Amazing Investment In Associate In Balance Sheet

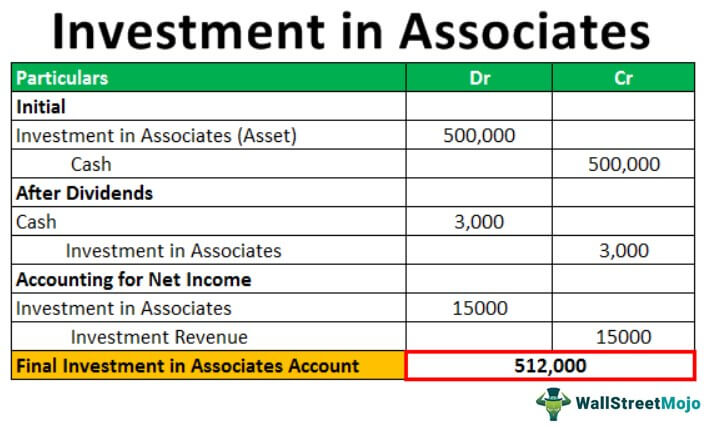

Investment in C Associate company Cost of investment 750 40 x Change in retained earnings 400 - dividend received 40 - goodwill impairment value 54 816.

Investment in associate in balance sheet. Investment in associate - equity method. The profits the associate has. It is calculated as the cost of the investment plus the parents share of post-acquisition retained profits ie.

