Outstanding Traditional Income Statement Mcgraw Hill

Net Income Before Taxes.

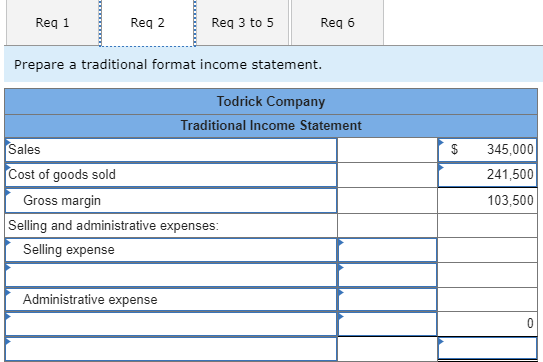

Traditional income statement mcgraw hill. The traditional income statement separates expenses by function emphasizing the distinction between production and administrative and selling expenses. Gain Loss on Sale of Assets----Other Net. This video explains the single step income statement both the elements that make up the statement as well as the format of the statement.

Showing fixed costs on a per unit basis on the income statement might mislead management into thinking that the fixed costs behave in the same way as. In simple words this format expresses the revenue. We have reviewed the accompanying consolidated balance sheet of The McGraw-Hill Companies Inc as of March 31 2004 and the related consolidated statements of income for the three-month periods ended March 31 2004 and 2003 and the consolidated statements of cash flows for.

