Fun Healthy Balance Sheet Ratios

The ratios calculated from a companys balance sheet are used to determine its liquidity solvency and profitability.

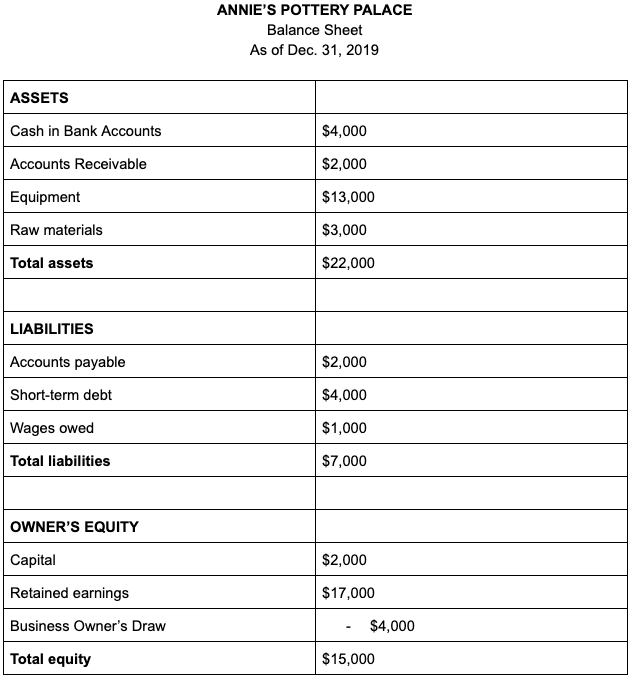

Healthy balance sheet ratios. Another fundamental gauge is the ratio of liabilities to equity. By analyzing the activity. A strong current ratio Sometimes known as the liquidity ratio the current ratio is determined by dividing the businesss current assets by its current liabilities.

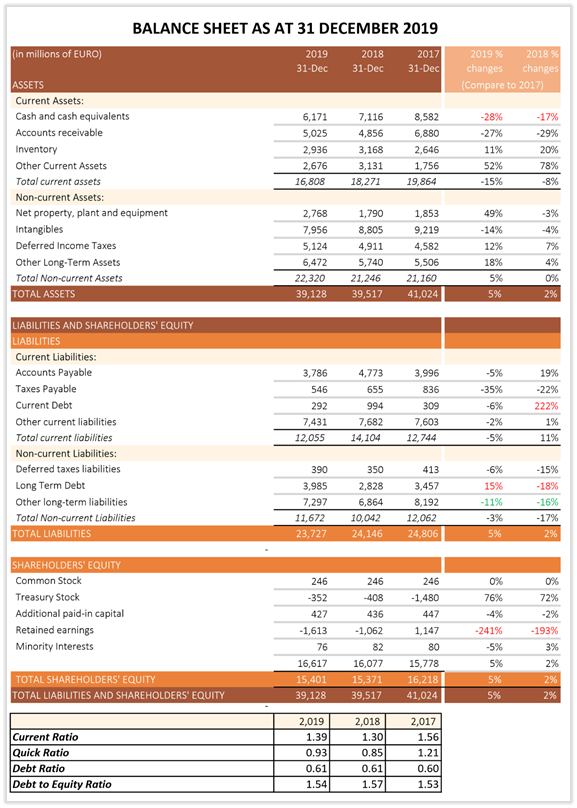

Aim for a result of 15 or higher. Useful ratios used to analyse balance sheet are current ratio debt ratio debt to equity ratio and lastly days sales outstanding ratio DSO. A Current Ratio thats greater than 1 is a good thing because it tells us that the companys Current Liabilities or short-term obligations can be paid off based on their Current Assets.

Here are a few examples of the best small business balance sheet ratios. A debt ratio of less than 1 tells us the company has more assets than debt so the lower the ratio the stronger the balance sheet. This ratio is simply calculated as follows.

In the case of our sample balance sheet. Balance sheet is a common tool used to analyse the net worth and expense management techniques of companies. A few simple key ratios can establish Balance Sheet strength.

Here are seven ratios will help you understand you current financial health better. Activity financial ratios measure how well a company is able to convert its assets in the balance sheet into cash or sales. Well using the current assets and current liabilities information presented on a balance sheet you can determine a companys current ratio.

First is the current ratio which is current assets divided by current liabilities. Various financial ratios can give a better sense of the companys liquidity as well as its ability to generate cash flow. Heres how to calculate your debt-to equity ratio from your balance sheet.