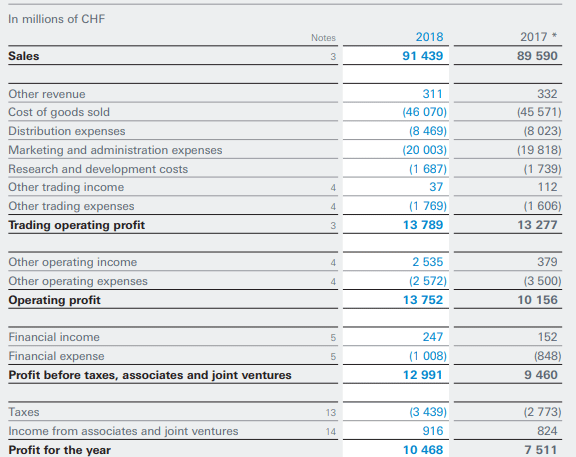

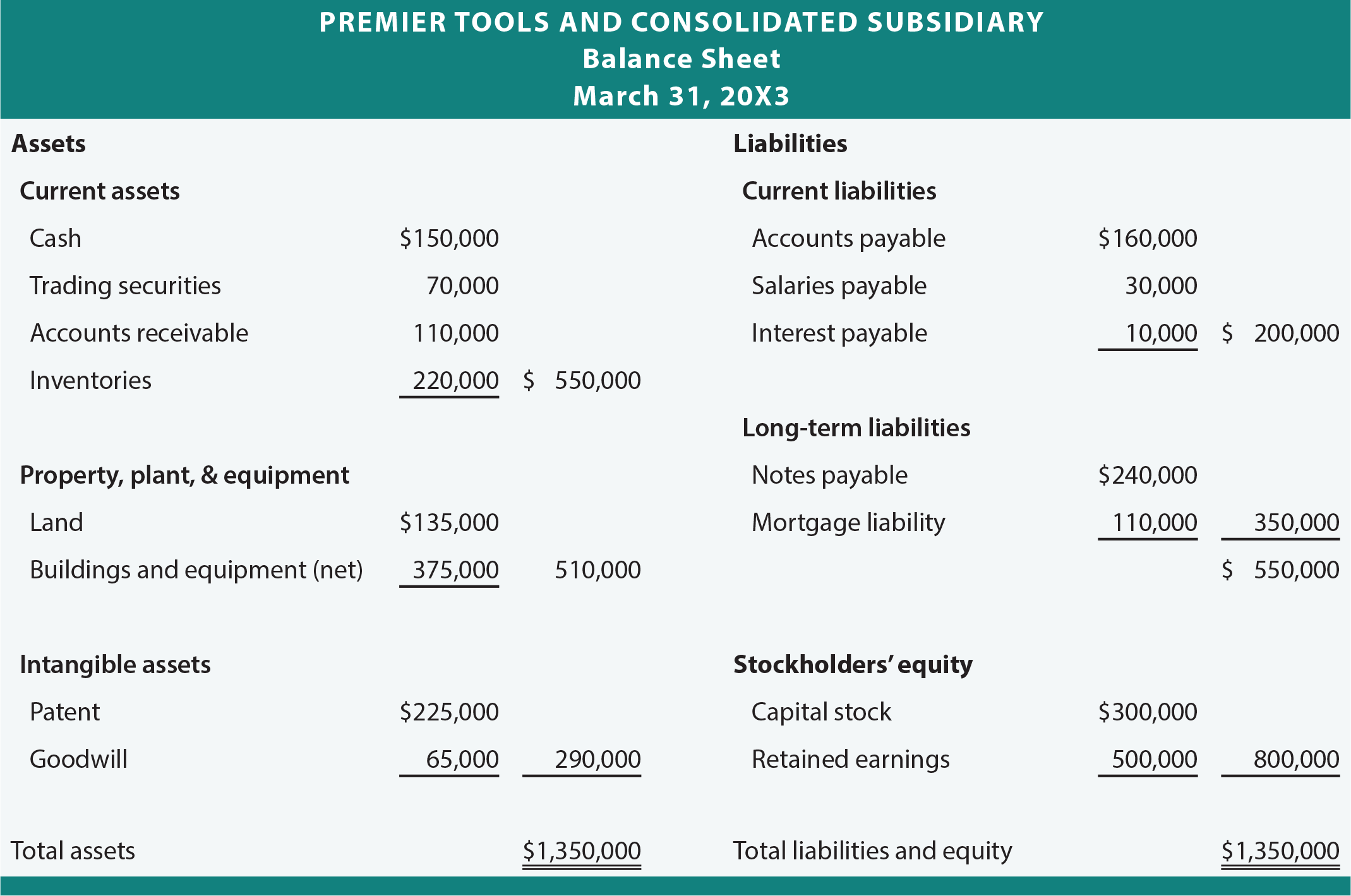

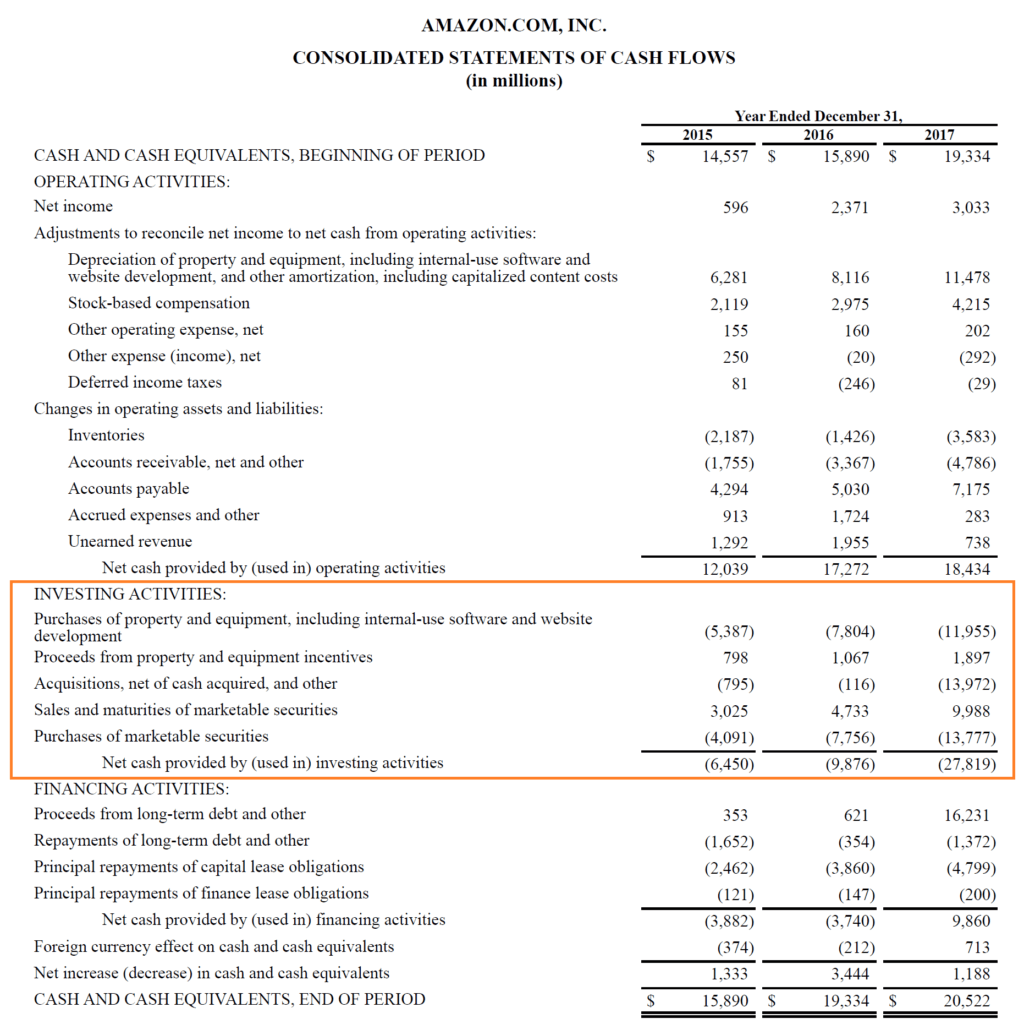

You report the quoted investments in the balance. It is recognised that the traditional manner of accounting for investments in associates- recognising the investment in the balance sheet at cost subject to reduction for any other than temporary diminution in the value of the investment and recognising the income from investment on the basis of distributions received from the associate may not be an adequate measure of the investors stake in. An associate is an entity over which an investor has significant influence being the power to participate in the