Looking Good Year To Date Profit And Loss Statement Balance Sheet Format As Per Indian Accounting Standards

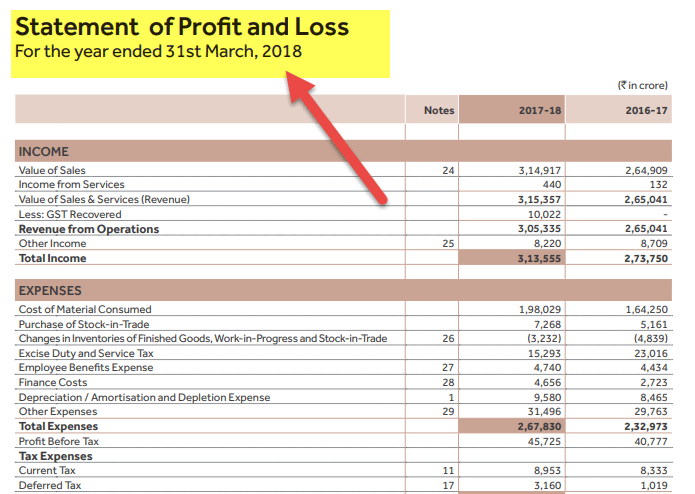

Profit and Loss Account provides the vital link between the balance.

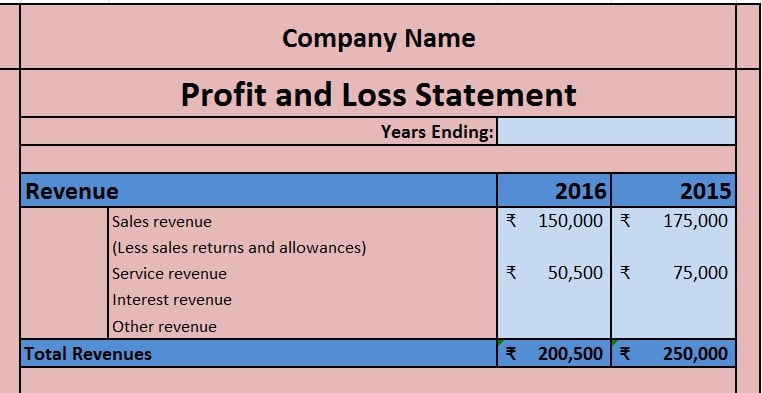

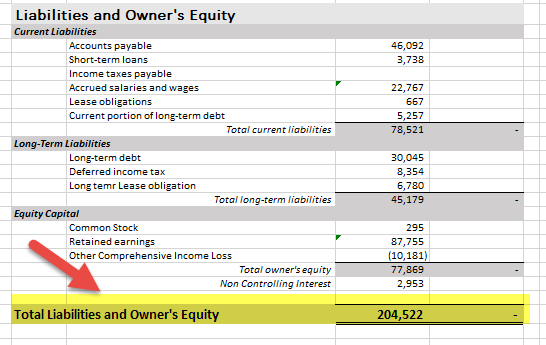

Year to date profit and loss statement balance sheet format as per indian accounting standards. Balance Sheet vs Profit and Loss The profit and loss statements of an organization and the balance sheet has to be prepared to reach a very clear picture of the providers fiscal stability. A profit and loss PL statement. For instance you may compile a balance sheet after the fiscal quarter.

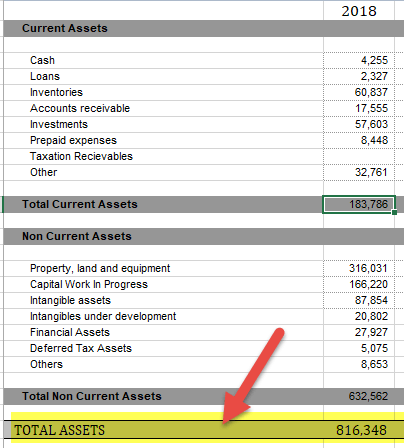

Each individual company that desires to survive and become worthwhile demands to maintain monitor of its earnings and costs. The PL statement is one of the three most important financial statements for business owners along with the balance sheet and the cash flow statement or statement of cash flows. Balance sheet shows the position of assets and liabilities of a business entity as on a particular date.

Capital is the first item shown on the liability side of the balance sheet of an organization. A balance sheet provides both investors and creditors with a snapshot as to how effectively a companys management uses its resources. Read this article to learn about the following two formats ie Format A for Balance Sheet and Format B for Profit and Loss Account.

These standards prohibit firms from engaging in unethical business activities and enable for a more accurate comparison of financial reports to. A PL is also commonly referred to by other terms such as the income statement statement of operations financial results statement and earnings statement. Brief on amendments to Schedule III Division I to the Act for Companies whose financial statements are required to comply with the Accounting Standards.

The Income Statement provides a complete summary of revenue generated and expenses incurred by a company which in turn gives an insight into a companys financials. However cash flow statement was earlier also required to be included in view of the Accounting Standard 3 Cash Flow Statements. Capital is a liability for the business as the business has to pay.

There are some contrasting difference in the style of presentation of Statement of Financial Position or Balance Sheet as per Indian company law and IFRSs. Profit and Loss Account is the first financial statement prepared before preparing the Balance Sheet. Both the profit and loss statement and balance sheet are important financial statements - but each has a different function for business owners and investors.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)