Awesome Financial Leverage Impacts The Performance Of The Firm By

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

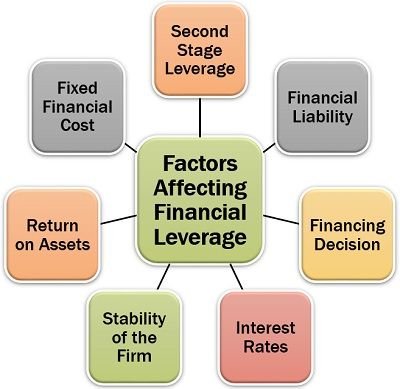

Increasing the volatility of the earnings to firms shareholders.

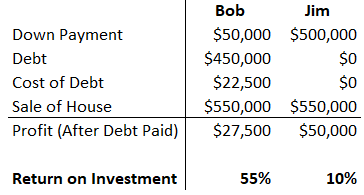

Financial leverage impacts the performance of the firm by. Financial leverage has no significant positive relationship with firm financial performance of listed oil refineries in Pakistan H1A. Financial leverage impacts the performance of the firm by. Hypothesis The hypothesis that set for this paper is.

None of the above. Financial leverage is negatively associated with return of assets and equity which shows that firms borrow less while market-to-book ratio shows positive profitable association with firms. Ad Find Firm Financial.

Financial leverage impacts the performance of the firm by. Decreasing the volatility of the firms EBIT. Ad Find Firm Financial.

For Teachers for Schools for Working Scholars for. 1Financial leverage impacts the performance of a firm by. Financial leverage impacts the performance of the firm by.

Based on the results the firms having high level of long term debt and total debt tend to show poorer performance of return on assets and return on equity. Increasing the volatitity of the firms net income. Decreasing the volatility of the firms EBIT.

Medium EPS AND RISK TO EQUITYHOLDERS b 20. Strong negative impacts of financial leverage measured by LTD and TD on performances of ROA and ROE while STD had insignificant effects on ROA and ROE of these firms. Financial leverage impacts the performance of the firm by.

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-02-53842f4fc058478b8b874decd8e1c8af.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-03-03d6cea476bc45fc88f7571417961fff.jpg)

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)

:max_bytes(150000):strip_icc()/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)