Ace Pro Forma Financial Statements Definition

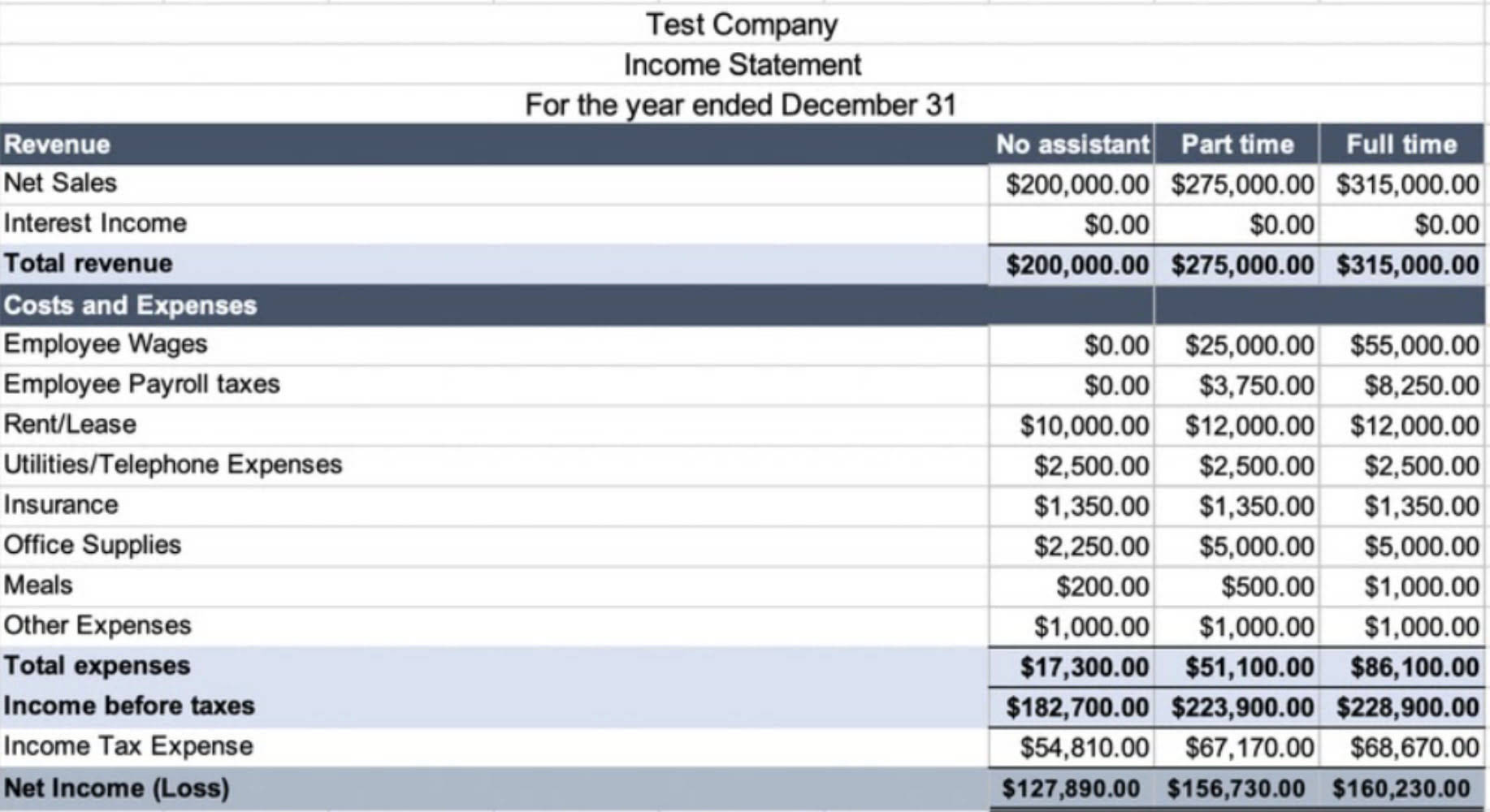

For example if a company is considering acquiring another it may prepare a pro forma financial statement to estimate what effect the acquisition would have on its own financial circumstances.