financial and operating policy decisions of the investee but not control or joint control and investments in associates are with limited exceptions required to be accounted for using the equity method.

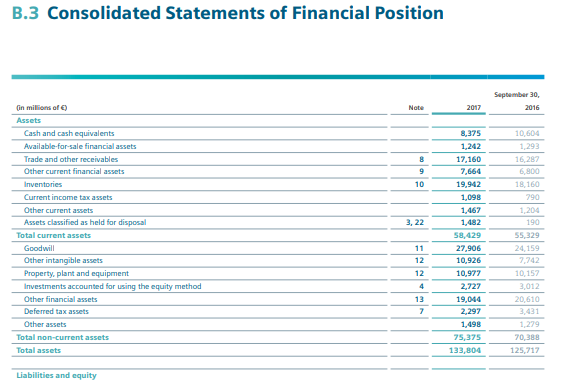

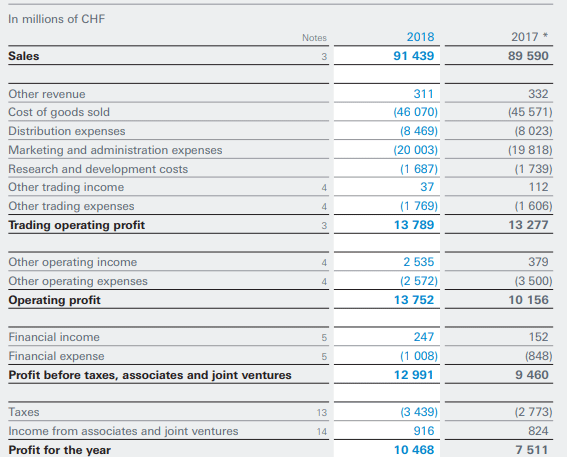

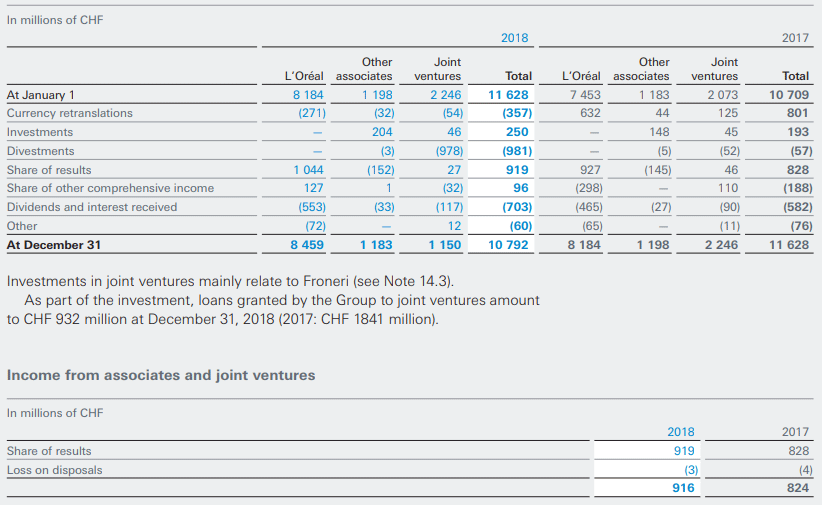

Rather the Investment in Affiliate or Equity Investment non-current asset account on the balance sheet serves as a proxy for the Company As economic interest in Company Bs assets and liabilities. It is simply booked as Dr Cash Cr Income from shares in associates PL. As at 31 December 2017 would be 149016 million 144020 million 6256 million - 1260 million.

