Beautiful Define Post Closing Trial Balance

An accounts balance refers to the total of such an account to date.

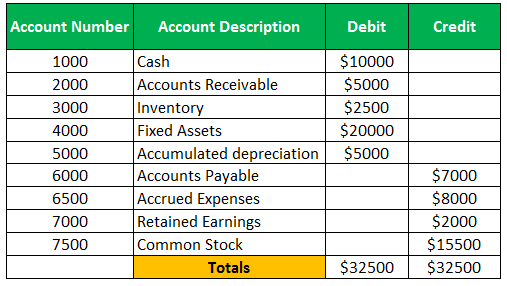

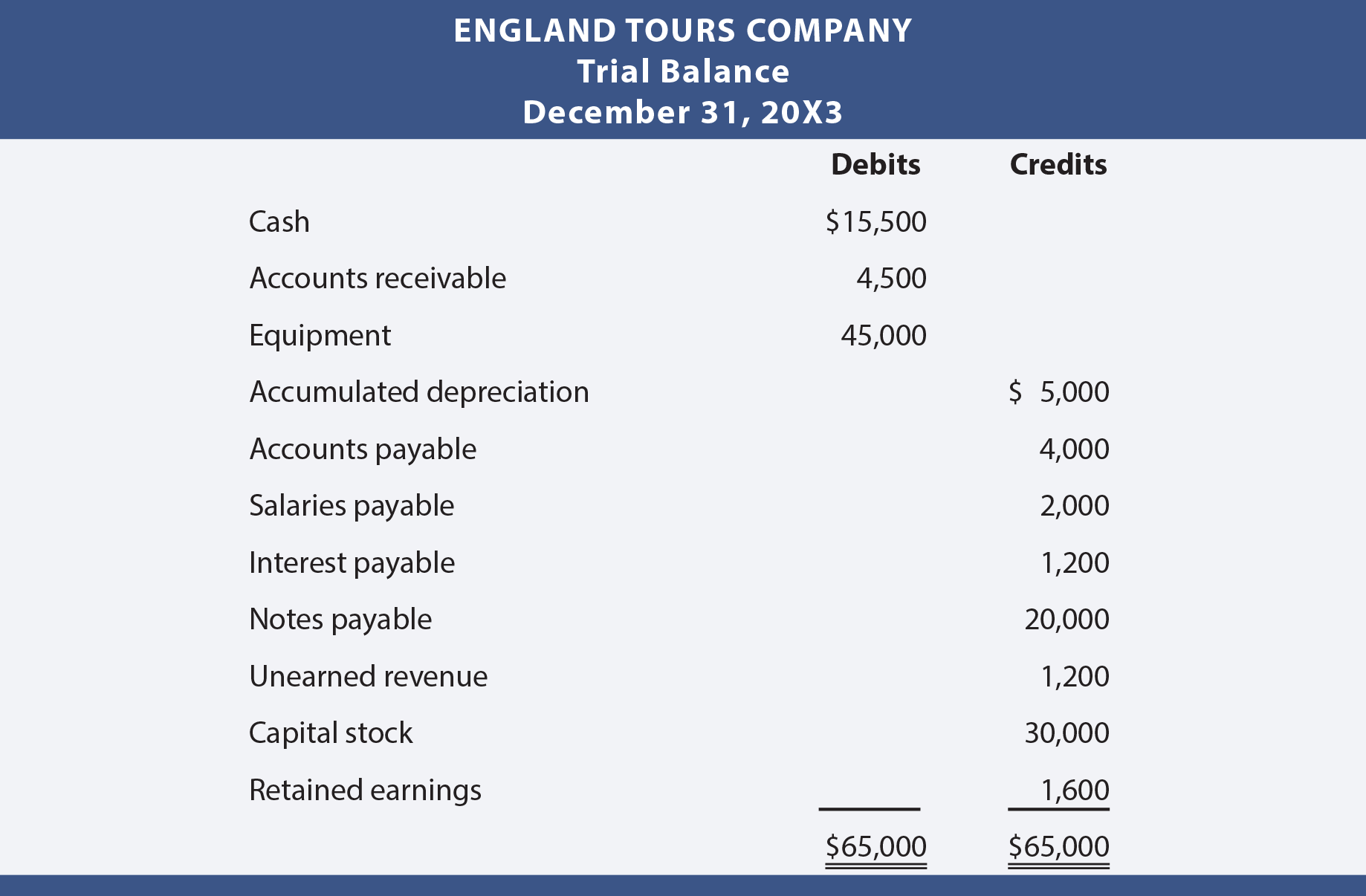

Define post closing trial balance. Explain how to add adjusted accounts to a work sheet when they did not appear on the trial balance. Trial balance is the records of the entitys closing ledgers for a specific period of time. It is important for your business to calculate the balance of each account at the end of each financial year.

