Simple Deferred Tax Disclosure Note

B Impairment of financial assets available-for-sale.

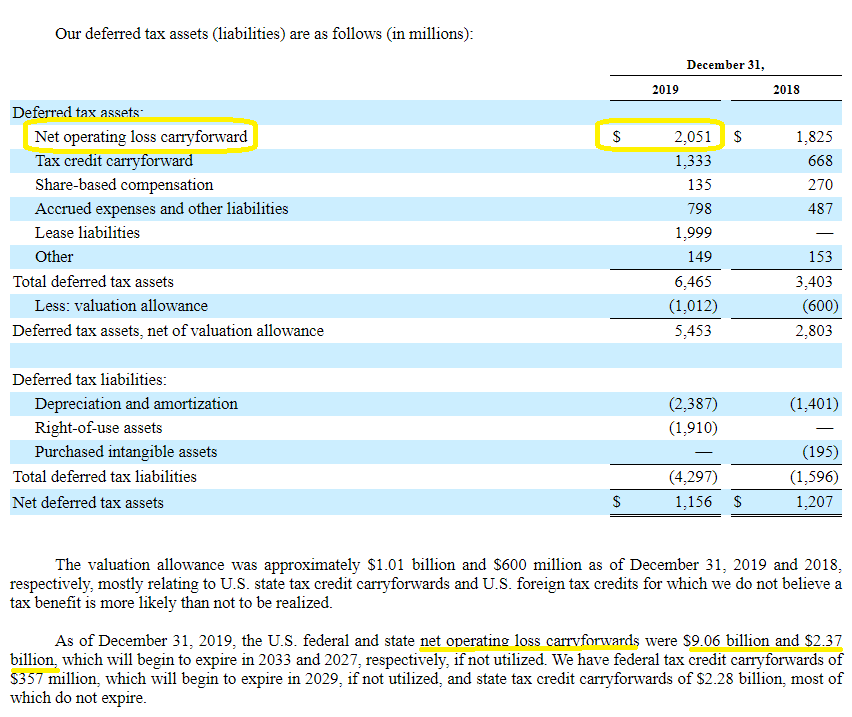

Deferred tax disclosure note. And OCI and Note 10 apply only if the parent. Deferred Tax Asset Attributable to Excess Stock Option Deductions Sample Disclosure 1. Which a deferred tax asset amounting to 250000 was recognised based on the anticipated future use of tax losses carried forward by those entities.