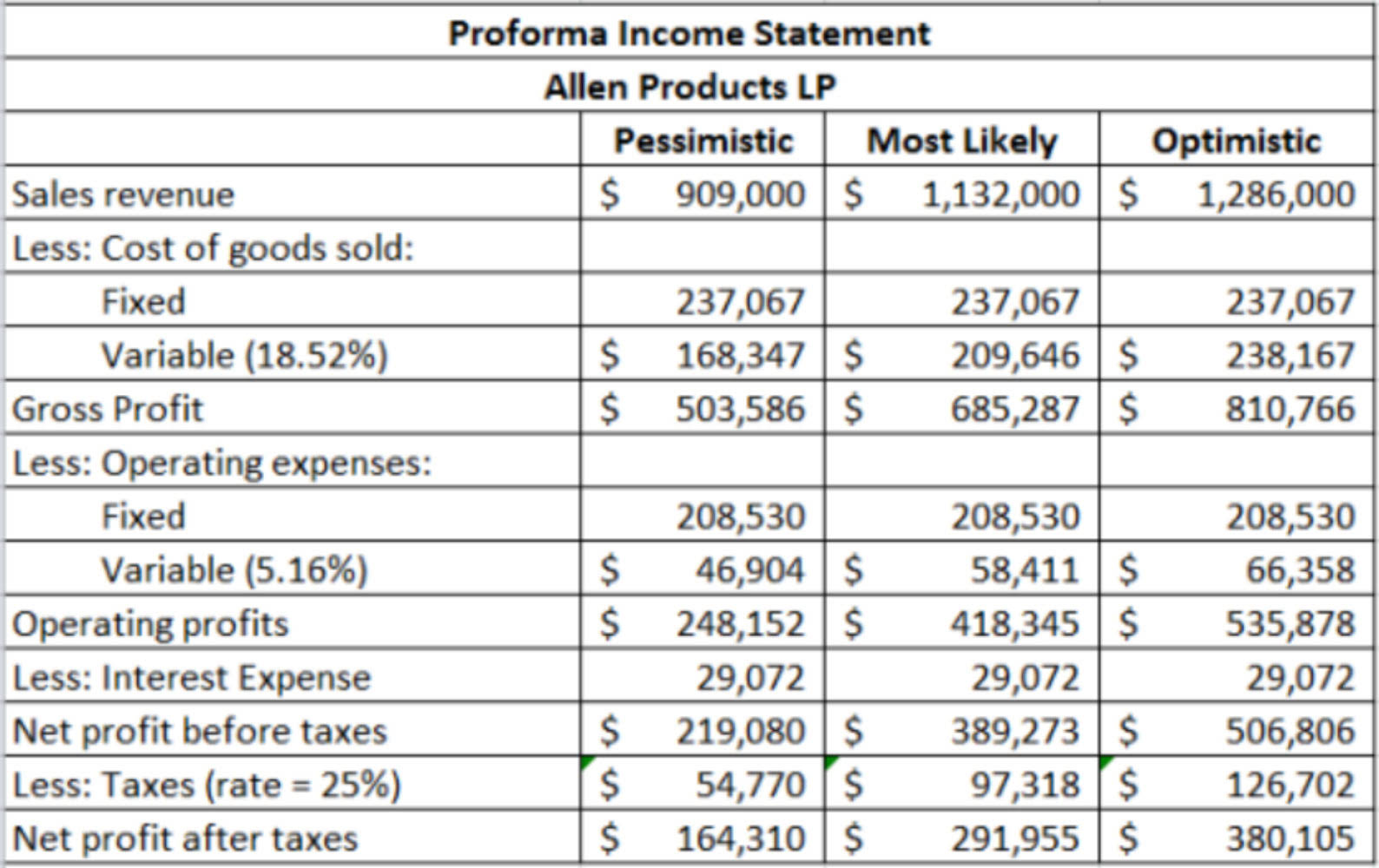

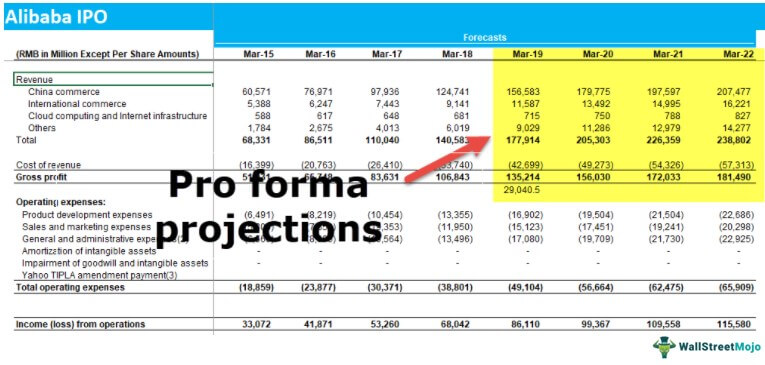

Pro forma financial statements definition. Pro forma financial statements essentially forecast the future. Analyzing the definition of key term often provides more insight a. These statements are used to present a view of corporate results to outsiders perhaps as part of an investment or lending proposal.

