Nice Provision For Doubtful Debts In Cash Flow Statement

It is similar to the allowance for doubtful accounts.

Provision for doubtful debts in cash flow statement. What is the treatment for bad debts written off against provision for bad debts in cash flow statement. Credit Bad Debts by the same amount. When increase then expense deducted from profit and when decrease then income added in profits.

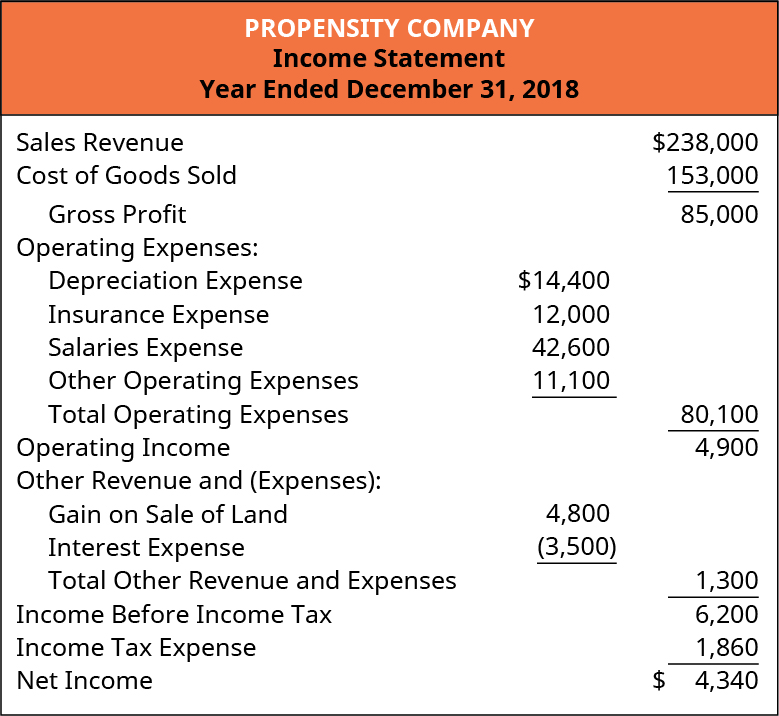

From the net income line on the income statement. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. Net cash flow or the total resultant change in cash and cash equivalents is calculated using either the direct or indirect method.

Assuming that earlier in Quarter 1 provision for doubtful debts of 100000 is created hence reducing corresponding the profit by the same amount. Cash Flow Statement is an important chapter in Class 12 as it provides very strong understanding about this topic. It is identical to the allowance for doubtful accounts.

The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the debtors. That gives you a more realistic picture of your businesss income than assuming every receivable will be paid in full. Thus Bad Debts now has a zero balance and Provision for Bad Debts has a lower balance than before.

Bad debts are thus included as an expense in the income statement but not included as a line item in the cash flow statement direct method. The bad debt provision reduces your accounts receivable to allow for customers who dont pay up. For calculating cash flow from operating activitiesprovision for doubtful debts is _____ the profit made during the year added todeducted from.

Debit the account called Provision for Bad Debts for the appropriate amount. The sources of information appearing in the table can be used to prepare a cash flow statement. It is nothing but a loss to the company which needs to be charged to the profit and loss account in the form of provision.