Awesome Form 26as In Icici Net Banking

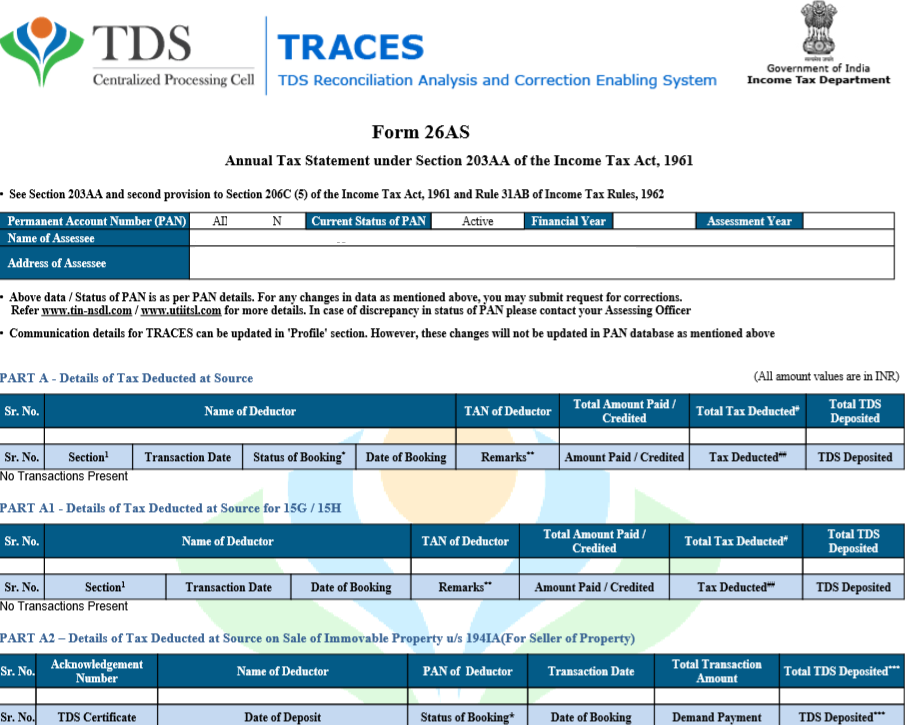

Form 26AS also provides the details of tax refunds if any received by you from the income tax department in the financial year.