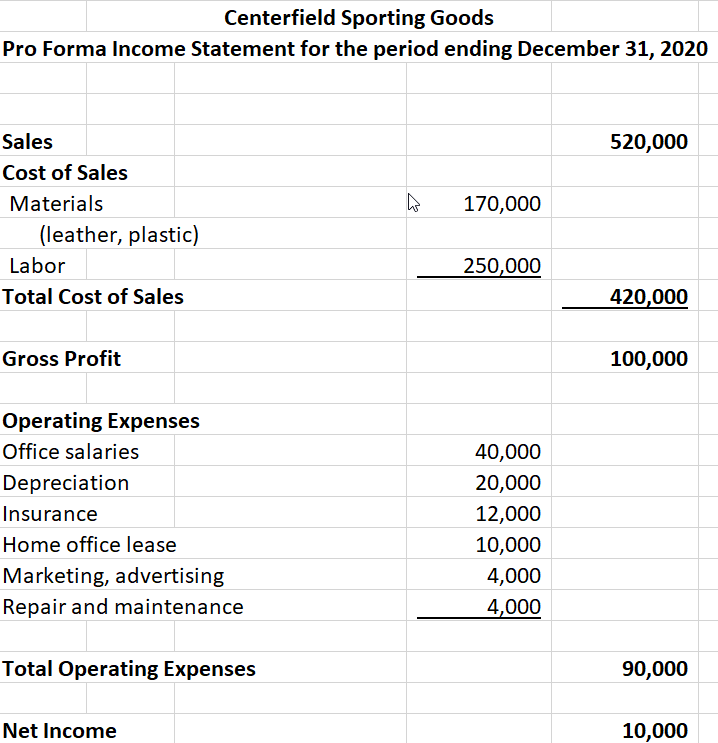

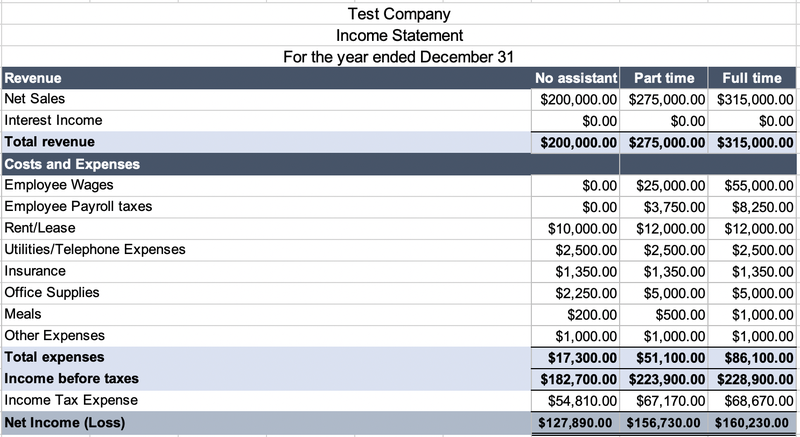

Pro forma financial statements are preliminary financials that show the effects of proposed transactions as if they actually occurred. Pro forma financial statements are a great tool that can assist anyone trying to predict the financial results of a certain action make big business decisions and plan corporate budgets. Pro Forma Financial Statements means the unaudited pro forma statement of financial position for the Resulting Issuer as at July 31 2018 to give effect to the Business Combination as if it had taken place as of July 31 2018 which is attached to this Listing Statement as Schedule E.

A pro forma financial statement offers projections of what management expects to happen under a particular set of circumstances and assumptions. When it comes to accounting pro forma statements are financial reports for your business based on hypothetical scenarios. Pro Forma Financial Statement.

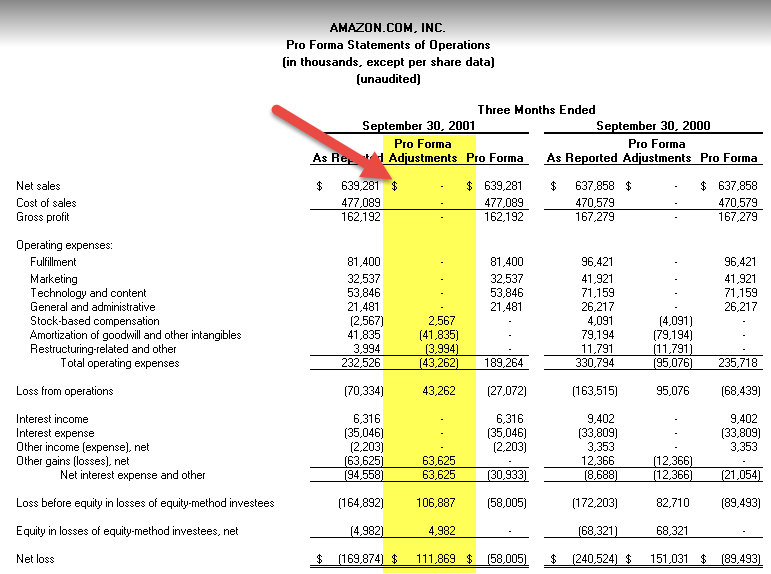

Sample 1 Sample 2 Sample 3. According to Merriam-Webster pro forma means. The pro forma accounting is a statement of the companys financial activities while excluding unusual and nonrecurring transactions when stating how much money the company actually made.

Standard financial statements are based on a companys historical performance. The pro forma or projected financial statements are the heart of the financial section of a business plan. Standard accounting statements like the balance sheet look at historical financial information but pro forma documents look forward to help you predict future income through different types of accounting statements.

Proforma financial statements are the projected or forecasting financial statements prepared by the company using a certain driver conditions form or factors to projected the accounts balance or transactions of the proforma financial statements. A pro forma income statement is a financial statement that uses the pro forma calculation method mainly to draw potential investors focus to specific figures when a company issues an earnings. In other words these are mock-up financials that are used by management to estimate what the company performance would look like if proposed events actually happened in the future.

/pro-forma-invoice--1053078376-3fb3269f97f84b93832c203f105ac972.jpg)