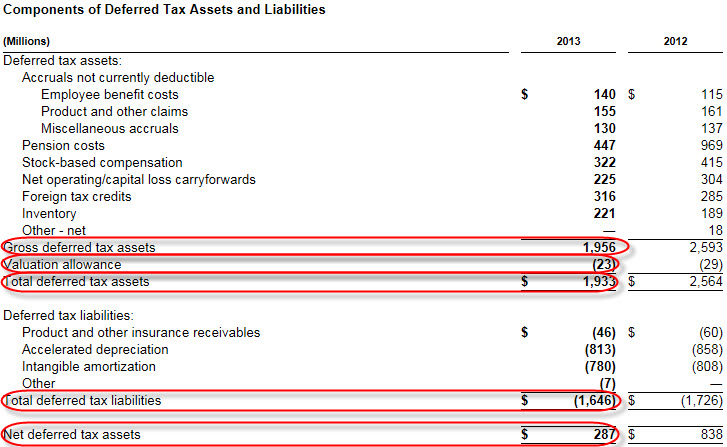

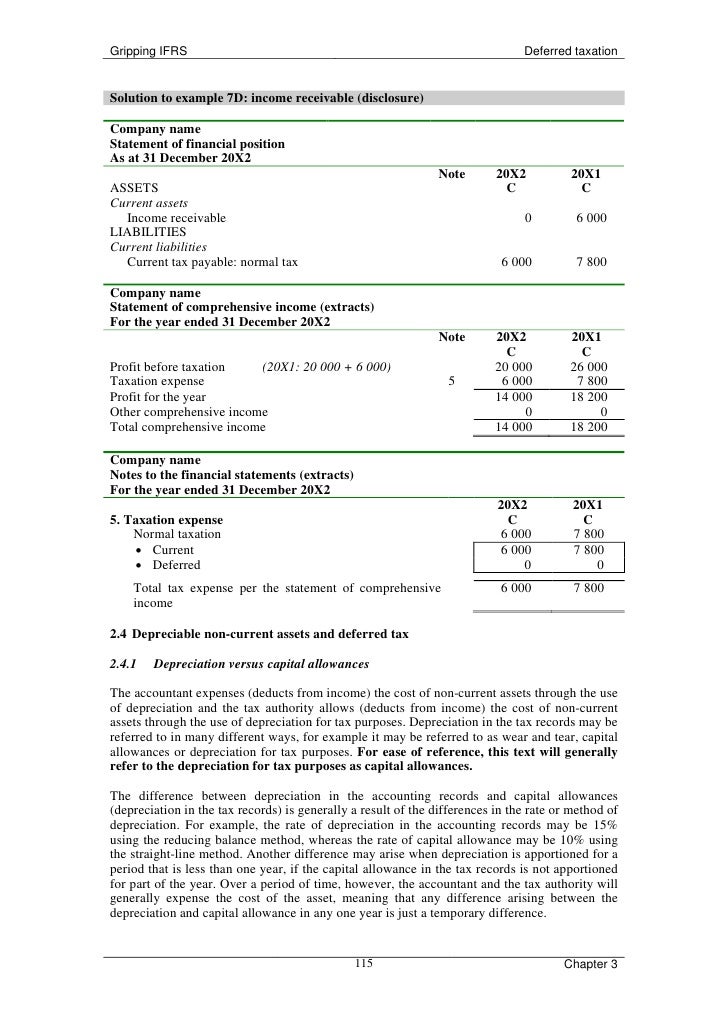

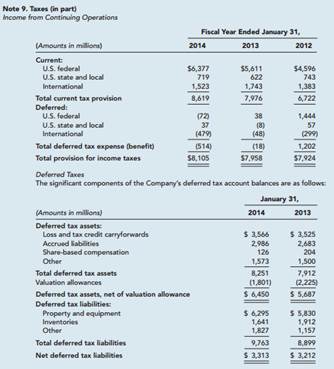

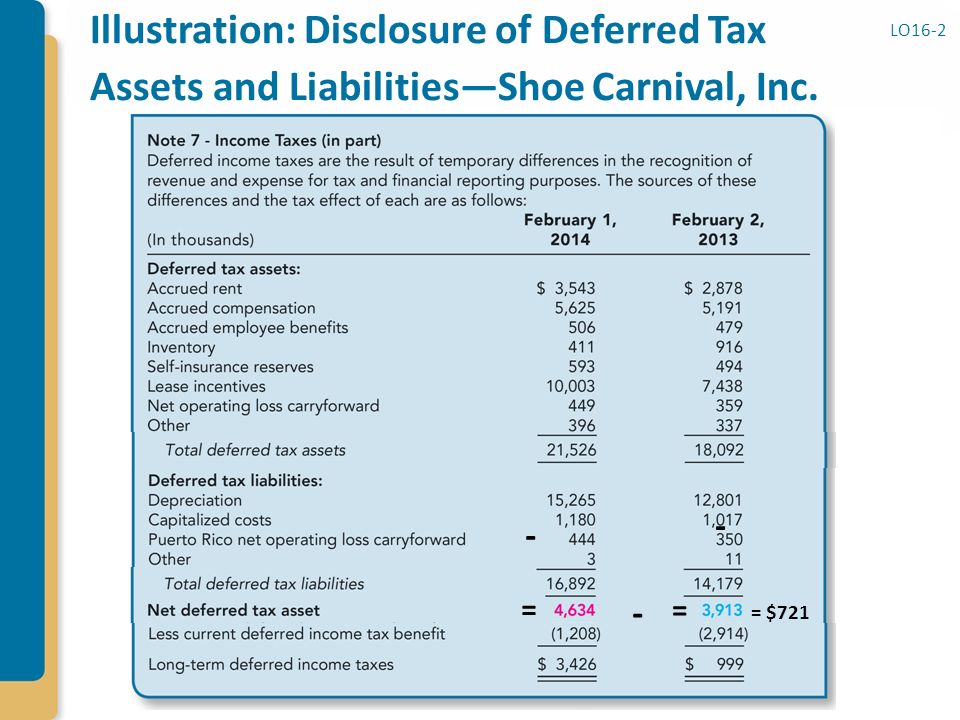

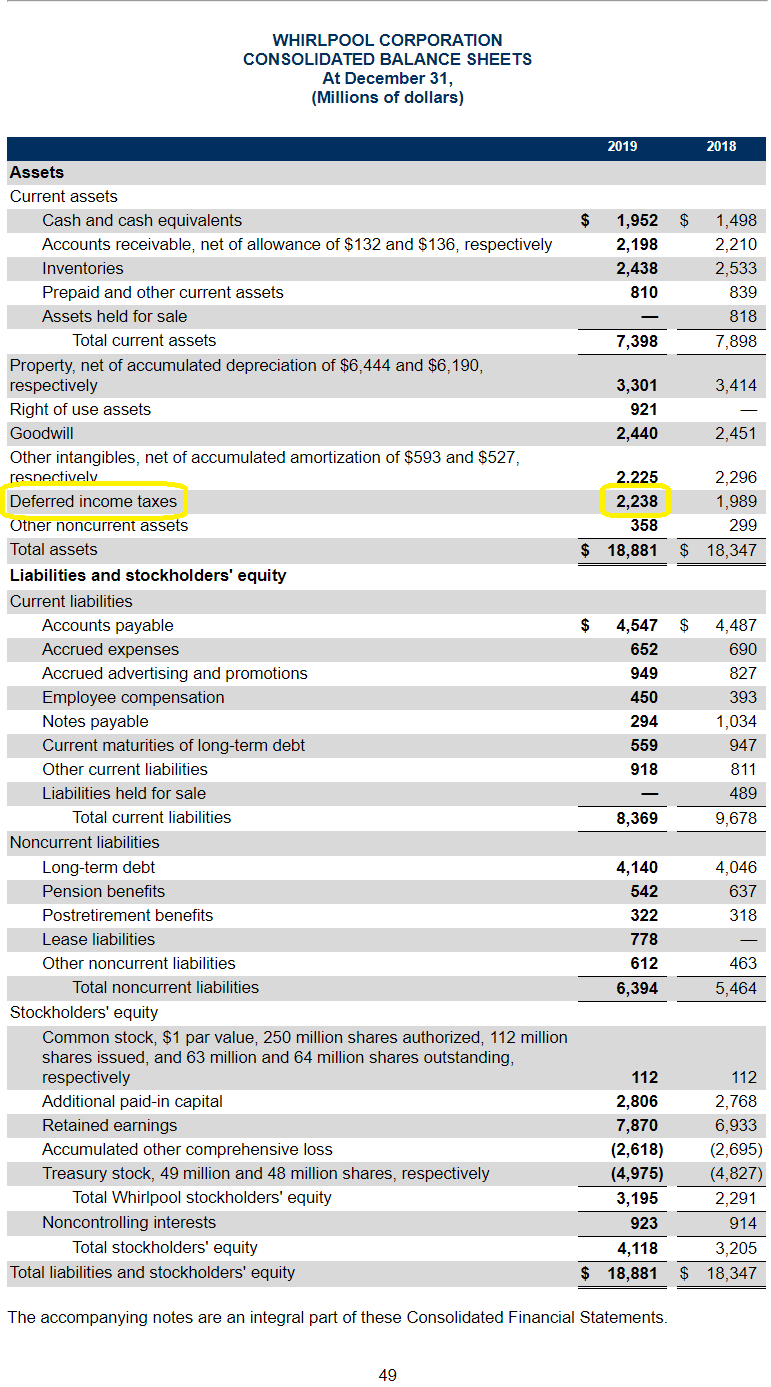

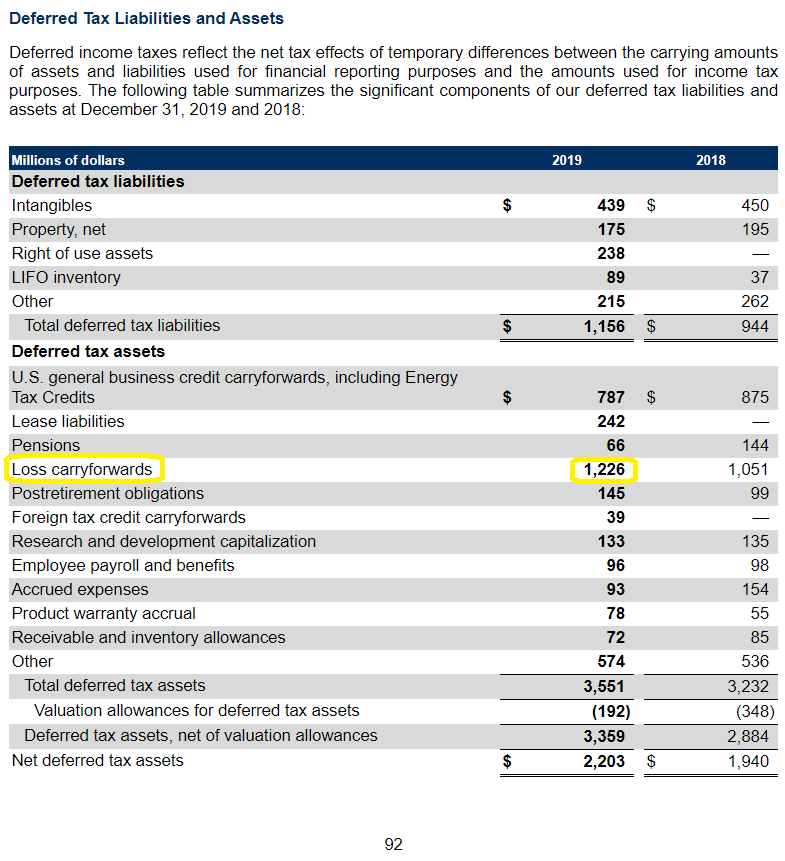

Guidance notes are provided where additional matters may need to be considered in relation to a particular disclosure. Deferred tax is recognised on differences between the carrying amounts of assets and liabilities in the financial statements and their corresponding tax bases temporary differences. Disclosures can provide detailed information relating to the derivation of deferred tax assets and liabilities.

