Fantastic Icici Bank Financial Ratios

Transcript for Analyst Call held on July 24 2021.

Icici bank financial ratios. Total Debt Equity x. Operational Financial Ratios. As we saw in the above tables and graphs that in current ratio quick ratio credit deposit ratio and Cash deposit ratio the ICICI bank performance is better and in case of earning per share the ICICI bank increasing continuously while HDFC bank earnings per share goes down in the last year.

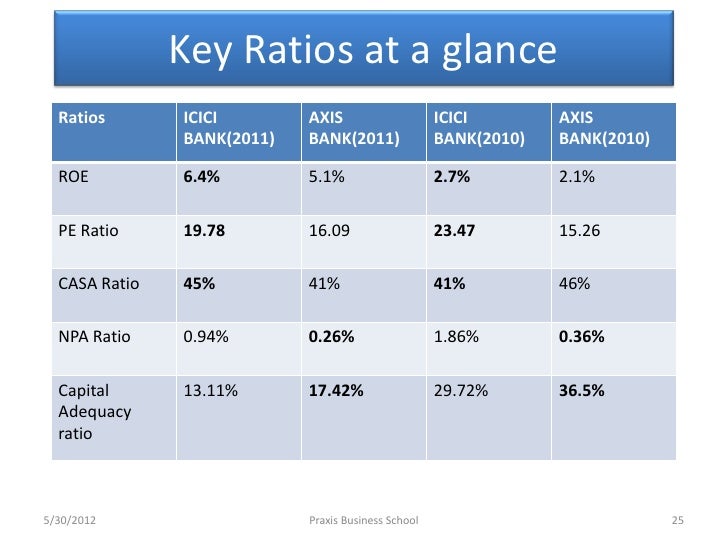

Adjusted EPS Rs 1225. An Info-graphic from ICICI Bank on 5 financial ratios. Presents the key ratios its comparison with the sector peers and 5 years of Balance Sheet.

A high leverage ratio means that the company is using debt and other liabilities to finance its assets. Earnings Per Share Rs 2658. The Balance Sheet Page of ICICI Bank Ltd.

PE RatioTTM The Price to Earnings ratio is the ratio of companys current share price to its earnings per share. ICICI Banks b2 branchfree banking was adjudged Best E-Banking Project Implementation Award 2008 by The Asian Banker on May 11 2009 at the China World Hotel in Beijing. ICICI Bank bags the Best bank in SME financing Private Sector at the Dun Bradstreet Banking awards 2009.

Loans Deposits x 033. Basic EPS Rs 2401. Investor Presentation on Performance Review Q1-2022.

Operational. Dividend Per ShareRs 200 000 100 150 250 500. Download ICICI Bank Key Financial Ratios ICICI Bank Financial Statement Accounts.