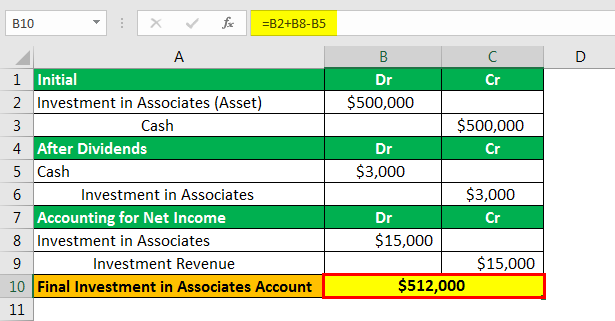

IAS 28 outlines the accounting for investments in associates. In order to account for the investment in the associate that company A has the following two things should be recorded. Dividend recieved from associate company C 100 x 40 40.

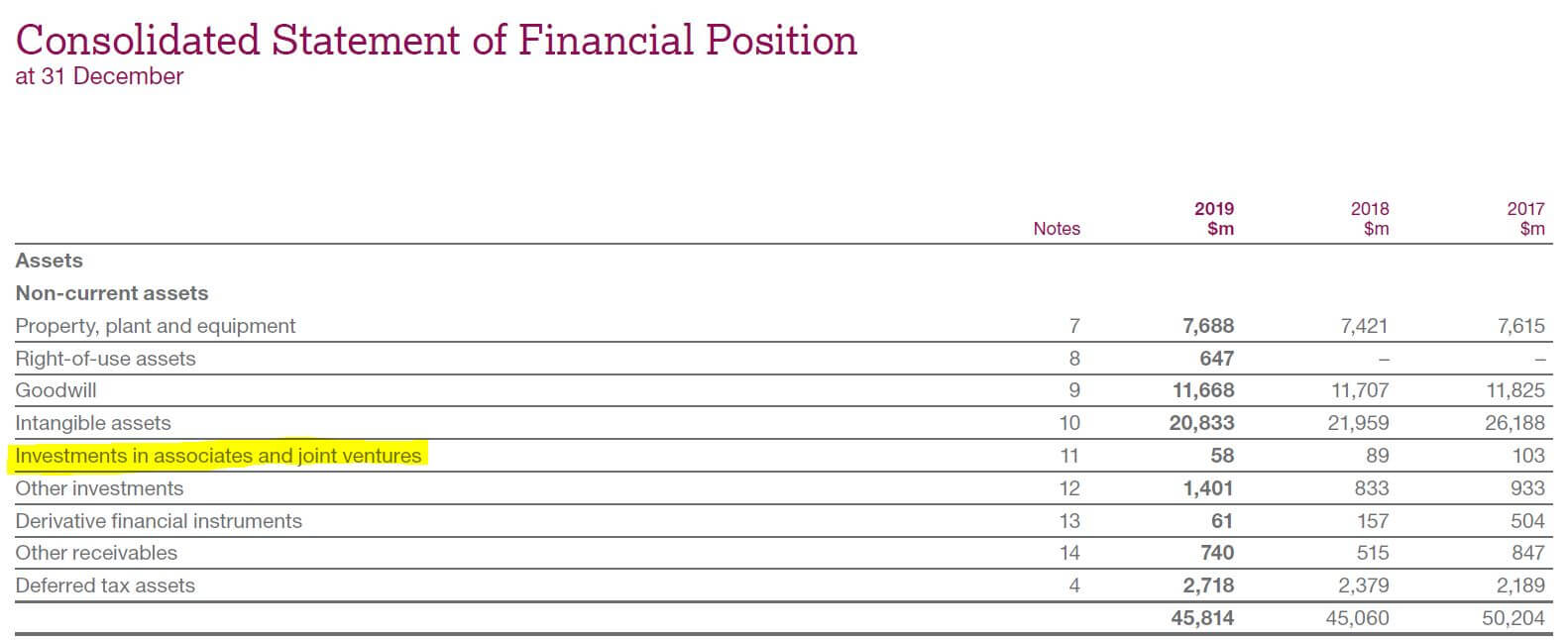

The carrying value of your investment in Apple Inc. Share of profit from associate 400 x 40 160. Investments in associates accounted for using the equity method should be classified as long-term investments and disclosed separately in the consolidated balance sheet.

On the statement of financial position and under the non current assets the investment in Company B should be recorded at 500000 plus 40 of the 500000 which are the post acquisition profits that the associate generated. This applies to both the consolidated This publication contains general information only and Akintola Williams Deloitte is. Investment in an associate or joint venture at initial recognition comprises the investments purchase price and any directly attributable expenditure necessary to acquire it.