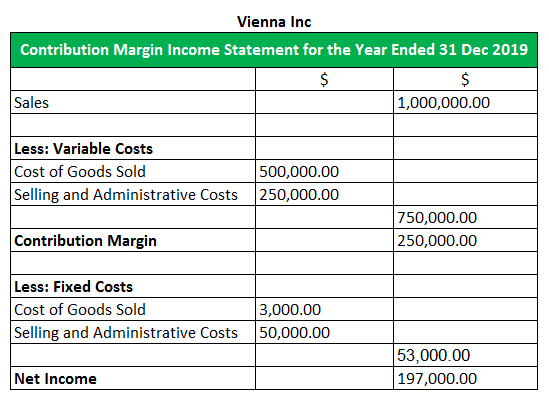

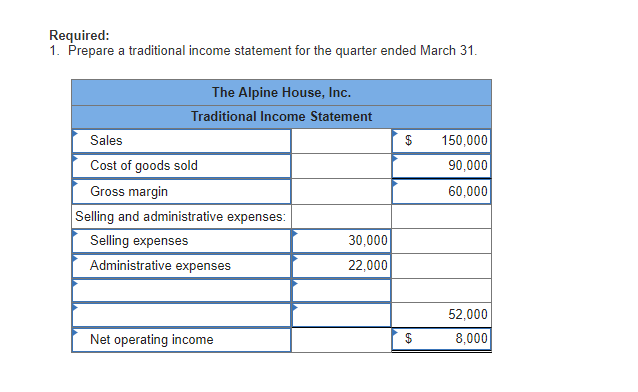

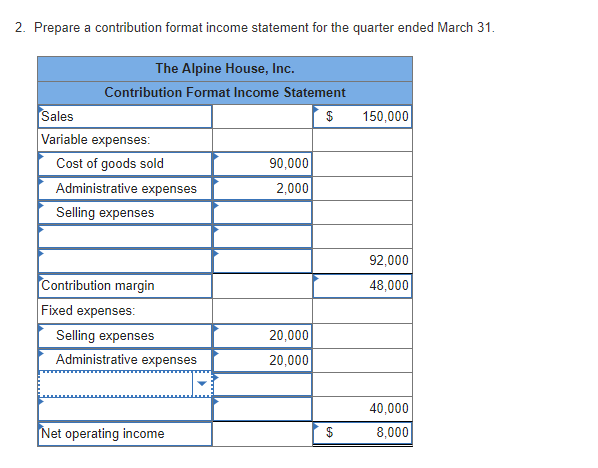

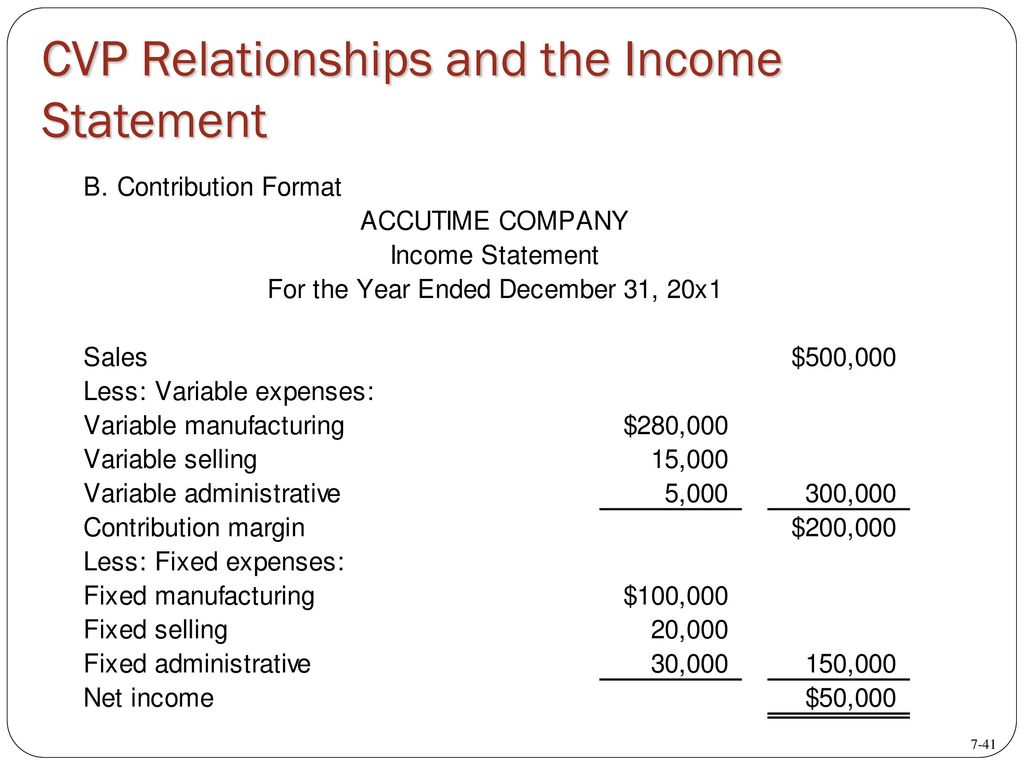

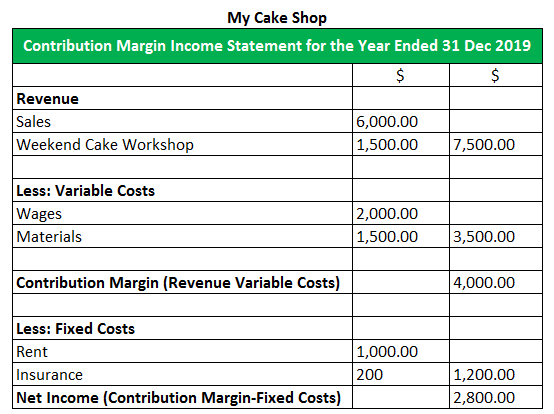

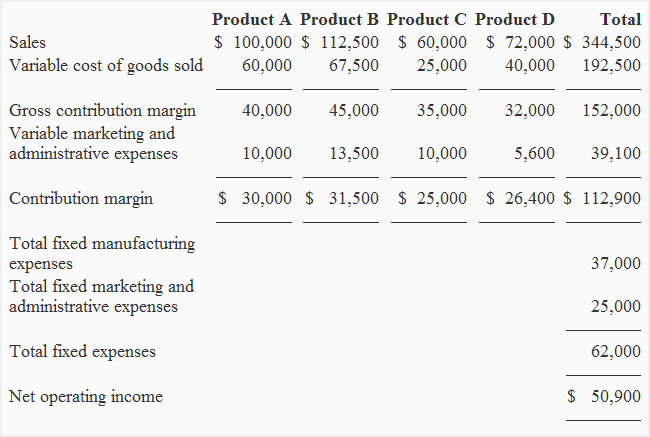

The Company Assembled The Information Shown Below For The Quarter Ended March 31. Get the detailed income statement for McGraw-Hill Education MHED. It shows the revenue generated after deducting all variable and fixed expenses separately.

Exercise 1-15 Traditional And Contribution Format Income Statements LO1-6 The Alpine House Inc S A Large Reta Er Of Snow Skis. Traditional Income Statement For the Month Ended November 30 Sales 150000 Cost of goods sold 90000 Gross margin 60000 Selling and administrative expenses. View as YoY growth or as of revenue.

