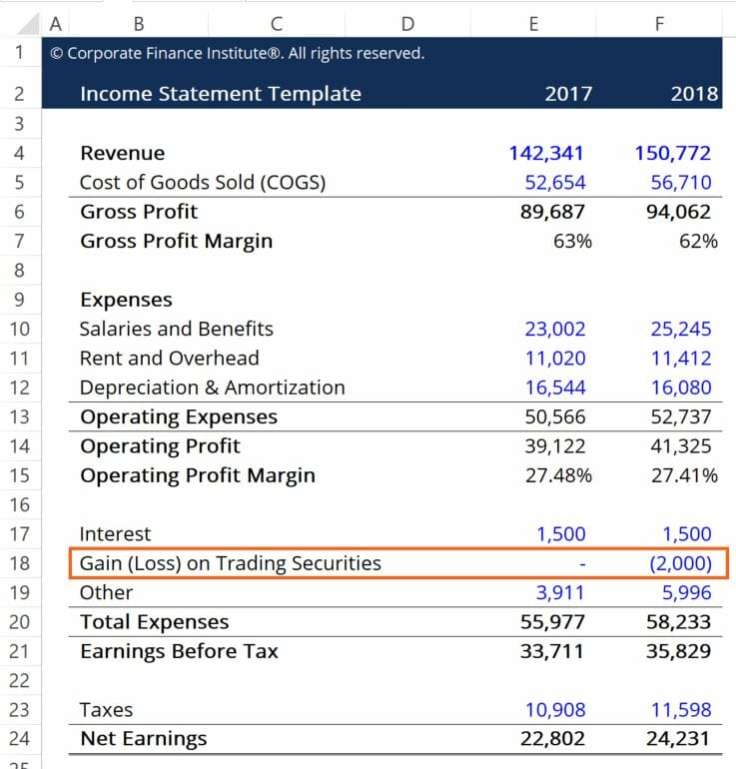

Fair value of a company can be determined through profit or loss. Lets take a look at the following example to clarify our concepts related to the accounting of financial assets at FVOCI equity instruments. It is a myth and simply incorrect to state that only realised gains are included in the statement of profit or loss SOPL and that only unrealised gains and losses are included in the OCI.

The fair value of your guarantee. Credit Liabilities from financial guarantees. All other financial assets are measured at fair value with limited exceptions.

The fair value of the liability decreases by 10000 with 2000 of that decrease due to a change in the entitys own credit risk. Fair value hedge pertains to a fixed value. Fair value is defined as whatever price a buyer and seller agree.