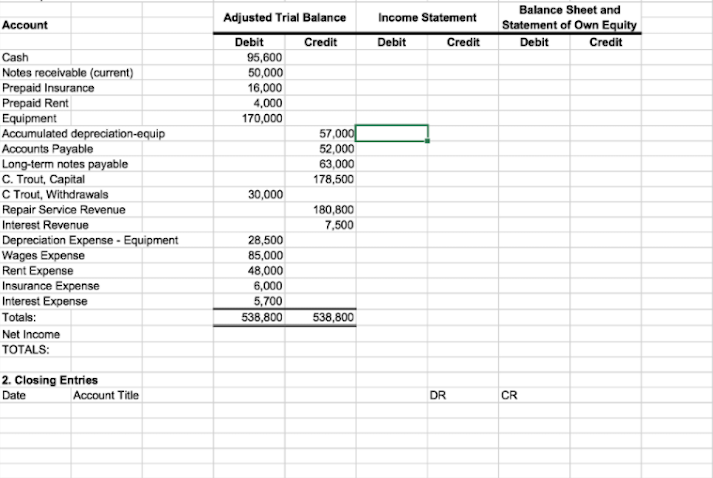

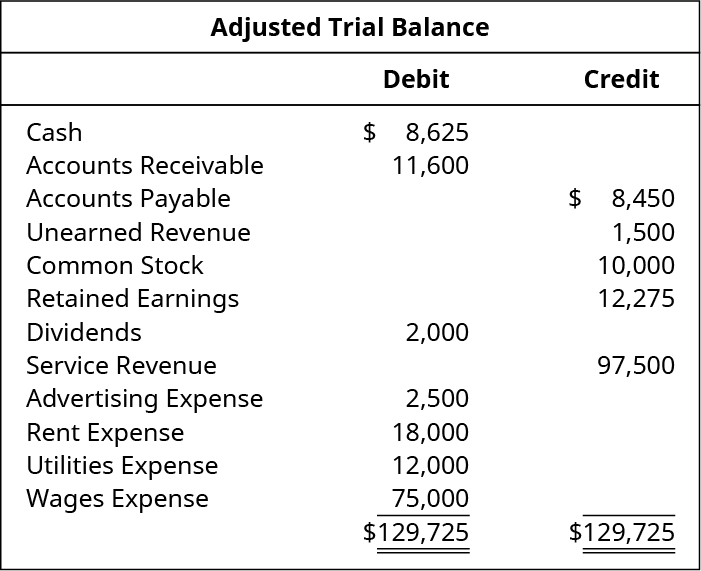

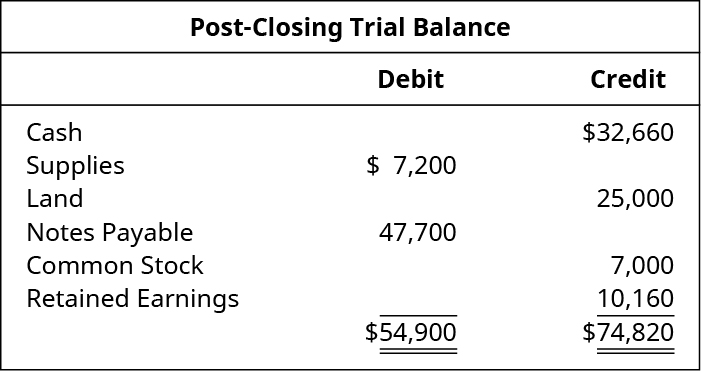

Closing Entries and Post Closing Trial Balance. A trial balance is a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal. At the end of the period the ledgers are closed and then move all of the closing balance items into trial balance.