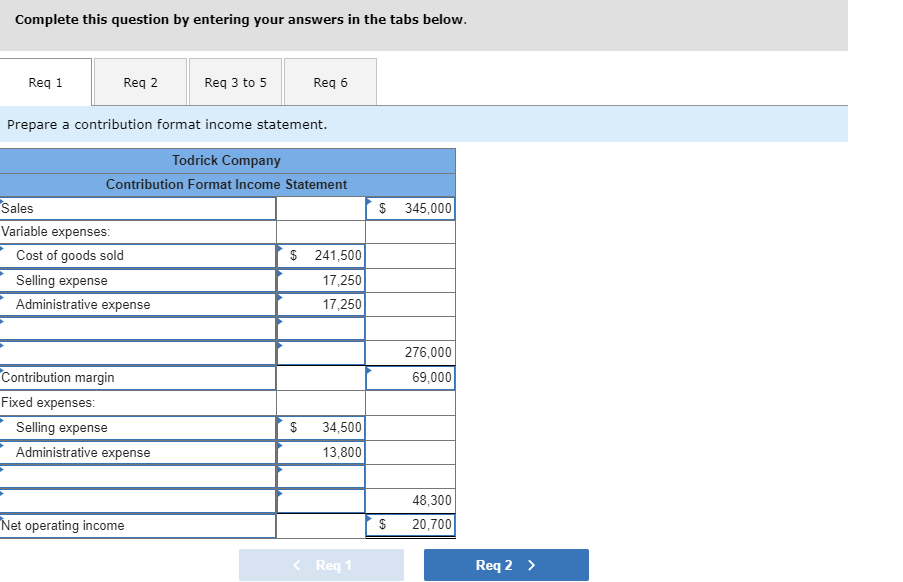

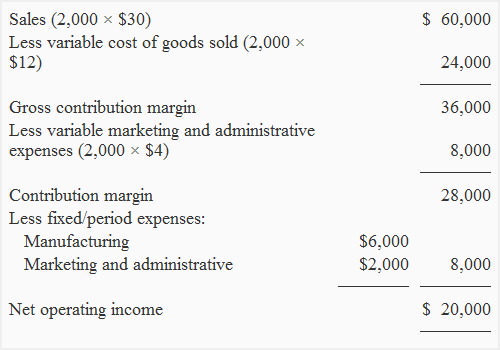

Solution for All applicable exercises are available with McGraw-Hills Connect Accounting EXERCISE 5-1 Preparing a Contribution Format Income Statement LO5-1. Financial Statement Analysis McGraw Hill Higher Education. A traditional income statement employs absorption costing to arrive at a profit or loss figure.

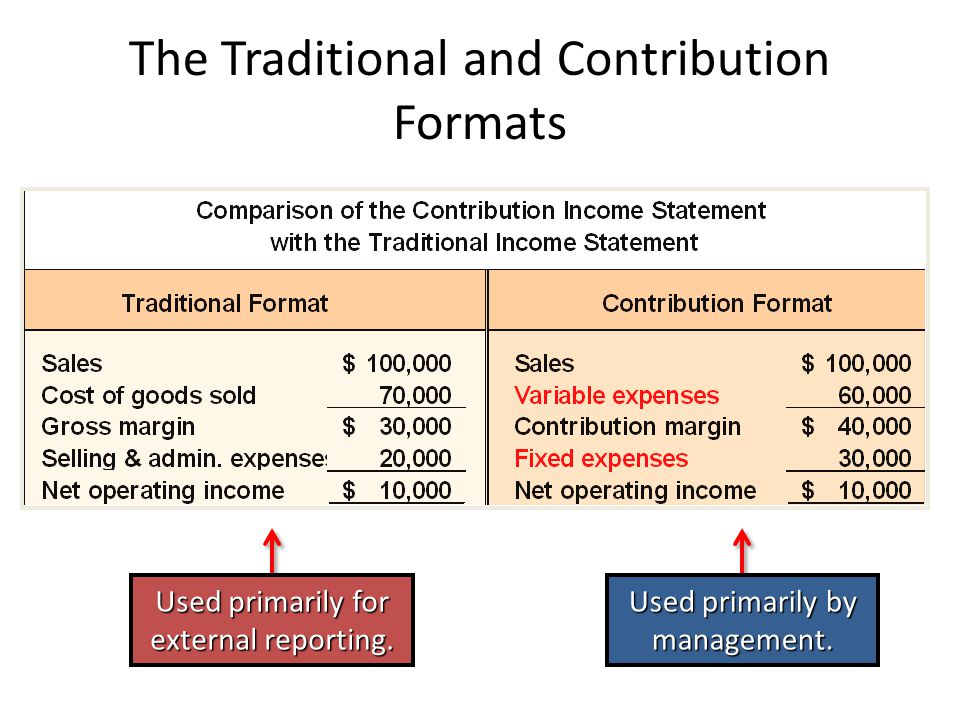

The difference between a traditional format income statement and a contribution format income statement is. It is a special format of the income statement that segregates the variable and fixed expenses involved in running a business. That the traditional format organizes costs into cost of goods sold and selling and administrative expenses while the contribution format organizes costs into variable and fixed costs.