Properties used by Group entities 2. Property plant and equipment - Difference between carrying value and tax basexxxxx xxxxx. Please refer to Appendix 1 Example 1 for other disclosure examples.

As a result of certain realization requirements of ASC 718 the table of deferred tax assets and liabilities does not include certain deferred tax assets as of December 31 20X3 and. Deferred tax is the amount of tax payable or recoverable in future reporting periods as a result of transactions or events recognised in current or previous periods accounts. The carrying amount of a liability is lower than its tax base.

Continue reading Sample Disclosure Note On Unrecognised Deferred Tax Liability 21 December 2010 Unrecognised Deferred Tax Liability The Company has not recognised deferred tax liability amounted to approximately RM10345000 as at the end of the financial year relating to temporary differences arising from the difference between the carrying values of property plant and equipment. The tax currently payable is based on taxable profit for the year. See a simple example below.

Undiscounted provision for deferred tax. Note on unrecognised deferred tax liability 1 notes to accounts 1 notes to the accounts 35 notes to the financial statements 24 notes to the financial statments 3 notes to the financila statements 1 Oil Palm Industry 1 oil palm inventories policy 1 omission of interim dividend 1 operating lease commitments 1 operating segments 2 other income 5. Our tax charge is made up of current and deferred tax as explained in note 8.