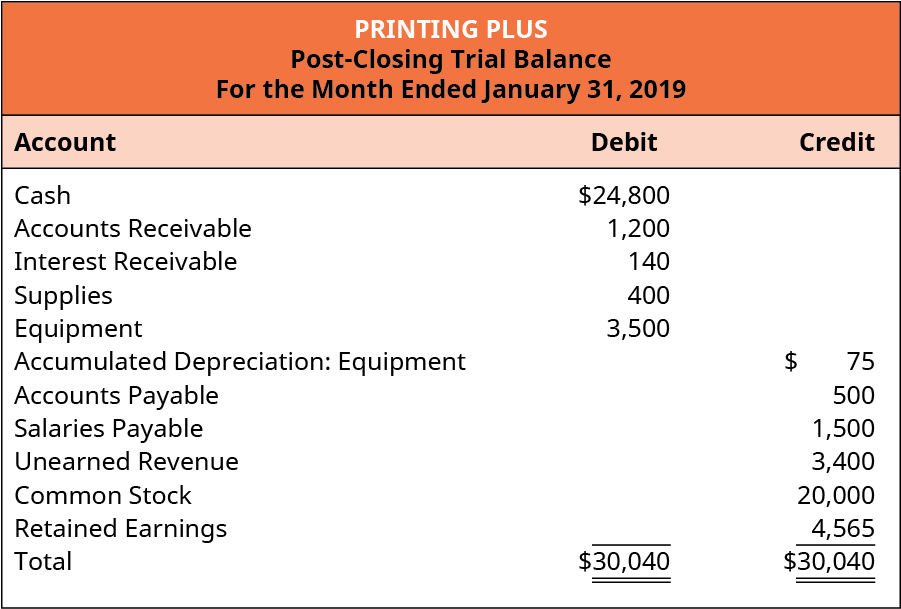

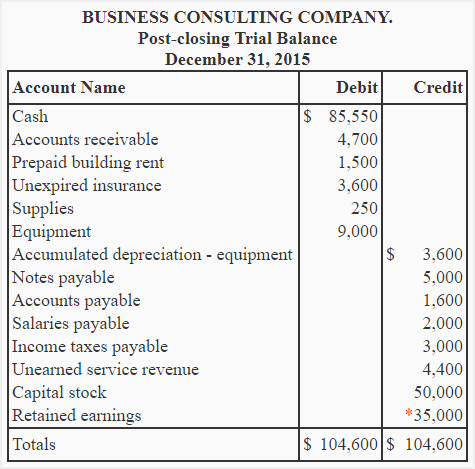

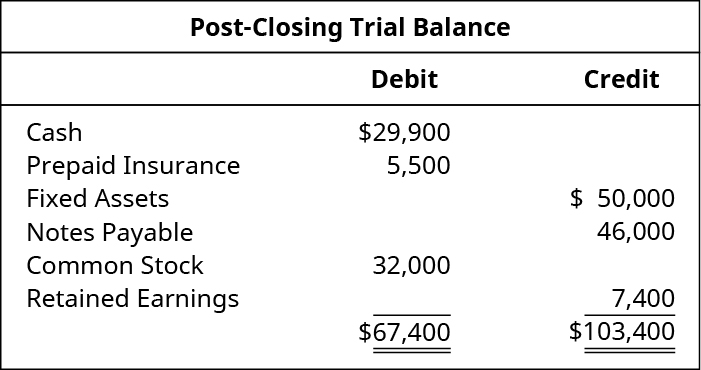

Definition of a Trial Balance A trial balance is a bookkeeping or accounting report that lists the balances in each of an organizations general ledger accounts. The post-closing trial balance is used in accounting to verify the equality of the total of debit balances and the total of credit balances which should net to zero. It is a listing of all permanent accounts and their balances after closing.

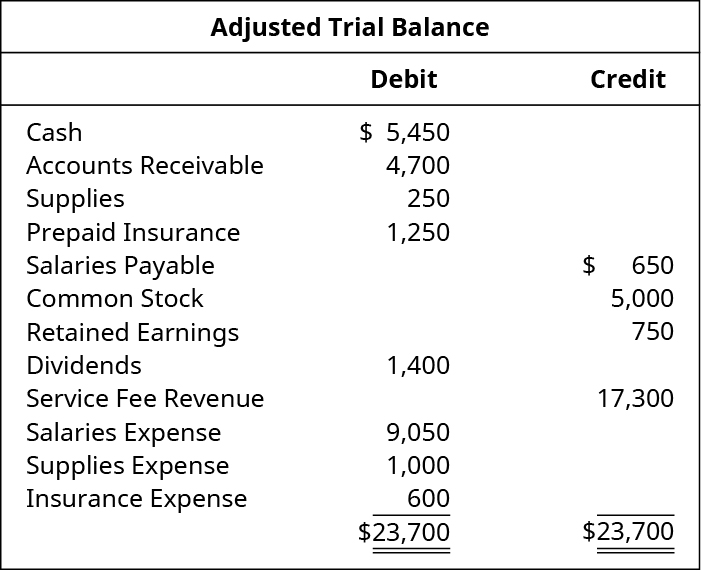

Select the statement below that describes a post-closing trial balance. Expense revenue gain dividend and withdrawal accounts to the retained earnings account the new balances of temporary accounts are zero and therefore they are. This means that the listing would consist of only the balance sheet accounts with balances.

The adjusted trial balance is typically printed and stored in the year-end book which is then archived. The zero items are not usually included. If playback doesnt begin.

The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances which should net to zero. Post closing adjusted Trial Balance Examples. The trial balance is strictly a report that is compiled from the accounting records.