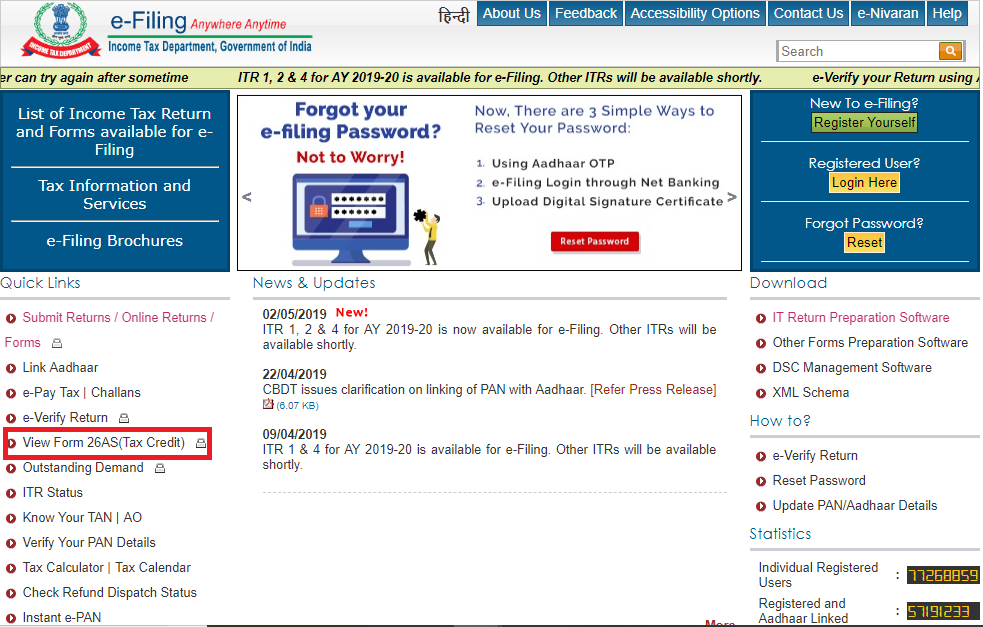

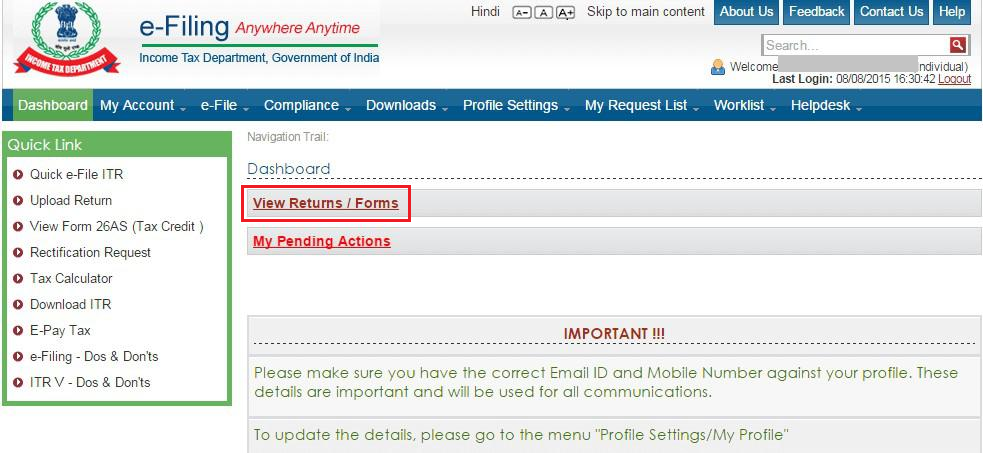

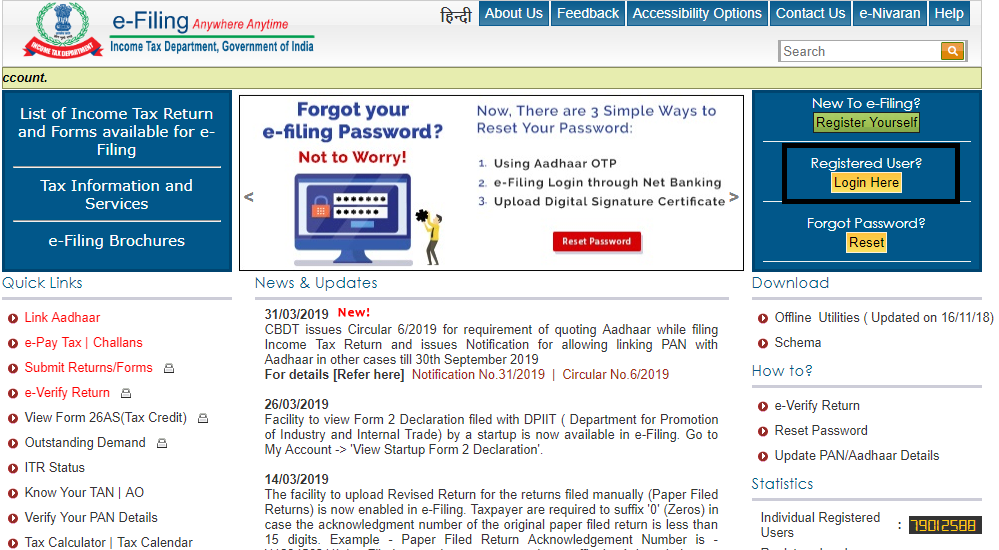

Form 26as in icici net banking. Click View Tax Credit Form 26AS Select the Assessment Year and View type HTML Text or PDF. Every bank has its own idea or system of navigation to 26AS you need to locate that. Form 26AS can be downloaded.

It contains all information about taxes that have been deducted such as TDS tax on salary professional tax TDS by banks any advance taxes or self-assessment taxes paid etc. We have provided a list below of approved banks for your convenience. This form is an annual statement indicating all the tax related information TDS TCS refunds etc connected with the PAN Card of a person.

On the TRACES website or via Net Banking Facility of authorized banks Step 1. How to Download Form 26AS. Associated with a PAN Permanent Account Number.

Apart from that it also contains information about refunds that you may have received as an individual. Is it possible to link Form 26AS in your net banking. Form 26AS also known as Annual Statement provides a consolidated record of all tax-related information such as TDS TCS and refund etc.

One of the modes through which tax payer. Form 26AS is an income tax form that is a consolidated or summarized version of an individuals taxes. Yes A lot of banks like ICICI SBI etc provide a direct link to your form 26AS through internet banking.

You can also download Form 26AS using the net banking facility of the banks mentioned above. This facility can be availed only if you have account in banks which are approved by the Income Tax Department. Go to httpsincometaxindiaefilinggovin and Login using your income tax department login password.